Every day, The Real Deal rounds up Los Angeles’ biggest real estate news. We update this page in real time, starting at 9 a.m. PT. Please send any tips or deals to tips@therealdeal.com

This page was last updated at 4:18 p.m. PT

A preservation battle is underway at Eva Gabor’s longtime home. City officials ordered the owner, which records list as Core Development Group’s Philip Rahimzadeh, to stop any demolition work at the Holmby Hills estate. The Paul Williams-designed home is being considered as a potential city landmark, meaning any demolition or remodeling has to be put on hold while its status is under consideration. [Curbed]

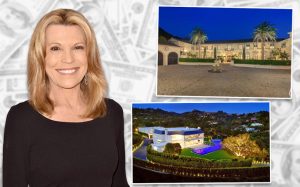

Vanna White (Credit: Getty Images)

Los Angeles County’s top five listings totaled $213 million last week. The group included Gala Asher’s $110 million Beverly Hills estate and a property connected to “Wheel of Fortune” co-host Vanna White. [TRD]

Affordable housing developer Flexible PSH Solutions has a big project in the works. The firm is starting the first phase of its 454-unit permanent supportive housing development in Rampart Village. [TRD]

Adam Neumann has started discussions about his future role at WeWork. He could possibly transition into the role of chairman or stay on as CEO with an independent chairman joining the board. Neumann has faced growing criticism about his role at the company as WeWork attempts to hold an initial public offering before the end of the year, but the discussions have put a board challenge from investors on hold for now. [Reuters]

WeWork has made some unique design choices on its IPO prospectus. Normally, companies rank banks linearly on the cover of their offering documents, putting the lead bank with the most input in the top left. But WeWork decided to have the names of banks like JPMorgan and Goldman Sachs encircle its logo instead. “Sadly,” wrote Wall Street Journal reporter Lauren Silva Laughlin, “the protective ring of Wall Street institutions around We Co. failed to save it from a stalled offering.” [WSJ]

The wreckage after last year’s deadly Camp Fire in the town of Paradise. (Credit: California National Guard)

PG&E closes $11 billion settlement with insurance companies over deadly wildfires. The deal covers insurance companies and hedge funds seeking compensation for payouts to damaged and destroyed homes from several fires over the last few years. It does not cover private civil claims made by victims themselves. [WSJ]

Tom Petty’s former home on Lake Sherwood sells below asking. The late rocker’s 5,300-square-foot home saw several price cuts and was most recently listed at $4.7 million before selling for $4 million. The home was built in 1931 and features stone and bare wood walls and floor. A stone pathway in the backyard leads to 125 feet of lake frontage, a boat ramp, and a dock. Petty died two years ago. [LAT]

Silver Creek Development eyes 2021 groundbreaking for unusual WeHo development. An initial study distributed by the City of West Hollywood anticipates a May 2021 groundbreaking for the unique Morphosis-designed project. The 15-story project would replace the Viper Room club at 8850 Sunset Boulevard with a super-modern podium building spanning the entire block. Many new projects in the area have faced some opposition. [Urbanize]

SoftBank is pushing for Adam Neumann to be ousted as WeWork’s CEO. The bank is WeWork’s largest investor but has become frustrated with Neumann’s behavior, the company’s troubled plans for an initial public offering and its hemorrhaging losses, according to The Real Deal. Neumann and other executives did not expect such a negative reaction to the company’s IPO prospectus last month and have since said they will delay WeWork’s IPO. They have made other changes as well, but some critics maintain they are not enough. [TRD]

Fannie Mae and Freddie Mac could start keeping their profits again this week. The expected agreement between the pair of mortgage finance companies and the Trump administration would be a major step toward letting the firms build up capital and operate as private companies again, according to the Wall Street Journal. They would be allowed to keep about one year’s worth of profit ($20 billion) under the deal, years after the government essentially nationalized them following the 2008 financial crisis. [WSJ]