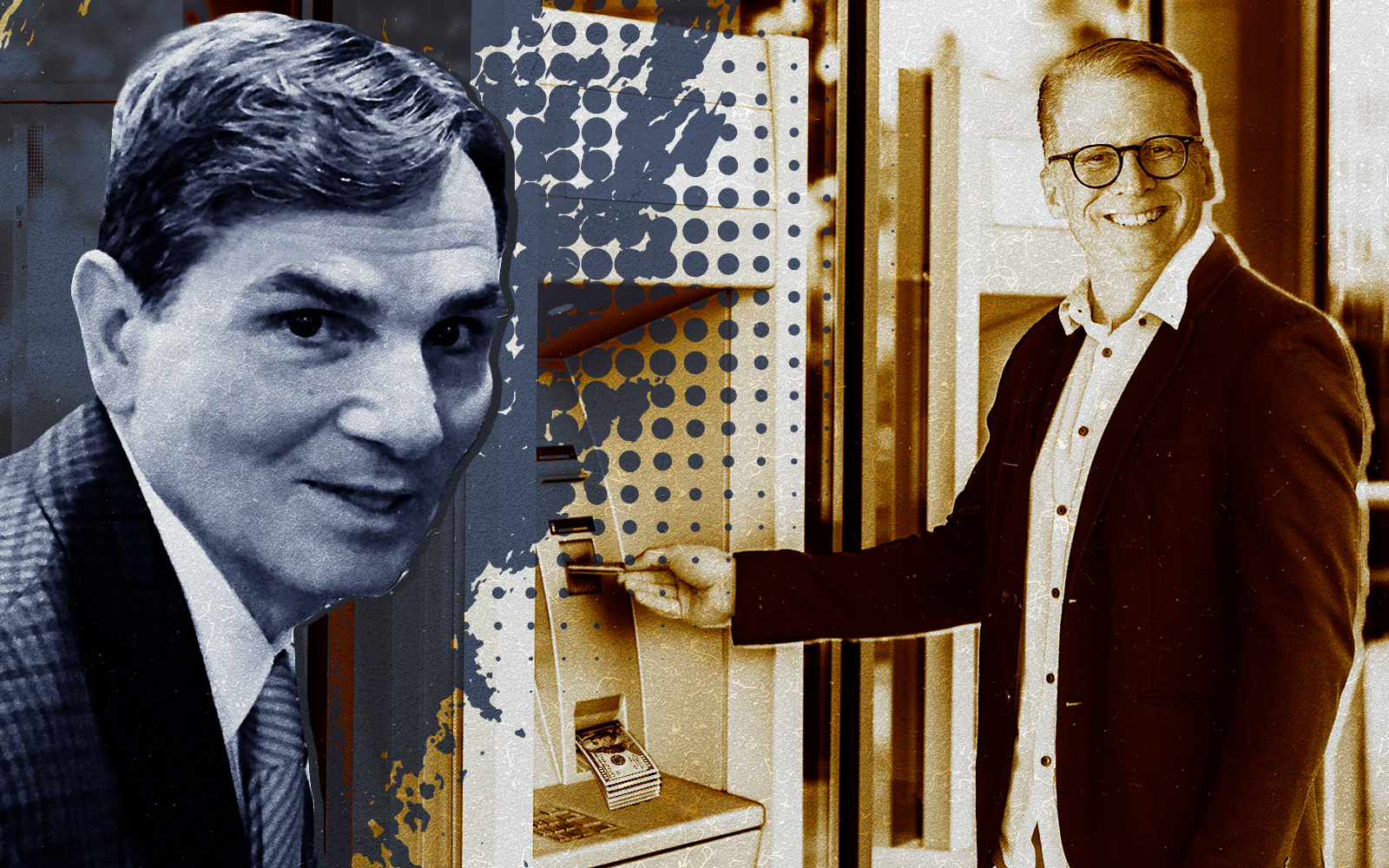

LoanDepot, one of the nation’s largest mortgage lenders, has settled a spat with founder and Chairman Anthony Hsieh over the direction of the troubled firm.

The Irvine-based real estate finance firm has named Hsieh ally Steven Ozonian to a larger board of directors, effective immediately, according to a settlement agreement, the Orange County Business Journal reported. Hsieh got an $857,000 payout in the deal.

The dispute broke out in February when Hsieh threatened a proxy battle because he said the board might not approve Ozonian as a director after Hsieh was ousted as the company’s executive chairman. He remains the chairman and the firm’s largest shareholder.

Hsieh, during a plunge in revenue for the lender, praised Ozonian for his “significant and relevant operating experience” in the real estate industry. Ozonian has been the CEO of Williston Financial Group since 2017.

As part of the settlement, Ozonian, along with current directors Andrew Dodson, managing partner at Parthenon Capital, and Pamela Hughes Patenaude, a housing policy expert who once served as a deputy secretary of the U.S. Department of Housing and Urban Development, will be nominated for election to three-year terms at the firm’s 2023 annual meeting.

At the annual meeting next year, the company will nominate only Hsieh and Brian Golson and the board will be reduced from nine to eight directors.

The addition of Ozonian to the board “will help loanDepot navigate the extraordinary challenges facing the mortgage industry,” Hsieh said in a statement.

The rise in interest rates by the Federal Reserve over the past year has decimated earnings for loanDepot, whose reported sales fell 65 percent last year to $1.3 billion. Analysts predict sales will fall another 25 percent this year to $908 million.

The dispute over loanDepot’s board became public on Feb. 7, when Hsieh used his majority voting power to unilaterally nominate Ozonian for election to the board of directors, according to Housingwire.

Hsieh has a more than 40 percent financial stake and 57 percent of the combined voting power at the lender, according to regulatory filings.

The following day, the company announced Hsieh was stepping down as executive chairman while remaining as chairman. But Hsieh said in a news release that “the board, in a 5-2 vote (with one director not present), terminated” him as executive chairman.

loanDepot agreed to pay Hsieh $857,000 and certain other amounts — conditioned upon Hsieh providing the company a general release of claims — due to his termination as executive chairman, according to a filing with the Securities & Exchange Commission.

Dawn Lepore, chair of the board’s nominating and corporate governance committee, said in a statement that with the agreement, “we avoid the distraction of a contested election and management, and under Frank Martell’s leadership as CEO, can focus fully on the continued execution of our Vision 2025 plan to position LDI for long-term value creation.”

LoanDepot moved $225 million of its cash out of Signature Bank last month after the New York-based financier was shut down and transferred under the control of the Federal Deposit Insurance Corporation.

In January of last year, billionaire Hsieh paid $30 million for a waterfront Star Island mansion in Miami Beach and $19.5 million for a unit at One Thousand Museum in Miami.

— Dana Bartholomew

Read more