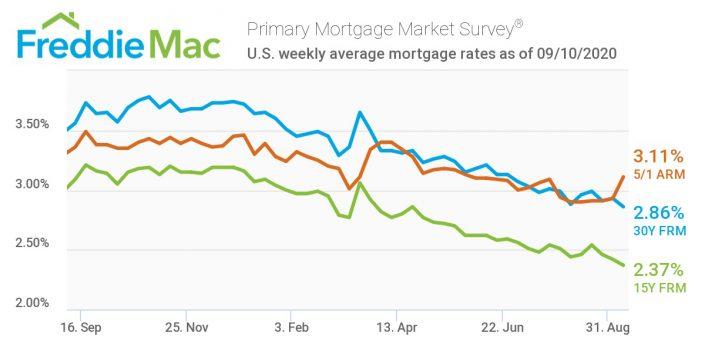

Mortgage rates sank to an all-time low — again.

The average rate for a 30-year fixed-rate mortgage dropped .07 percentage points for the week ending Sept. 10, reaching 2.86 percent — a new low since Freddie Mac began conducting the survey in 1971. This time last year, the mortgage rates averaged 3.56 percent. Fifteen-year mortgages declined, too, to an average of 2.37, while five-year mortgages were up 18 percentage points to 3.11.

(Source: GlobalNewswire)

Sam Khater, Freddie Mac’s chief economist, said a late summer slowdown in the economic recovery was to thank for the low mortgage rates, but that might not hold through the fall, when a lack of supply could drive up prices and deter homebuyers.

“These low rates have ignited robust purchase demand activity, which is up 25 percent from a year ago and has been growing at double digit rates for four consecutive months,” said Khater. “However, heading into the fall it will be difficult to sustain the growth momentum in purchases because the lack of supply is already exhibiting a constraint on sales activity.”

The survey covers only conventional mortgages, where borrowers have excellent credit and make a 20 percent down payment. Jumbo loans, which are typically reserved for luxury homes which exceed the federal housing agency purchase price limit, are not included.

Since the Federal Reserve lowered its benchmark rate in mid-March, and later signaled the rate would stay low for the long haul, mortgage rates have reached historic lows — although not as low as expected. The gap between the 10-year treasury yield and the 30-year fixed-rate mortgage rate is at its widest since 2008.

Still, the historically low mortgage rates have led to a frenzy of homebuying, and even a rebound for timber real estate investment trusts, responding to the higher demand for lumber. The average home price also broke the $300,000 mark for the first time in July.

Existing home sales were up 24.7 percent in July, according to the National Association of Realtors, after two consecutive months of gains.