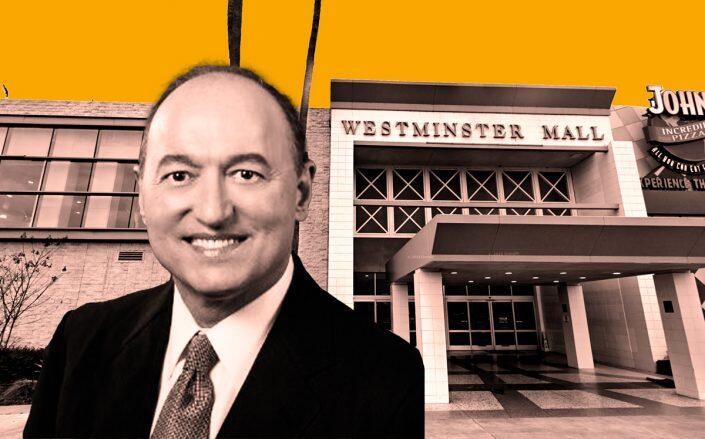

Shopoff Realty’s Bill Shopoff and 1025 Westminster Mall (Google Maps, LinkedIn)

A local investment company has paid $46.3 million for part of a 47-year-old enclosed mall in Westminster once occupied by Sears.

Shopoff Realty Investments, based in Irvine, bought a 14.1-acre portion of the Westminster Mall at 1025 Westminster Mall, GlobeSt.com reported. The seller was Seritage Growth Properties, a Sears spinoff based in New York.

The acquired land parcel includes a now-vacant former Sears store, which offers Shopoff an opportunity for redevelopment. Sears closed in January 2018 during the shutdown of 103 stores nationwide.

The 90-acre Westminster Mall, built in 1974, includes 1.3 million square feet of retail space anchored by Target, JCPenny and Macy’s.

“As the owners of various retail and commercial properties across the country, being able to purchase a portion of the iconic Westminster Mall is an exciting opportunity for our firm,” William Shopoff, CEO of Shopoff Realty, said in a statement. “We look forward to working with the city of Westminster to determine the future of this fantastic property, and ultimately breathing new life into the property.”

In connection with the acquisition, New York-based Mavik Capital Management provided Shopoff with $20 million in financing. Los Angeles-based bridge lender Hankey Capital provided Shopoff with senior financing for the initial purchase and for a planned redevelopment of its part of the mall.

Shopoff Realty Investments, founded by Shopoff in 1992, has a portfolio of 33 properties, mostly in California, with some in Nevada, Texas, New Mexico and Midwestern states, according to its website.

In December, it acquired land for a master-planned development with up to 3,650 residential units and 250,000 square feet of commercial space in the Inland Empire. It also plans to build two warehouses totaling 1.8 million square feet in Riverside County.

Seritage Growth Properties was spun out of the troubled Sears department store in 2015 with 235 properties formerly owned by Sears Holdings.

This month, its board recommended the company sell all of its assets and dissolve as its deadline to pay off a loan from Warren Buffett’s firm nears. In March, the company had interests in 161 properties with 19 million square feet of leasable space.

[GlobeSt] – Dana Bartholomew

Read more