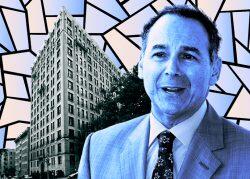

Before Efrem Harkham sold the Luxe hotel on Rodeo Drive to French luxury conglomerate LVMH for $200 million in 2021, he had allegedly defaulted on the property.

Harkham and his son Aron owed $9.5 million in default payments and rushed to sell the property quickly in a fire sale, according to a recent court complaint filed by Efrem Harkham’s brother, Benjamin.

Efrem Harkham did not respond to a request for comment.

Benjamin Harkam, who said he bought into the property with a 12.5 percent stake, alleges he never saw a dime from the sale. He’s suing his brother and nephew for “devising a plan to steal his interest and wrongfully exclude him from the partnership.”

“Defendants used all the profits, including tens of millions of dollars owed to plaintiff, to buy replacement properties for themselves,” Benjamin Harkam said in his complaint, which was filed with L.A. Superior Court in December.

Efrem and Aron Harkham shuttered the 86-key hotel at 360 North Rodeo Drive in 2020, citing pandemic-related financial issues. The property got “caught up with the bad timing of the global travel market,” Aron Harkam told the Los Angeles Times in September 2020.

After that, the father-son team explored “all scenarios,” including a sale and refinancing, JLL said at the time of the sale.

The Harkham family, including Benjamin, bought the hotel for $12 million in 1995, according to court records and property documents filed with L.A. County. Efrem then spent $14 million to renovate the property, adding three ground-floor retail spaces.

In 2017, the Harkhams scored a $38 million loan from Jefferies LoanCore — now known as LoanCore — to refinance the property. The loan was personally guaranteed by Efrem Harkham, according to Benjamin’s complaint.

Under the agreement, the Harkhams were required to operate the property as a hotel and retail property. If they didn’t, it would trigger a default under the loan agreement, the complaint said.

In March 2020, Efrem and Aron Harkham stopped operating a hotel at the property, after the city ordered businesses to shut down at the outset of the pandemic. The lender declared default.

“To further default, full acceleration of the loan, and millions of dollars of personal exposure,” Efrem and Aron Harkham “raced to sell the property,” the complaint says.

The sale to LVMH came out to $2.3 million per key — one of the largest ever in terms of a per key price in California, Alan Reay at Atlas Hospitality Group said at the time.

But on a square-foot basis, the $4,700-a-foot deal was relatively low compared to other Rodeo Drive buildings that traded before the pandemic. LVMH, one of the most frequent shoppers of Rodeo Drive property, paid $11,000 a square foot to acquire a 22,300-square-foot retail building at 468 North Rodeo Drive, where it is now planning to build a Cheval Blanc hotel.

Since then, Efrem and Aron Harkham have failed to pay out a fair share to Benjamin, according to the suit, instead using the proceeds to buy other properties through 1031 exchanges, which offer property owners a tax break on capital gains.

Between February and April 2022, limited liability companies formed by the defendants purchased $151 million worth of real estate in Los Angeles and New York, according to the complaint.

Read more