While some parts of the real estate lending world have been shut down by the coronavirus pandemic, plenty of investors still need to find places to deploy their capital — but a bit more carefully.

Banks, funds, mortgage real estate investment trusts, and agencies like Fannie Mae and Freddie Mac have all begun adjusting their lending approach in face of the economic downturn, according to a new capital markets report from Miami-based real estate capital advisory firm Primrose Capital.

“At present there is a conundrum between investment managers’ inherent need to deploy capital, while simultaneously assessing risk and ensuring appropriate capital preservation measures are in place for its stakeholders,” the report says, noting that private real estate debt funds globally had $181 billion in assets under management as of last July.

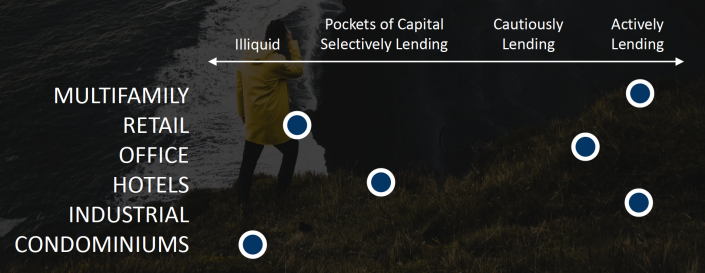

Lending remains active for multifamily and industrial assets, while office properties have seen a slight pullback. Retail lending has become almost entirely illiquid amid mass store closures, while investors see slightly more opportunity in hotels, albeit on a very selective basis. And condo lending, which was already at a standstill pre-coronavirus, is not likely to turn a corner any time soon.

(Click to enlarge)

Debt funds and mortgage REITs have remained active in bridge lending, and somewhat less so in construction lending, as cities across the country have halted non-essential building in response to the epidemic. Commercial banks are focusing on existing clients or experienced borrowers while reducing leverage.

CMBS issuance has dried up due to lack of investor demand, and Fannie and Freddie have introduced stricter terms for new loans — while offering relief for existing borrowers.

Finally, large developers in the lending space have been selectively offering bridge financing for projects with unique needs — and charging as much as a 2-percentage-point spread premium in return.

Read more