Marriott International believes the hotel industry believes the worst is over, so it’s halting its relief measures for hotel owners’ bills and forging ahead with new development.

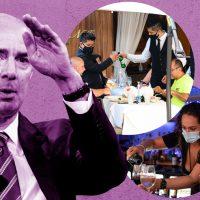

While announcing the hotel company’s second quarter earnings on Monday, CEO and president Arne Sorenson acknowledged the cataclysmic effect the coronavirus pandemic has had on its business, before sounding a note of optimism.

“This is by far the most significant crisis ever to impact our business,” he said. “We’re a company that is 92 years old and has weathered the Great Depression, World War II, and numerous natural disasters around the world, that is saying something.”

Read more

The company’s net loss totaled $234 million for the quarter, a nosedive from the $232 million in net income Marriott reported during the same period last year. Total revenue fell 72 percent to $1.5 billion last quarter, from $5.3 billion during a year earlier. Revenue per available room for the quarter fell 84 percent worldwide.

Despite grim earnings, Sorenson said “overall negative trends appear to have bottomed in most regions around the world.” He pointed to rising bookings from domestic travellers in China and some properties in the U.S. As of Monday’s call, Marriott said 91 percent of its hotels are open.

Marriott’s CFO Kathleen Kelly Oberg said that the company’s 50 percent fee discounts and payment deferrals in April and May have meant most of Marriott’s hotel franchisees and owners are intact.

“We think overwhelmingly that the system is surviving so far. Obviously, it will get tougher the longer it lasts. But we do think we’re at bottom,” she said.

She estimated that so long as hotels have 10 percent occupancy, properties are better off being open.

“The losses will be lower than the losses associated with being closed,” she said. “Broadly, you’re going to probably break even at 30 percent or so occupancy in the select brands and maybe 40 percent occupancy in the full service brands. But again, still do better by being open at occupancy levels which are lower.”

She said during the earnings call that discounts and payment deferrals will not continue: “We expect to get paid. We provide those programs and services, and the owners have an obligation to pay us.”

Marriott is also continuing new hotel construction and conversions of competitors’ hotels into Marriott-branded properties. Other companies, such as Hilton, are doing the same.

Marriott said it added 11,400 rooms to its global portfolio during the second quarter, up 4 percent year over year. About 2,000 of the rooms were conversions from competing hotels. Its pipeline of new units now totals 510,000 rooms and approximately 45 percent of that are under construction.

Sorenson said the pace of new deals has slowed, but there hasn’t been an uptick in deals falling apart despite the crisis.

“Like us, many owners are taking a longer term view on the market opportunity,” he said.

Write to Erin Hudson at ekh@therealdeal.com