LBA Realty has recapitalized its One Culver creative office campus in Culver City in a deal worth more than $500 million.

The Irvine-based investment firm struck the deal on the eight-story property at 10000 Washington Blvd. in a joint venture with Blackstone Real Estate Income Trust valued “in excess of $500 million,” the Commercial Observer reported, citing an unidentified source.

LBA did not return requests for comment from the Observer. Blackstone and Newmark, which advised on the joint venture, declined to comment.

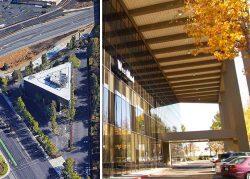

The nearly 400,000 square-foot One Culver building, at the junction of Washington and Culver boulevards, has 325,000 square feet of office space, three sound stages and 15,000 square feet of shops, restaurants and an Equinox Fitness Club.

It’s next to Sony Pictures Studio and not far from Amazon Studios and the Sony Pictures Animation Campus within a high-tech region known as Silicon Beach.

One Culver, built in 1986, was bought by LBA Realty in 2014 for $159 million. The firm renovated the pyramid-like property in 2017 with a design by Gensler, an architectural firm based in Downtown Los Angeles.

The LBA Realty venture with Blackstone was not the first time it partnered with the New York-based REIT.

In January 2021, the firm sold a 60-percent stake in two industrial portfolios to Blackstone through its LBA Logistics industrial arm. The packaged deal, valued at $1.6 billion, included 71 properties of nearly 10 million square feet, mostly in California and the state of Washington.

In October, LBA Realty paid $16.1 million for a building in Chicago’s Goose Island whose lease to a cloud manufacturing startup marked the area’s largest industrial lease in the first quarter. It;s affiliate also paid $76.5 million for the 85,000-square-foot Triangle Building in San Jose, leased by Apple.

In December 2020, it secured $316 million in loans for a mammoth vertical warehouse project for Amazon in Queens, New York.

[Commercial Observer] – Dana Bartholomew

Read more