Trending

SpaceX on radar as Blackstone lands $1.8B CMBS loan

Six banks provide refi for more than 110 US properties

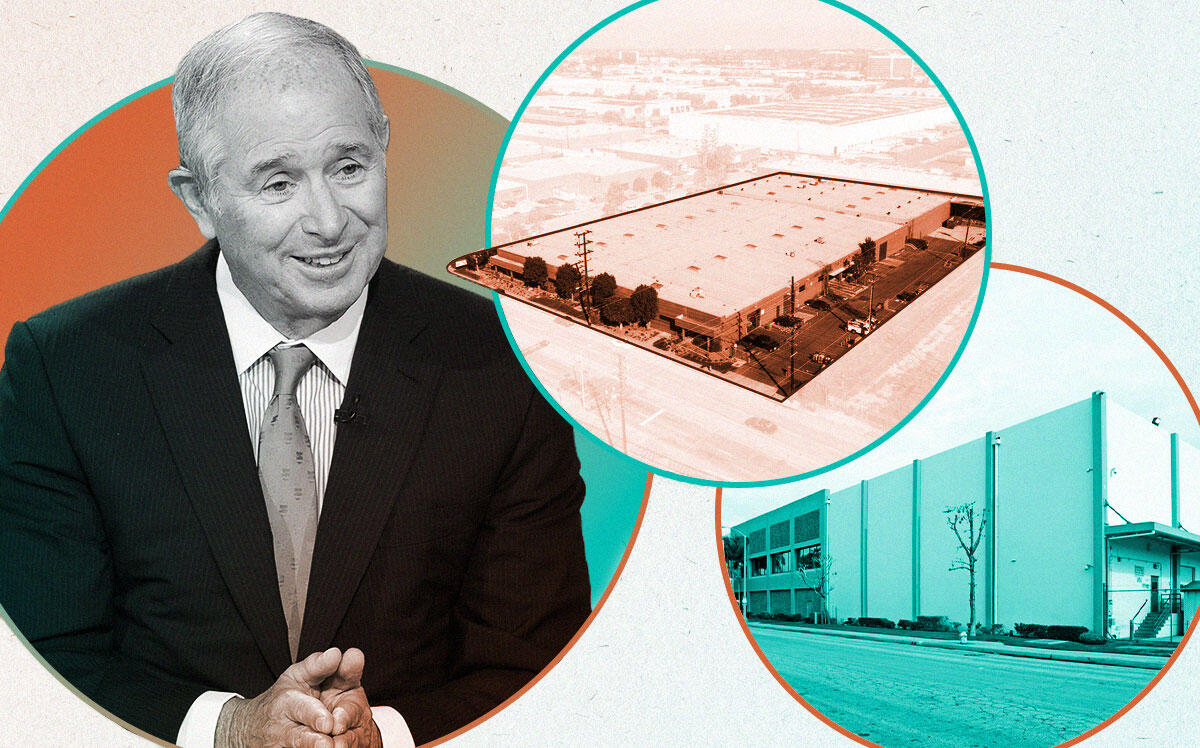

Blackstone has scored a $1.8 billion CMBS loan to refinance more than 110 warehouse, manufacturing and office properties across the country, The Real Deal has learned.

Six banks — Morgan Stanley, Bank of America, Barclays, Goldman Sachs, Natixis and Deutsche Bank –– participated in the refinancing deal, according to public records filed with Los Angeles County and a Moody’s report.

A spokesperson for Blackstone declined to comment.

The two-year, first-lien mortgage loan bears interest at a floating rate — the one-month secured overnight financing rate plus 2.71 percent, according to Moody’s. As of April 18, the one-month SOFR was 0.54 percent.

The loan is backed by 116 industrial properties across 22 cities, including Los Angeles, Chicago, Houston, Dallas, New Jersey, San Francisco and in South Florida. Around 26 percent of the portfolio’s square footage is located in Atlanta.

Together, the portfolio spans more than 19 million square feet, with 89 percent of the properties classified as warehouse, manufacturing and light industrial space. The rest are a mix of cold storage, data center, truck terminal and office facilities.

Clorox, the cleaning product manufacturer, leases the most space out of the portfolio, taking up almost 1.5 million square feet.

Industrial real estate has become increasingly more institutionalized over the last two years, as demand for e-commerce has spurred massive rent growth and investment pricing. In Southern California’s Inland Empire — the tightest market in the country — availability in the first quarter was virtually nonexistent.

In Southern California, the loan will refinance 16 properties in Los Angeles, Orange and San Bernardino counties.

In its largest allocation in California, $72.8 million of the total CMBS loan will go towards Blackstone’s 521,093-square-foot property at 1 Rocket Road in Hawthorne — the headquarters of Elon Musk’s SpaceX, records show. Blackstone bought the property for $27.9 million in 2014.

SpaceX pays $3.8 million in base rent at the property, according to the Moody’s report.

Around $203 million of the loan will be allocated to a 1.5 million-square-foot property in Fairburn, Georgia — the largest allocation in the portfolio.

Blackstone’s new CMBS loan comes just a month after it snagged $415 million in refinancing for 110 different industrial properties from Clarion Partners.