Trending

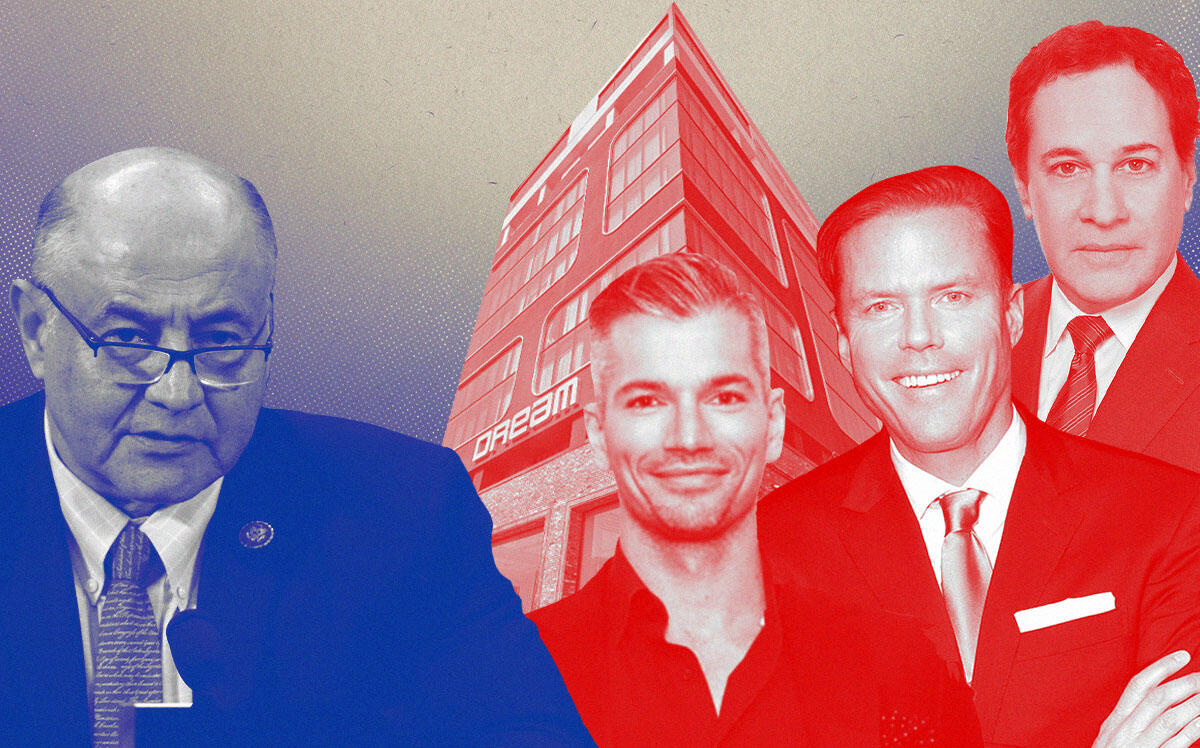

Congressional contingent asks about Relevant’s EB-5

Follow up to union’s query on whether developer met program’s obligations at Hollywood hotels

UPDATED: Feb. 28, 2022, 7:57 a.m.: A number of Southern Californians are among a contingent of 16 members of the U.S. House of Representatives who want answers on Relevant Group’s use of EB-5 financing.

The representatives have asked U.S. Citizenship and Immigration Services to investigate Relevant Group’s EB-5 financing for its hotel projects in Los Angeles. The legislators want to know whether the firm fulfilled its obligations in creating jobs, according to a letter sent to the agency last week.

Rep. Luis Correa – who represents a district that stretches from Anaheim to Santa Ana in Orange County – was the first signatory of the letter. Correa is on the House’s Subcommittee on Immigration and Border Security, which oversees USCIS. The letter comes months after Unite Here Local 11, a hospitality union, sent a similar letter to the agency.

The federal agency oversees the EB-5 visa program, which allows foreigners who invest at least $500,000 into a business in the U.S. to apply for visas granting permanent residency — often called “green cards.”

Relevant Group said it raised more than $250 million in capital from Chinese sources through the EB-5 program to finance a “major hotel and entertainment development,” according to the letter, citing marketing materials for a Relevant fund, which listed four hotels in Hollywood as existing assets.

The firm has built out a portfolio of hotels across a few blocks between Sunset and Hollywood Boulevards in recent years. In 2021, Relevant opened its Hyatt-branded Thompson and Tommie hotels after scoring $72 million in “rescue” mezzanine financing.

In 2017, Relevant co-founder Grant King said the firm’s Dream Hollywood hotel scored funding from 180 Chinese investors. According to EB-5 program rules, each investor must put in a minimum of $1 million in high-employment areas to, in turn, create full-time positions for at least 10 employees.

“If each of the 180 investors is an EB-5 participant, the Dream Hotel itself would have to create 1,800 jobs to abide by USCIS rules,” the letter said. “The hotel seems to have fallen far short of that requirement.”

When the 169-room Dream Hollywood hotel opened in 2017, local reports said the project created 700 jobs.

Relevant Group did not respond to a request for comment. In October, CFO Andrew Shayne told TRD “Relevant has always taken great care to comply with all EB-5 requirements,” and has completed four EB-5 projects.

Unite Here said it does not know how many people Dream Hollywood currently employs, but noted that Relevant obtained two federal paycheck protection program loans totaling $3.75 million for its Dream Hollywood in connection with 183 employees in 2020–well short of its apparent obligations for job-creation under the EB-5 program.

Relevant disclosed that the proceeds of the loans were to be used for payroll.

When applying for a PPP loan, firms must disclose the “the total number of employees, including part-time employees” over a 12-month time period, according to the Small Business Administration, which manages the program.

“Major investors should not have the opportunity to take advantage of the program and should be held accountable when they are not meeting the job creation and economic development requirements they agreed to,” Rep. Correa said in a statement, adding jobs are needed during recovery from the pandemic.

The congressional letter – also signed by prominent Southern California Democrats Rep. Katie Porter, Rep. Judy Chu and Rep. Ted Lieu, asked USCIS to disclose how much EB-5 financing the project used and how many investors participated – along with whether any investors received Green Cards.

Unite Here Local 11 has also submitted freedom of information requests to obtain information related to Relevant’s EB-5 financing, but has not yet received any documents, a union representative told TRD.

The letter comes amid a pause in new EB-5 investment, after Congress failed to come to a deal to reauthorize a key component of the program last June.

A previous version of this story said each investor must put at least $900,000 to qualify for the EB-5 program. This story has been corrected to reflect the correct minimum investment amount is $500,000.