Michael Rosenfeld defaulted on almost $1.8 billion in loans connected to his Century Plaza redevelopment in Century City last July, but the Reuben brothers, who held part of the loan, allegedly let it slide.

So another mezzanine lender fought back.

In March, an entity controlled by DigitalBridge filed a lawsuit against David and Simon Reuben’s investment vehicle, Motcomb Estates, alleging it “violated its responsibilities” in servicing the $821 million mezzanine loan, according to a filing with New York Supreme Court.

Motcomb did nothing after the default, knowing it would benefit the Reuben brothers, DigitalBridge — formerly known as Colony Capital and now led by Marc Ganzi — said in its complaint.

Just before a judge denied Motcomb’s motion to dismiss, the brothers initiated a UCC foreclosure, after holding out for months. The $2.5 billion Century Plaza project is now headed to auction on Dec. 14, according to a public sale notice first reported by CoStar.

The Reubens delayed pursuing a UCC foreclosure to protect their own interests, according to court documents and sources familiar with the matter. Over the course of four years, the brothers went from holding a small stake in the senior loan for the property to holding more than $1.2 billion worth of debt on the project.

Choosing not to act is unusual for the Reubens, who have had no issue pursuing UCC foreclosures in the past. Last year, they initiated foreclosure proceedings on One Thousand Museum in Miami — developed by a consortium including Todd Michael Glaser — and the the Witkoff Group and Ian Schrager’s West Hollywood Edition in L.A.

Meanwhile, DigitalBridge pushed to salvage its debt stake by seeking a UCC foreclosure as soon as possible.

In a June memorandum asking the court to dismiss the case, Motcomb called DigitalBridge’s claims “baseless,” adding the firm has allegedly failed to show any true monetary damages.

DigitalBridge declined to comment, while neither Rosenfeld nor the Reubens responded to a request for comment.

Rosenfeld has spent more than a decade working on the Century City development — years filled with construction delays, lawsuits, ballooning debt and city planning obstacles. Now, it’s a project he’s set to lose.

Ground-up funding

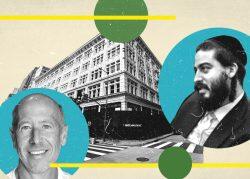

In 2008, Rosenfeld unveiled an initial ambitious $2 billion plan to redevelop the historic Century Plaza Hotel at 2050 Avenue of the Stars in Century City. After purchasing the hotel for $367 million, his new entity, Next Century Associates, looked to demolish and replace it with a tower with 130 luxury condos and another with a 240-key hotel, plus residences.

But just two years later, Rosenfeld scrapped the demolition plans, after pushback from L.A. City council members and the L.A. Conservancy. Instead, his firm went forward with plans for residential towers behind the hotel — a project estimated at $2.5 billion.

Construction finally started in 2016, after Rosenfeld scored city approval and a hefty financing package. JPMorgan provided a $446 million senior loan, DigitalBridge predecessor Colony Capital gave $120 million in mezzanine financing and EB-5 lenders also pooled together $450 million. The Reubens also contributed a small stake to the senior loan, making them eligible for payouts first in the event of a default.

The initial funding wasn’t enough. Various construction delays and cost increases forced Woodridge to go back to its lenders and ask for even more money.

JPMorgan and Colony Capital agreed to additional funding. By 2018, Colony had coughed up more than $500 million and handed over a preferred equity investment of about $89 million, according to the March complaint.

Reshuffling the stack

Delays and cost overruns were exacerbated in March of 2020. Next Century went back to its lenders yet again, looking to restructure its financing.

The Reubens decided to hand out more money and agreed to provide a senior mezzanine loan of up to $275 million, according to court documents.

This allowed the Reubens to climb over Colony in the debt stack. In the event of default, they would get paid before Colony. With the deal, they also agreed to take over as the administrative agent — essentially the entity ensuring the terms of the loan are met, according to sources familiar with the terms.

Colony agreed and ended up holding a $550 million mezzanine loan — classified as more junior to the Reubens’ debt.

At the start of September 2020, the final mezzanine loan amount totaled $821 million.

When Colony signed the agreement, it was actually giving up power: it “voluntarily relinquished” any opportunity to determine how the mezzanine loan was to be controlled, enforced and administered on a day-to-day basis, Motcomb wrote in a request to dismiss the lawsuit in June.

To foreclose or not to foreclose?

In September 2021, Rosenfeld lauded the opening of the new Century Plaza — to be branded as a Fairmont hotel. He succeeded in restoring the 19-story, curved property and added two towering residential properties with 268 more units.

“My wings are getting tired from flapping so long,” he told the Wall Street Journal last year.

Three months prior, Motcomb notified Colony — now known as DigitalBridge — that the borrower had failed to repay both the senior and the mezzanine loans in full before they were set to mature according to court records.

By September of last year, Motcomb told DigitalBridge that it had also bought out JPMorgan as a lender.

With that, Reubens became the sole lender of the $890 million senior loan and about $271 million worth of the mezzanine loan. DigitalBridge still held $550 million worth of the mezzanine loan.

“They’re putting the interest of Colony under water,” said a source familiar with the foreclosure. “When it does go into foreclosure, its interest becomes so low.”

Motcomb allegedly receives about $9 million in interest for every month of default, DigitalBridge said in its complaint.

Motcomb was also preoccupied with another foreclosure — in July of last year, it initiated one on the West Hollywood Edition, a 190-key hotel owned by the Witkoff Group. Witkoff ultimately avoided a foreclosure by scoring a refinancing package.

Read more

Instead of a UCC foreclosure, the brothers presented DigitalBridge an alternative plan to allow the firm to become the sole mezzanine lender. Then, the Reubens would put the property into foreclosure and DigitalBridge would become the sole owner of the project.

DigitalBridge declined the offer, arguing it was too much liability and too expensive. It preferred a typical UCC foreclosure, where it could recover some of its owed debt and the Reuben brothers could bid on the asset using its existing debt and take control of the property.

Given its status as a mezzanine lender, DigitalBridge can still bid on the property in December and take control of the hotel and condo development, where units are still up for sale.

“Properties like the Century Plaza Hotel are one-of-a-kind,” Rosenfeld said in 2008. “They have lasting value.”

Even if that’s true and regardless of who takes control of the property, he lost his chance to make a profit.