EBS Realty Partners and a Connecticut investor have bought the former manufacturing campus for Teva Pharmaceuticals Industries in Irvine for $24 million.

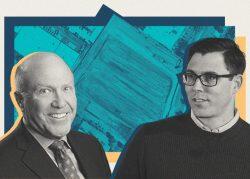

The Newport Beach-based commercial investor and Penwood Real Estate Investment Management bought the three industrial buildings at 19 Hughes Avenue, the Orange County Business Journal reported.

The 6.7-acre site includes three buildings totaling 186,000 square feet, including a main building of 88,000 square feet near the south side of the Great Park.

The property was once occupied by the Tel Aviv-based pharmaceutical firm, once the second largest drugmaker in Orange County. Teva, which bought the buildings in 2007, closed its Irvine plant after the U.S. Food and Drug Administration discovered contamination.

Last March, Teva announced plans to permanently cease manufacturing operations in Irvine, and took a $54 million write-off as a result of the decision, according to regulatory filings.

Real estate experts had expected the industrial campus to fetch up to $50 million, given recent pricing for new industrial projects.

Patrick Remolacio, a principal with EBS, attributed the lower-than-expected price to weakened market conditions and troubled debt markets since the facilities were listed last year.

The company is weighing several options for the site in light of new market conditions.

Teva’s lease runs out in a few more months, EBS said, at which point the developer will look at redeveloping the site on a build-to-suit or speculative basis, or lease the buildings as they stand.

Redevelopment may pose a challenge because of proposed changes to Irvine’s entitlement process, according to EBS.

“The planning staff has proposed a requirement of conditional use permits for new industrial properties, which would add a considerable amount of time to the entitlement process and would be problematic to future users,” Remolacio told the Business Journal.

In 2021, the EBS-Penwood venture bought the former LT Platinum site next to Angel Stadium at 2030 South State College Boulevard for $43.8 million. The site, once eyed for a mixed-use high-rise development, has a 100,000-square-foot warehouse leased through early next year.

In 2019, the Newport Beach firm bought a 95,000-square-foot industrial building at 14192 Franklin Avenue in Tustin for nearly $20 million. The next year, it leased it to Rivian Automotive, an electric vehicle company based a few blocks away.

— Dana Bartholomew

Read more