Archway Holdings and 3D Investments buy Century City office building for $36M

Archway Holdings and 3D Investments buy Century City office building for $36M

Trending

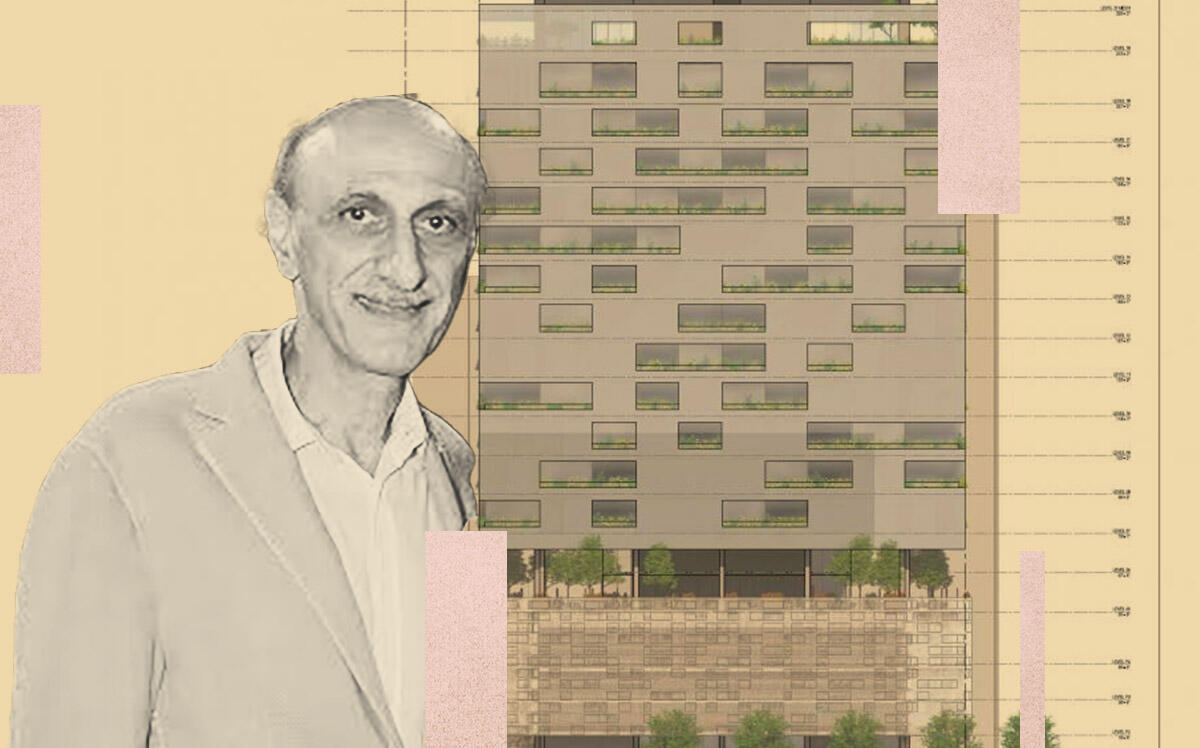

3D Investments plans 20-story apartment building in Beverly Grove

Tower would replace a 71-year-old office building at Wilshire and San Vicente

A local developer wants to bulldoze a 71-year-old office building in Beverly Grove and build a 20-story, mixed-use apartment building.

3D Investments, based in Beverly Hills, has filed plans to build the 77-unit tower at 6527-6535 Wilshire Boulevard, at the corner of San Vicente Boulevard, Urbanize Los Angeles reported.

The development would require razing Anderson Place, an 18,000-square-foot commercial building. The gabled, two-story brick building with dormer windows was built in 1951.

Plans call for a 243-foot tall building with 77 one-, two- and three-bedroom apartments and 4,000 square feet of ground-floor shops and restaurants. A parking garage, above and below ground, would serve 151 cars.

The developer would be allowed increased density and floor area through Transit Oriented Communities affordable housing incentives in exchange for eight affordable apartments for households earning extremely low-income.

The building, designed by Abramson Architects of West Adams, would be sheathed in gray metal and glass, with varied horizontal windows and perforated panels hiding three floors of above-grade parking.

It would include a fitness center, club rooms, co-working space, a landscaped terrace deck and rooftop pool.

Pending approval, 3D Investments could break ground in early 2024 and complete construction by spring 2026.

3D Investments, a family-owned firm led by Joseph Daneshgar, has owned and operated retail centers, regional malls, apartment complexes, office buildings and hotels for four decades, with major investments in Nevada.

In January, 3D paid $216 million for Tivoli Village, an open-air mall with 670,000 square feet of offices, shops and restaurants in Las Vegas. It was the biggest mixed-use commercial deal there since 2017.

In 2018, Daneshgar paid $44 million for Boca Raton, a 200-unit luxury condo complex south of the Las Vegas Strip. The next year, his company bought nearly 60 acres east of the Strip for $130 million. It also acquired Las Vegas Grand, a 212-unit apartment complex for nearly $48 million.

Adam Daneshgar, his nephew, founded Langdon Street Capital of Beverly Hills and bought the century-old Grand Central Market and Million Dollar Theater in Downtown Los Angeles in 2017.

— Dana Bartholomew

Read more

Archway Holdings and 3D Investments buy Century City office building for $36M

Archway Holdings and 3D Investments buy Century City office building for $36M

Burbank tower occupied by New York Film Academy lists for $40M

Burbank tower occupied by New York Film Academy lists for $40M