A third of California homeowners own their properties free and clear.

Nearly 2.4 million homeowners across the state in 2021 had no property mortgage, the third highest among the states and Washington, D.C., the Orange County Register reported.

In a ranking of the numbers of homeowners without loans, Texas led at 2.9 million, followed by Florida at 2.5 million. After California comes New York at 1.7 million and Pennsylvania at 1.5 million.

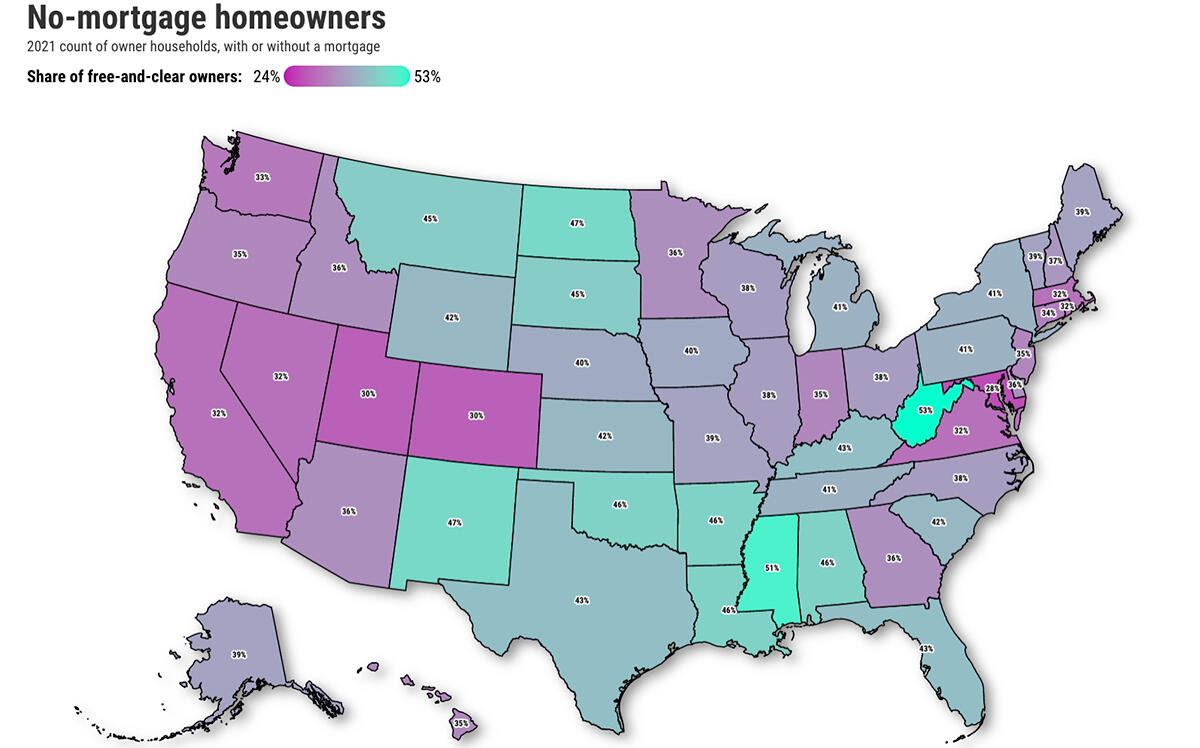

But when ranked according to the percentage of no-mortgage owners, California ranked toward the bottom at 33 percent. Only three states and the District of Columbia have a smaller share: D.C. at 24 percent; Maryland at 28 percent; and Colorado and Utah at 30 percent.

Screenshot of the Interactive Map (Census)

The Register conducted the state-by-state-and-D.C. analysis by reviewing U.S. Census data tracking homeowners — dividing households between those living with or without mortgages — for 2021 in the 50 states and the District of Columbia.

West Virginia had the largest share of free-and-clear owners at 53 percent, followed by Mississippi at 51 percent, North Dakota and New Mexico at 47 percent and Louisiana at 46 percent.

Texas and Florida were both at 43 percent.

The Census compiles homeowner’s expenses such as property taxes, insurance and upkeep, as well as mortgage payments.

In California, those expenses translated to median monthly housing cost for a no-mortgage household of $694 in 2021, the ninth-highest among the states, according to the Register.

Add a mortgage and the median cost of a home in California was $2,523 a month in 2021 — ranking No. 3 behind only D.C. at $2,639 and Hawaii at $2,584, among the priciest places to buy a home in the U.S.

After California in the total cost ranking was New Jersey at $2,458 and Massachusetts at $2,323.

The lowest cost states were West Virginia at $1,071, followed by Arkansas at $1,147, Indiana at $1,195, Mississippi at $1,200 and Alabama at $1,223. Texas was No. 16 at $1,765 and Florida was No. 22 at $1,616.

Despite the low ownership costs for those without a mortgage, meeting housing costs can still be a struggle.

Some long-time owners who have paid off home loans can still be financially stressed by other housing costs that strain cash flow.

In California, 17 percent of free-and-clear owners in 2021 were considered “burdened” by housing costs because they spend 30 percent or more of their income on shelter, the eighth-highest level nationwide, according to the Register.

In California, free-and-clear costs in 2021 were 72 percent below those paid by mortgaged households, which ranked third among the states in a tie with Louisiana and Nevada. Bigger savings were only found in Hawaii at 77 percent and Virginia at 73 percent.

California hovers near the bottom on home ownership, with 55 percent of residents owning a home, a level unchanged since 2019.

— Dana Bartholomew

Read more