Trending

Force majeure lawsuit over LA land deal is simply an act of cold feet, ExxonMobil says

Developer Pacific Collective says coronavirus fallout voids $4.2M sale in Culver City

A lawsuit filed in Los Angeles County may test which real estate deals can be voided due to the coronavirus pandemic.

Pacific Collective, a Santa Monica developer whose projects include shopping centers and marijunana dispensaries, sued ExxonMobil for breach of contract, claiming the energy giant has not honored the force majeure clause in a Culver City land sale.

Pacific Collective agreed to buy a 120-acre vacant lot at 3800 Sepulveda Blvd. from ExxonMobil for $4.2 million, land that was formerly site to a Mobil gas station, according to the complaint.

ExxonMobil signed a contract that included a force majeure waiver, the complaint reads, but balked when Pacific Collective asked to push back the sale date until at least May 1. Pacific Collective wants $7.9 million, plus an injunction to stop ExxonMobil from shopping the property to other buyers.

Per the complaint, a deal between the parties was struck on Feb. 7 and set to close March 31, with Pacific Collective providing $120,000 in deposits to ExxonMobil.

Before the close date, though, the coronavirus pandemic triggered stay-at-home orders from Gov. Gavin Newsom and Culver City officials, which Pacific Collective asserts counts as a force majeure event.

The term, which translates to “superior force” in French, frees parties in a contract from their liabilities when an “extraordinary event” or “act of God” prevents them from fulfilling their obligations. President Donald Trump famously used the obscure clause as a defense when he sued Deutsche Bank in 2008 in an effort to avoid paying $40 million that he personally guaranteed on a construction loan for the Trump International Hotel and Tower in Chicago.

“Under the force majeure clause, plaintiff could not immediately bring in construction workers, architects, inspectors, and other persons necessary to redevelop the property,” the Pacific Collective complaint reads.

ExxonMobil, though, claimed Pacifc Collective is backing out of the deal because it lost its tenant and financing, events that were outside the force majeure clause, according to an April 2 letter to Pacific Collective that has been filed in Los Angeles County Superior Court.

Further, ExxonMobil pointed out that both financial institutions and construction are designated as “essential” businesses, allowed to operate even under emergency stay at-home edicts.

“The seller does not accept the ‘Safer at Home’ order as a force majeure event under the agreement as none of these orders prevented or prohibited the closing from occurring,” the letter reads.

Messages left with Pacific Collective and ExxonMobil Tuesday were not immediately returned.

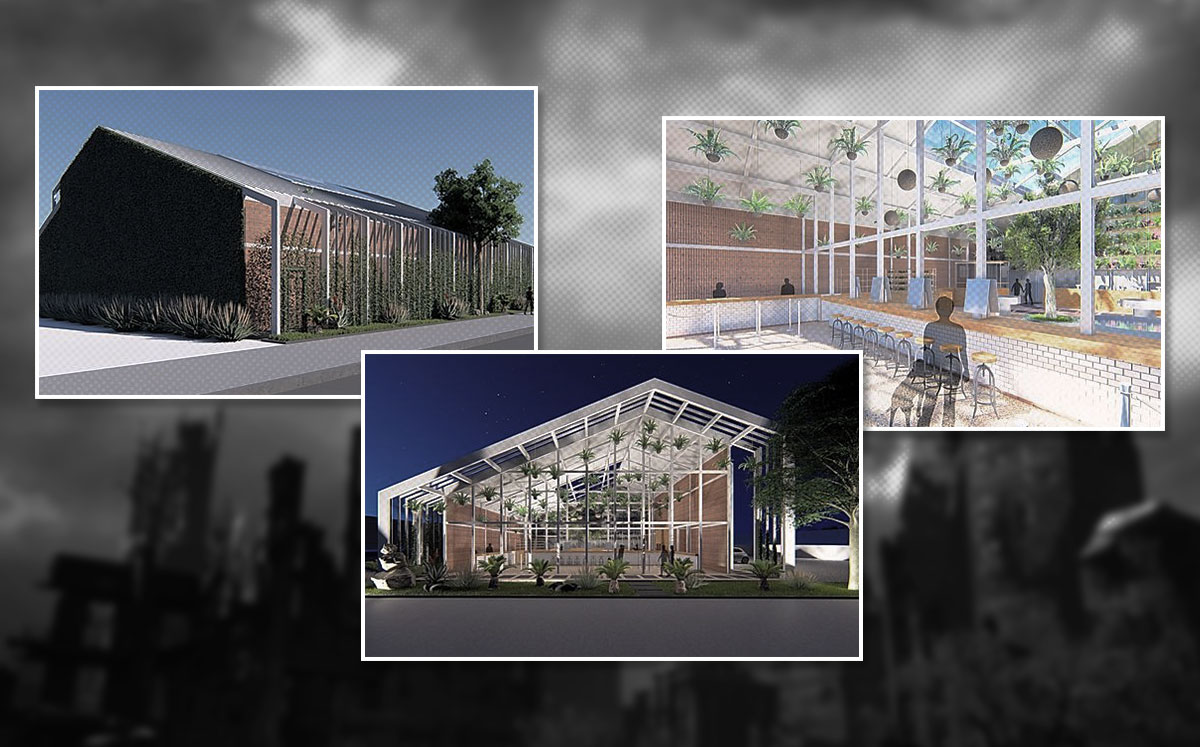

According to Pacific Collective’s website, the land was to be used as a marijuana dispensary, the “first LEED-certified dispensary in Los Angeles County” that would also include a sculpture garden. Vancouver-based hemp retailer Jushi Holdings was slated to be to the tenant.

The coronavirus pandemic has so far brought multiple disputes over what contracts must be honored, including rental obligations by commercial and residential tenants. The pandemic also prompted Blackstone Group to sue over a scotched $265 million California hotel deal, in which the defendant KS Development also sought to invoke a force majeure clause.

Write to Matthew Blake at mb@therealdeal.com