Another New York City real estate player is getting federal funds to help it weather the coronavirus crisis.

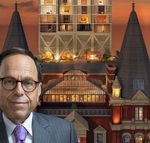

Allen Gross’ GFI Capital Resources Group has “completed the filing process and met the prerequisites” to receive $12 million in Paycheck Protection Program funds, the company disclosed to the Tel Aviv Stock Exchange on Wednesday. A $7.1 million portion has been approved so far, which GFI expects to receive in the coming week.

The company’s hotel holdings include the 179-key Ace Hotel Palm Springs in California, a 69-percent stake in the 286-key Ace Hotel in New York City, and a 35-percent stake in the Beekman Hotel and Residences, which has 287 hotel rooms and 67 condos.

The $349 billion PPP program, which ran out of money last week, is set to be refilled with more than $310 billion in new funds following a Tuesday deal between Congress and the White House.

GFI Real Estate, GFI’s bond-issuing subsidiary, owns stakes in 14 properties with a total worth of about $800 million, including more than 600 rental units and five hotels, according to S&P Global Ratings. The agency put GFI on credit watch with a negative outlook last month because of the coronavirus, noting that the company’s earnings are highly concentrated in the hotel sector.

The two Ace hotels and the Beekman — where operations are currently suspended — account for about 65 percent of the company’s net operating income. According to appraisals, total expenses at each hotel amounted to about $10 million per year.

The firm expects that 75 percent, or about $9 million, or the PPP funds will be forgiven, while the remainder will be paid back in two years at an interest rate of 1 percent. PPP loan proceeds spent on payroll, mortgage payments, rent and utilities within the first eight weeks are eligible for forgiveness, and borrowers are required to maintain payroll and retain employees at levels comparable to before the crisis.

GFI did not respond to a request for comment. It is unclear whether the company will reopen the hotels after receiving funds.

Last week, Rotem Rosen’s MRR Development secured a $1.7 million PPP loan for the Hotel Indigo Lower East Side at 171 Ludlow Street, which has remained open amid the slowdown.

Read more