Every day, The Real Deal rounds up Los Angeles’ biggest real estate news. We update this page in real time, starting at 9 a.m. PT. Please send any tips or deals to tips@therealdeal.com

This page was last updated at 3:45 p.m. PT

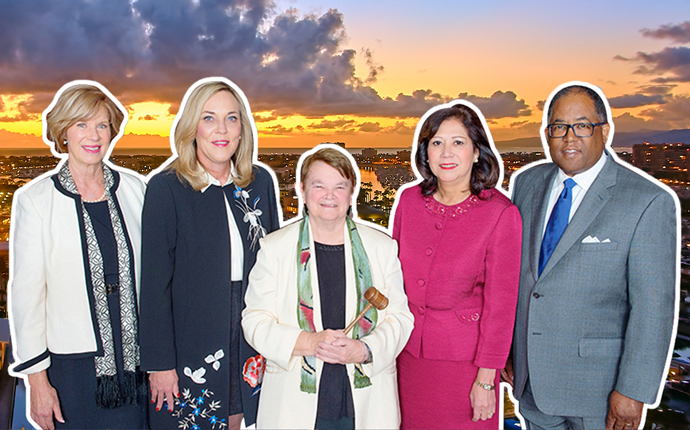

The Los Angeles County Board of Supervisors. From left: Janice Hahn, Kathryn Barger, Sheila Kuehl, Hilda L. Solis, and Mark Ridley-Thomas. (Credit: Pedro Szekely via Flickr)

LA County votes in favor of a permanent rent control ordinance. The County Board of Supervisors unanimously voted to support a measure that would limit rent increases and regulate just cause evictions in unincorporated areas. A final vote is expected by November.[TRD]

Trump officials visited Los Angeles, and not for its beaches. More than a dozen Trump administration officials visiting the city Tuesday to meet with Mayor Eric Garcetti’s team and tour the homeless encampments in the region. There are rumblings that the officials are considering moving the city’s growing homeless population into government-backed facilities. [WaPo]

Statewide rent control is now one step closer to becoming a reality. AB 1482, which would bar landlords from hiking rents more than 5 percent in one year in cities without rent control, cleared the Senate on Tuesday after a half-hour debate. If passed, the bill would exempt buildings built within the past 15 years and single-family homes. It now heads back to the Assembly for approval before heading to Gov. Gavin Newsom’s desk. [Curbed]

Mohamed Hadid bought a cottage in Beverly Hills. The spec home developer spent $4.5 million to buy a seemingly modest residence in the Beverly Hills Post Office, a far cry from his massive, yet troubled “Starship Enterprise” in Bel Air. Spanning 4,300 square feet, the home has four bedroms and four bathrooms. [Variety]

More office landlords are trying to beat WeWork at its own game. Hines Interests is one of the latest landlords to try their hand at co-working, partnering with WeWork competitors Industrious and Convene to launch “Hines Squared” this June. Firms like Boston Properties and Tishman Speyer have taken a similar approach, presenting yet another challenge to the We Company as it prepares for an IPO. [WSJ]

A massive title insurance merger has been called off. Fidelity National Financial and Stewart Information Services announced Tuesday that their proposed merger has been called off, after the Federal Trade Commission did not provide the necessary approval. Fidelity will pay Stewart a $50 million reverse termination fee as a result. [TRD]

Southern California Wildfires (Credit: Getty Images, MaxPixel)

PG&E wants to cap its wildfire liabilities at $18 billion. That’s half of what it says it owes. The utility faces a series of lawsuits and other liabilities after its equipment was blamed for starting fires across the state between 2017 and 2018 that killed more than 100 people and destroyed whole communities. Lawyers for victims claim PG&E is liable for $40 billion in damages and insurance companies alone claim the company owes them $18 billion. [LAT]

John Buck Company and 3MR Capital plan 279-unit mixed-use project in Culver City. The joint venture wants to build the project — with 55,000 square feet of ground-floor commercial space and 51,000 square feet of office space — on a triangle-shaped parcel at the intersection of Jefferson and Sepulveda boulevards. [Urbanize]

Reality television studio ITV America decamping to North Hollywood. The subsidiary of British production house ITV is behind “Hell’s Kitchen,” “Queer Eye,” and “Love Island.” The company signed a 10-year lease for 42,000 square feet at J.H. Snyder’s 5250 Lankershim Boulevard. [LADN]

“Fast & Furious” producer lists Pacific Palisades home for $16.9 million. Steve Chasman and his wife Nadi Fares Chasman have owned the 1.2-acre property since 2006, when they purchased it for $6.9 million. The 1988 home has six bedrooms and bathrooms and a private screening room. [LAT]

WeWork CEO Adam Neumann and Softbank CEO Masayoshi Son (Credit: Getty Images)

SoftBank wants WeWork’s parent company to hold off on its IPO. The We Company’s largest outside shareholder, which is currently trying to raise $108 billion for its second Vision Fund, may have issues raising funds if the co-working firm IPOs at a big discount — and the company has been considering chopping its valuation by more than half amid scrutiny from investors and analysts. At the same time, holding off on the IPO would cause WeWork to lose access to a $6 billion loan from various banks that is contingent on the success of the public offering. [FT]

More resi firms are getting into mortgages and title insurance. Instant-homebuying company Opendoor became the latest example of this trend in recent weeks, after both acquiring a title and escrow company and launching a mortgage-lending business. Redfin and Zillow have operated such side businesses for years, both as an extra revenue source and a solution to homebuying’s “last mile” problem. [WSJ]

The hotel industry’s decade-long rally may be nearing an end. Hotel revenue growth per available room has fallen below 2 percent for two straight quarters for the first time since 2010, as owners struggle with weaker demand, booming supply and rising costs. Hotel REITs have been the second-worst performing category of REITs this year, with only mall REITs doing worse. [WSJ]

Realogy’s stock price jumped more than 11 percent on Monday. The uptick comes after a weekend of intrigue, rumor and conflicting statements surrounding the brokerage’s legal battle with Compass. Last week, Compass claimed Realogy CEO Ryan Schneider once attempted to sell the firm to Compass — a claim that Realogy has denied. [TRD]