Every day, The Real Deal rounds up Los Angeles’ biggest real estate news. We update this page at 9 a.m. and 4 p.m. PT. Please send any tips or deals to tips@therealdeal.com

This page was last updated at 4 p.m. PT

The Mountain of Beverly Hills foreclosure moves ahead. A bankruptcy court judge ruled Monday that the lender — the estate of Mark Hughes — can foreclose on the 157-acre spread. The property, now on the market for $650 million, is scheduled to be sold to the highest bidder at auction on Tuesday after last week’s auction was canceled. [TRD]

Swift Real Estate Partners made a swift, profitable exit out of North Hollywood. The San Francisco-based investment firm sold the Academy Tower office building to a joint venture of Rockwood Capital and Artisan Realty Partners. The new owners paid $91.2 million, which was $30 million more than what Swift paid for the Lankershim Boulevard property three years ago — before renovations. [TRD]

In San Pedro, a multifamily developer plans a 101-unit building. The project is tied to Adam O’Neill, who heads up two Los Angeles-based firms, Stonebridge Real Estate Group and Square One Homes. It would include 89 market-rate and 12 affordable units, and is an area that has received added attention because of its Opportunity Zone designation. [TRD]

A six-bedroom pad in Malibu’s Billionaire’s Beach listed for $44 million. The seller is Vadim Shulman, a Ukrainian business tycoon. The 9,500-square-foot home includes 150 feet of beachfront, plus the largest home spa ever permitted in Malibu. [TRD]

President Trump is feeling nostalgic for quantitative easing. In a tweet, he called for a 1 percent cut on interest rates and said the Federal Reserve should restart its crisis-era money-printing program. The Fed cut rates this month, which for real estate could mean lower borrowing rates. [CNBC]

The Liddel at 10777 Wilshire Boulevard

L.A. luxury apartments have a big first half for investors. According to a new Savills report, the city’s luxury residential rentals showed the best returns for investors from January through June of any major market city in the world. The 5.4 percent yield was better than the other top 20 major cities that Savills tracks. New York was third. [Mansion Global]

Designs revealed for new senior residential complex. The 57-unit complex at 1122-1136 S. Roxbury Drive would be developed by Duke Development, and designed by Albert Group Architects. The four-story construction would be a mix of one- and two-bedrooms and include 113-vehicle underground garage. [Urbanize]

In L.A., commuting is getting worse. It’s never been fun for residents to commute to work, but a new report from Apartment List shows how bad it is. For more than 150,000 people, the commute time is a total of three hours to and from work. These “super-commuters” are the norm for East Coast residents, but despite L.A.s’ efforts to give developers incentives to build near public transit hubs, the study suggests West Coast residents will now increasingly suffer that fate. [Curbed]

Donald Trump (Credit: Getty Images)

Trump is blaming warning signs of a recession on a conspiracy. President Donald Trump claims it’s the result of a conspiracy of organizations hoping to see him lose reelection. These include Federal Reserve chair Jerome Powell, who he has accused of purposefully acting against him, other countries that he says are trying to harm America’s economic interests and the news media. So far, real estate has held its own in the stock market amid broader economic concerns. [NYT]

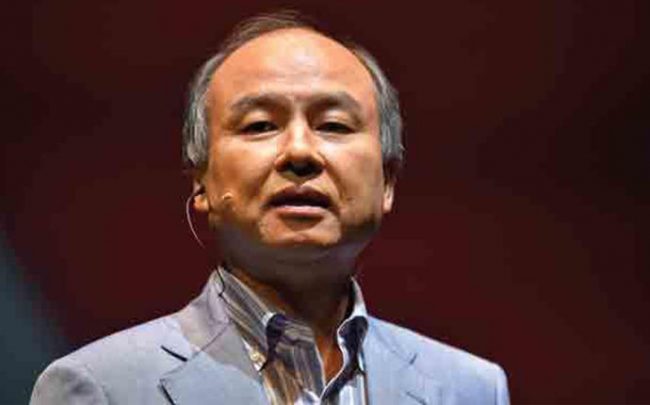

Softbank CEO Masayoshi Son

SoftBank, the biggest backer of real estate startups, will lend billions to its employees to invest in its second Vision Fund. The company plans to loan its workers as much as $20 billion to buy stakes in the venture-capital fund, according to the Wall Street Journal. CEO Masayoshi Son could account for up to $15 billion of it. The unusual move would double SoftBank’s exposure to a startup economy that has started to show signs of weakness, especially when it comes to initial public offerings. [WSJ]

FROM THE CITY’S RECORDS:

A developer has submitted plans for a 101-unit mixed-use apartment building with ground floor retail at 2111 & 2139 South Pacific Avenue in San Pedro. The development would include 89 market-rate and 12 very-low-income units. The apartment complex would replace an existing bar.