Valley National Bank is making its second major acquisition in the last three months, this time agreeing to acquire Bank Leumi USA for $1.15 billion.

Leumi’s shareholders will receive 3.8 shares of Valley National stock and $5.08 for every share they have, according to Bloomberg. Bank Leumi Le-Israel BM, the parent company of the U.S. banking side of the business, will own more than 14 percent of Valley National commons stock.

Valley National will be able to take advantage of Bank Leumi USA’s offerings for wealthy and middle-market commercial clients. The consolidation follows a June purchase by Valley National of Westchester Banking Holding Corp. for $210 million.

Prior to the sale, Bank Leumi USA possessed $8.4 billion total assets, $7.1 billion in total deposits and $5.4 billion in gross loans, as of June 30. The company is handing over keys to commercial offices in cities across the country, including New York City, Los Angeles, Chicago and Miami.

Shares in Valley National rose 5.1 percent during early morning trading on the heels of the acquisition news, Bloomberg noted. This year alone, Valley National shares have risen 30 percent.

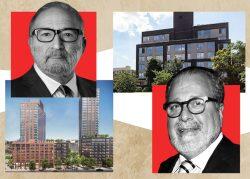

Both Valley National and Bank Leumi USA have been responsible for major loans in recent years that have impacted the real estate industry, particularly in terms of the construction of projects.

Valley National provided one of the biggest outer-borough loans in July, handing self-storage company Insite Property Group a $33.8 million construction loan for a property in College Point, Queens. The company is planning to build a four-story, 132,000-square-foot self-storage facility at 131-21 14th Avenue.

Meanwhile, Bank Leumi USA has recently spent time trying to foreclose on a $120 million loan for a South Street Seaport tower at 161 Maiden Lane that has struggled with a “leaning” problem. The bank and developer Fortis Property Group in August agreed to enter mediation to resolve the differences.

Read more

[Bloomberg] — Holden Walter-Warner