Los Angeles County home sales dropped dramatically after the coronavirus hit, but home prices actually went up.

That’s what Multiple Listings Service data shows on single-family home and condo deals in the L.A. market between April 1st and June 30th.

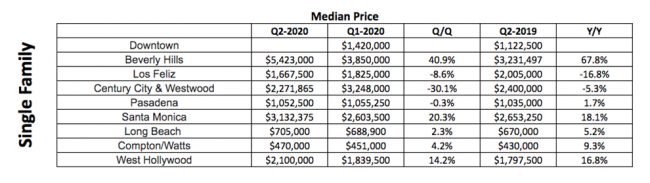

The Real Deal compiled data on closed deals in nine different markets: Beverly Hills, Century City/Westwood, Compton/Watts, downtown, Long Beach, Los Feliz, Pasadena, Santa Monica, and West Hollywood.

The areas represent a geographic and economic mix. The west side’s Beverly Hills had a median second quarter sales price of $5.4 million, while the south L.A. County area of Compton and Watts had a $470,000 median sales price.

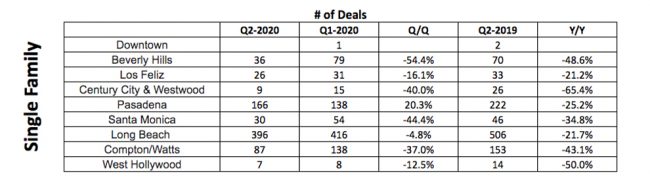

In the nine markets combined, home sales plunged 29 percent in the second quarter of 2020 compared to quarter two 2019. The drop happened amid government shelter-in-place orders that banned open houses, and, for a time, private showings.

But in the same markets, prices increased 23 percent year-over-year to a median price of $2.1 million.

“People are concerned about their health, their money and the state of the world,” said Colin Keenan, vice president and general manager of Westside Estate Agency. “But they are not concerned about home prices.”

The increase was partly due to a whopping 68 percent jump in Beverly Hills.

But eight of the nine neighborhoods (save Century City/Westwood) exhibited a median sales price climb. For example, in Santa Monica prices leaped 18 percent year-to-year to $3.1 million, even as the number of deals plunged 44 percent.

L.A. brokers have a few theories why this is.

“The interest rates are at historic lows and so is the inventory,” Keenan said.

Myra Nourmand, principal at Nourmand & Associates, said the high-end market is driving the region.

“More affluent neighborhoods like Beverly Hills and Santa Monica are slower to reduce their prices, because the people that live there can usually afford to wait,” Nourmand said. “There are fewer sales but higher prices partially because buyers want large homes that are remodeled.”

Indeed, price jumps were less pronounced elsewhere. In Long Beach, for example, there was a five percent gain in median sales price in the time studied.

The condo market did not show a similar price/sales disjunction. In the markets studied, sales were down 29 percent while the median sales price dipped six percent to $716,000.

The latest figures come as brokers wait and see how the L.A. County surge in coronavirus cases affect their livelihoods.

Many brokers championed the idea “pent up demand” from the spring shutdown would bear fruit in the summer. Brokers interviewed are holding onto this idea, or at least hopeful the worst is ever.

“There’s not going to be an unbroken chain of successes,” Keenan said. “We do expect some ups and downs. But we do not expect in any way to be back to where we were in March and April.”