In the Hollywood Hills’ exclusive Bird Streets neighborhood, a flock of ultra-luxury homes sits on the market, with soaring price tags.

On Robin Drive, tech executive and spec home developer Farzin Aghaipour just listed his 17,000-square-foot home to the tune of $42.5 million.

On the same block, Francesco Aquilini has been shopping his mansion as a $58 million pocket listing since the start of the year, and motorcycle racer-turned-developer John Kocinski’s spec home is perched at $19 million, after a recent price chop from $40 million. On Oriole Way, the former home of alleged financial fraudster Jho Low is on the market for $39 million. The U.S. government seized the home, saying it was acquired with stolen funds.

In the Bird Streets, sky-high asking prices remain plentiful. But amid Los Angeles’ luxury market slowdown, uncertainty in the greater economy and shifting buyer tastes, the big-ticket sale remains a rare sighting, and some brokers say they could be headed for extinction.

Lynda Weinman

Over the last 12 months, the highest sale on the Bird Streets was tech guru Lynda Weinman’s mansion on Oriole Way. Rockstar Energy beverage founder Russell Weiner paid $16.5 million for it in late August, nearly 40 percent less than what Weinman had shelled out for the home just three years earlier.

Notably, Weiner quickly relisted that property with the same $27.9 million asking price Weinman paid in 2016. It hasn’t sold yet.

Buyer-seller “chasm”

Besides Weinman’s home and a $15.8 million sale on Nightingale Drive in April, no Bird Streets property has traded for more than $11 million in the last 12 months.

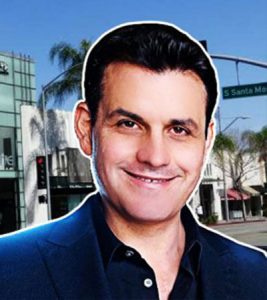

Jason Oppenheim

Jason Oppenheim, who leads luxury brokerage Oppenheim Group, represented the seller on the Nightingale Drive deal, and has sold two other homes this year in the Bird Streets. Both were Mid-century properties that sold for $4.2 million and $2.7 million. He also represented the buyer on a $3.7 million sale.

There is still interest among buyers for some on-the-market spec homes, he said, but sellers aren’t willing to drop their pricing. Oppenheim called it “a chasm” between seller expectations and what buyers are willing to pay.”

“Sellers are adamant about swinging for the fences with pricing and if they can’t hit the home run they eventually come back to earth,” he said. “But it seems every seller wants the home run.”

Developers are still building castles and charging princely sums. But little has changed from a year ago, when The Real Deal first reported on the rising number of spec homes languishing on Bird Streets blocks.

While many sellers are holding steady to their price, there are some who are increasingly willing to lower their listing to close a sale.

A third-quarter Douglas Elliman report found that of the most expensive homes on the L.A. market, sellers dropped their prices an average of 11.2 percent from final list price to closing. That marks the biggest discount in nearly six years, and doesn’t even factor in earlier cuts before the final ask.

In stronger markets, the mediocre stuff sells.

“The paradox is that the market still set a record,” said Jonathan Miller, author of the report and CEO of appraisal firm Miller Samuel. “Even though the seller traveled farther than they have in six years, when the dust settled you set a record. It shows you that the asking prices were several steps above where sellers were.”

Old birds still fly

The homes that are selling in the Bird Streets are the older vintage.

Just four of the roughly two dozen properties that have sold in the neighborhood over the last 12 months were built in the last 10 years. The majority of them were built before 1990. And more than half of all homes sold over that time spent over 100 days on the market.

Kurt Rappaport

Luxury broker Kurt Rappaport of Westside Estate Agency said that the game isn’t “old versus new,” but “high quality and good taste versus poor quality and bad taste.” He represented a buyer in an $11 million sale for a new construction home on Blue Jay Way.

In a booming economy, the quality of construction may get overlooked, he said. But this is not that time. “When the market adjusts, buyers become unwilling to accept flaws. In stronger markets, the mediocre stuff sells.”

Some of the Bird Streets’ older homes are marketed as development opportunities. The most recent sale in the neighborhood was last week. That Mid-century home marketed as a development site traded for $7 million after more than a year on the market.

The crop of new homes may be smaller and more understated than the mega-mansions that have dominated the Bird Streets and other hillside neighborhoods over the last several years, brokers said. Underwhelming sales for those properties could make developers rethink their approach in the future.

Buyers are moving past the “obsession” with square footage, although developers seem to still be on that track, Oppenheim said.

“Land, views, location, privacy and architecture are becoming more important again, thank goodness,” he said. “I think developers are realizing they can’t focus on smashing a huge piece of house on a crappy piece of land.”

As far as the inventory on the market today, Rappaport said it will be up to individual sellers to decide how to move them.

“Houses that are priced well will sell, houses that are overpriced will sit,” he said. “Some developers will make smart decisions and others will regret they didn’t take an offer that they had.”