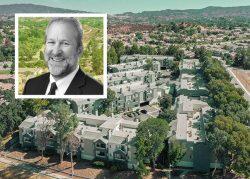

Harbor Group International and Azure Partners have joined forces to buy a 480-unit, mixed-use apartment complex in the Vista Canyon community of Santa Clarita for $173 million.

Norfolk Virginia-based HGI and the New York-based Azure Partners acquired the newly built Jefferson Vista Canyon property from multifamily developer JPI in Irving, Texas, according to the San Fernando Valley Business Journal.

“This acquisition highlights HGI’s investment strategy of acquiring properties in well-located, dynamic markets with strong employment fundamentals,” said Richard Litton, president of HGI, in a statement.

Jefferson Vista Canyon is the first major residential development within Vista Canyon, a 185-acre master-planned community by JSB Development, based in the Santa Clarita neighborhood of Valencia.

When completed, the walkable, mixed-use development south of the Santa Clara River at the edge of the Angeles National Forest will include 855 apartments, 245 detached houses built by KB Home, 240 hotel rooms, and nearly 1 million square feet of retail and office space.

Vista Canyon will get its own Metrolink and bus transfer station and include 25 acres of parks and 75 acres of open space.

Its Jefferson Vista Canyon segment includes 17 buildings for a total of 650,000 square feet of offices and 165,000 square feet of retail shops and restaurants to go with the 480 apartments that changed hands.

The luxury apartments come in studio, one-, two- and three-bedroom units. The complex includes two resort-style swimming pools, two fitness centers, a yoga/spin studio, a dog park and a rooftop deck and lounge. Cars can park in more than 700 spaces, including nearly 150 direct access garages.

Amenities include wood-style flooring, Caesarstone counters, fully equipped kitchens, in-unit washers and dryers, walk-in closets and personal balconies or patios.

The 18.5-acre mixed-use community, built in two phases in 2020 and 2021, includes an 11-acre park and direct access to 10 miles of walking and hiking trails.

As part of the plan, the city of Santa Clarita will build a bridge across the Santa Clara River to link the development with Soledad Canyon Road and the Canyon Country neighborhood of Santa Clarita.

JLL, based in Chicago, brokered the deal by arranging a $173-million floating rate loan on behalf of HGI and Azure. The loan was originated by Square Mile Capital Management, based in New York.

Investors have shown more interest in L.A.’s suburban markets like Santa Clarita since the coronavirus pandemic, which drove some renters in urban neighborhoods to seek more space elsewhere.

In September, San Diego-based Fairfield Residential paid $62 million to add a 130-unit Valencia complex to its portfolio. Los Angeles-based MKB Ventures paid $54.1 million for a 148-unit apartment complex in Santa Clarita.

[SFVBJ] – Dana Bartholomew

Read more