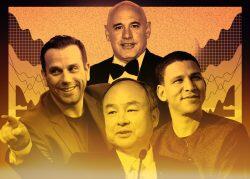

SoftBank has upped its stake in Compass, shelling out $72 million to buy stock in the newly public company.

The tech giant, already Compass’ largest shareholder, purchased 4 million shares on April 6 at $18 per share, bringing its total investment to 132.4 million shares, according to filings with the U.S. Securities and Exchange Commission. Sources said the transaction was made as part of Compass’ IPO.

On Friday, following a lackluster week of trading in which Compass’ stock dropped 15 percent, shares closed at $17.31. That values SoftBank’s stake around $2.3 billion, slightly lower than the $2.55 billion it was worth at the end of Compass’ first day of trading.

Compass declined to comment.

SoftBank holds a roughly 35 percent stake in Compass, after investing nearly $1 billion in the New York brokerage between 2017 and 2019, regulatory filings show.

Read more

Masa Son’s firm wrote its first check for nearly $450 million in 2017. In 2018, it invested $160 million and made an $80 million tender offer. And it invested $250 million during Compass’ Series G round in 2019, filings show.

After that round, Compass was valued at $6.4 billion. It was the last private funding round before the company went public last week.

Compass raised $450 million in its IPO on April 1, although it initially sought to raise twice that amount. Still, the company’s executives and investors now have stock holdings worth millions — and in SoftBank’s case, billions — of dollars on paper.

Co-founder and CEO Robert Reffkin owned 8.6 million shares prior to ringing Nasdaq’s opening bell on April 1. Those are now worth $148.9 million. Reffkin will receive more than 25.8 million shares in the coming years, filings show.

Prior to the IPO, Compass said the Reffkin family expressed interest in purchasing $18.5 million worth of shares in conjunction with the public offering. On April 6, Reffkin upped his stake by 411,111 shares, which he bought at $18 per share, or $7.4 million.

SoftBank and Discovery Capital — Compass’ second-biggest shareholder — also expressed interest in purchasing another $140 million in shares. It doesn’t appear Discovery has done so yet. The hedge fund, led by Robert Citrone, holds 33.5 million shares that are worth $579.8 million.

In general, it’s been a good week for the stock market. Both the S&P 500 and Dow Jones Industrial Average had record closings this week. Nasdaq climbed one percent on Thursday thanks to strong performances from Apple, Netflix, Microsoft and other tech stocks.

Earlier this week, SoftBank invested $500 million in digital mortgage lender Better.com. The tech giant purchased shares from existing investors at a $6 billion valuation.