Every day, The Real Deal rounds up Los Angeles’ biggest real estate news. We update this page in real time, starting at 9 a.m. PT. Please send any tips or deals to tips@therealdeal.com

This page was last updated at 3:20 p.m. PT

Massive housing community planned at former Carson car dealership. JPI is working to secure approvals for a 20-acre development with 1,000 housing units, 200-room hotel and 15,000-square-foot of retail in Carson. The project, designed by Withee Malcolm Architects, is being called Jefferson on Avalon. [Urbanize]

Edison considers cutting power in SoCal amid fire risk. Nearly 90,000 customers could lose power as Santa Ana winds and temperatures pick up, and the risk of fire grows stronger. Some utility providers, such as PG&E, cut power to about 24,000 customers on Monday night. [LAT]

Scammers sent out numerous phishing emails using Howard Lorber’s address. A Douglas Elliman source confirmed to Inman that multiple recipients had received scam emails that appeared to be from the brokerage’s chairman. It is unclear if Lorber’s account was compromised, or if a scammer simply “spoofed” his email address. [Inman]

Compass’ COO is out. Maëlle Gavet is leaving,the latest in a string of recent exits at the SoftBank-backed residential brokerage. In an email to agents Tuesday, CEO Robert Reffkin described the departure as a “mutual decision.” [TRD]

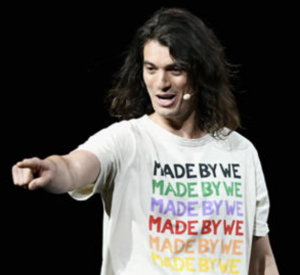

WeWork CEO Adam Neumann (Credit: Getty Images)

And Adam Neumann is stepping down as WeWork’s CEO. The startup’s founder is moving into a non-executive chairman position, after facing pressure from investors to resign. Artie Minson, the company’s CFO, and Sebastian Gunningham, its vice chairman, will replace Neumann as co-CEOs; the company said it will not search for an external CEO. [TRD]

Despite low mortgage rates, home-price gains are still slowing down. The deceleration continued for a 16th straight month in July, with home prices in 20 cities tracked by the S&P CoreLogic Case-Shiller index rising just 2 percent, the least since August 2012. Nationwide home prices rose somewhat faster, growing 3.2 percent. [Bloomberg]

real Welcome To Fabulous Las Vegas Sign at the entrance of the city. Nevada. USA

Virgin Trains and Fortress Investment push L.A. to Vegas rail project. The Virgin-branded company formerly known as Brightline and the Softbank-owned private equity firm are trying to convince Nevada and California officials that their 170-mile rail line is the future. They bought the project earlier this year and received permission from California to sell as much as $4.2 billion in tax-exempt bonds for the $4.8 billion project. [Bloomberg]

Attack on broker at open house is caught on camera. Surveillance footage showed a man pushing and groping a real estate agent at an open house in Encino. The agent, who was not seriously injured, said she believed the man was trying to lure her into a back room. [NBCLA]

Ex-Anaheim Duck lists Corona del Mar home. Hockey star Corey Perry is asking $6.7 million for the 5,400-square-foot Cape Cod-style home in the coastal Orange County city. The traditional home was built in 2013 and Perry bought it a year later for just over $4.8 million. The 34-year-old Stanley Cup champion spent 14 years with the Ducks, but signed a one-year contract with the Dallas Stars in July. [LAT]

Architect draws up unique edifice for Hancock Park apartment building. Architect Lorcan O’Herlihy Architects designed a twisting facade for an 11-story building for the 7,000-square-foot lot. The firm said the slim design creates more space between the building and its neighboring properties. Metros Capital is developing the property. [Curbed]

The WeWork IPO is just the latest in SoftBank’s long list of problems. SoftBank-backed companies including Uber, its Chinese rival Didi Chuxing, Slack and cancer-test company Guardant Health are all likely to be marked down in the firm’s third-quarter reporting. The odd structure of Softbank’s Vision Fund — in which 40 percent of the capital comes in the form of debt-like preferred stock — poses greater risks in a downturn, and Masayoshi Son’s firm recently took out an unusual three-year loan to pay back its investors, using its stakes in Uber and Guardant as collateral. [WSJ]

Some developers embrace short-term rentals. From a condo project in Nashville marketed for short-term rental use, to hotel-licensed, Airbnb-branded developments in Miami and Austin, developers are taking a new approach to increasing profits and driving sales. They are also taking steps to address safety and regulatory issues which have historically led landlords to shy away from transient uses. [WSJ]

New NAR data shows more brokers abandoning the franchise model. The latest numbers from the National Association of Realtors show that the percentage of brokerages affiliated with a franchise company has fallen to 11 percent from 13 percent two years ago. Keller Williams is the nation’s largest franchise with 153,904 agents, while Berkshire Hathaway saw the most gains over the past two years. [Inman]

U.S. mortgage holders’ home equity has hit an all-time high. With a collective gain of nearly $428 billion in the second quarter, the average mortgage holder saw a $4,900 home-equity gain in just one year. Despite all-time low mortgage rates, few homeowners are tapping into that equity than in the past — perhaps a holdover from the previous housing crash. [CNBC]