During May, the scarcity of luxury home sales in Los Angeles continued for a second straight month with a slight improvement.

From May 1 to May 30, the City of Los Angeles recorded 10 sales with prices above $5 million. About 17 homes in that price range went under contract in Los Angeles in the month, according to research by Amalfi Estates agency in Pacific Palisades.

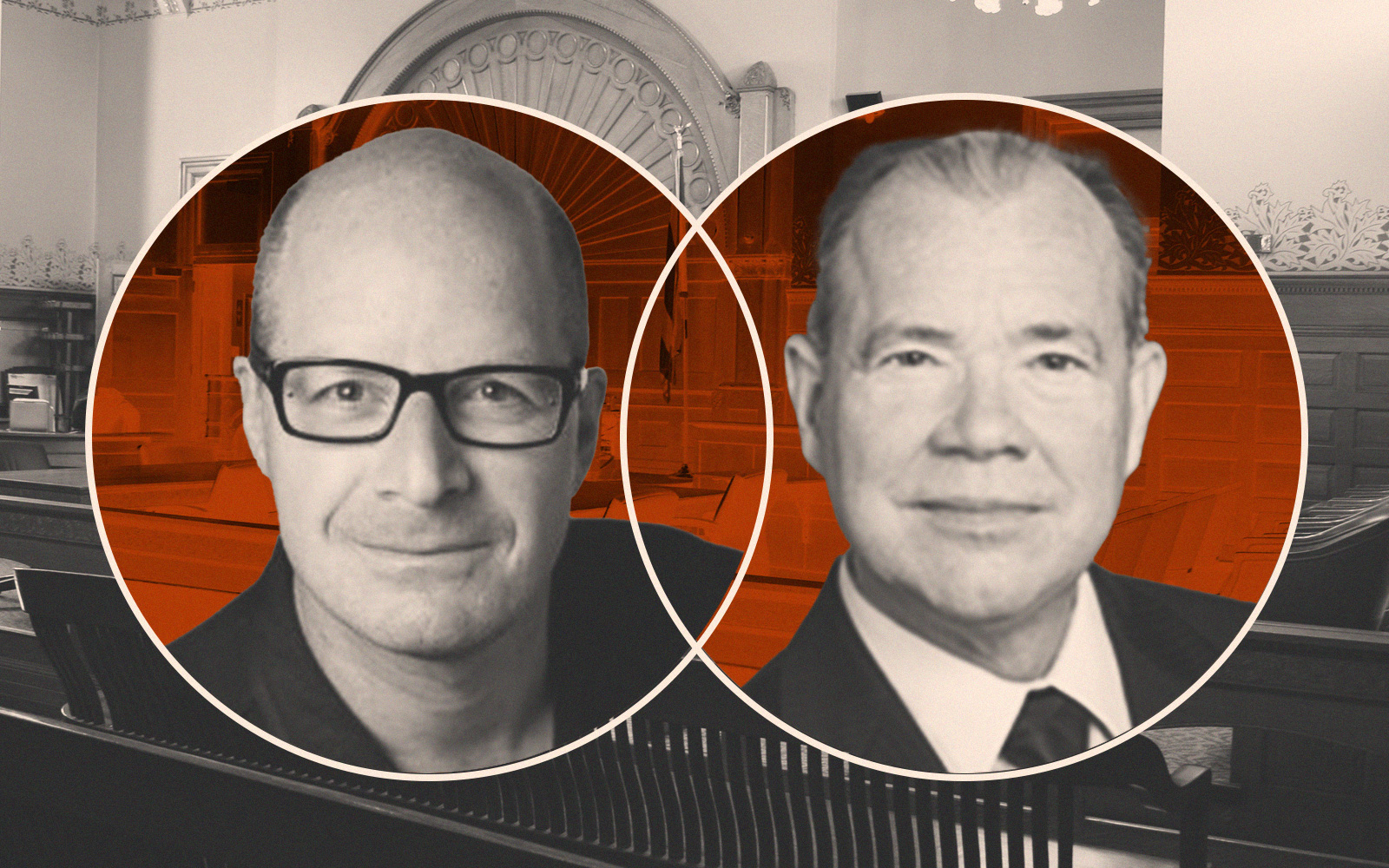

In April, following implementation of the city’s Measure ULA transfer tax on real estate deals, only two sales above $5 million took place. By comparison, for the past two years, on average, 50 deals over $5 million closed each month, said Anthony Marguleas, founder of Amalfi Estates.

“It’s not the 50 transactions we are used to seeing,” Marguleas said of the L.A. market. “But we are moving in the right direction, even with the Writers Guild strike, concern over the debt ceiling and recent bank closings.”

Eric Sussman, professor at the UCLA Ziman Center for Real Estate, said Los Angeles’ luxury market has not been this slow in recent memory, but he did not entirely place blame on the ULA, which charges an extra 4 percent on transactions above $5 million and 5.5 percent on deals above $10 million.

“There is no question that it’s a substantial tax. There is impact from a lot of other headwinds, such as higher interest rates, political uncertainty and [the question] are we going to have a recession? I think it’s a combination of things,” he said.

Cities not dealing with the ULA tax also have felt constraints on the market. Rochelle Atlas Maize of Nourmand & Associates and Steve Bohbot recently represented the seller for the $14.4 million sale of 513 N. Bedford Drive in Beverly Hills. The buyer was represented by Josh Flagg.

“There’s a spillover effect,” Maize said. “You would think that it would place Beverly Hills at more of a premium because you don’t have the tax. But there’s an overall vibe of the market going down. Buyers aren’t making purchases because they think prices are going to go lower. (In the city of Los Angeles) sellers are sidelined because they don’t want to pay the tax.”

She noted there’s a decline of sales for homes priced over $10 million in the exclusive Beverly Hills Flats neighborhood. Between January and May 2022, about 15 homes priced more than $10 million sold in Beverly Hills Flats. In the same time period in 2023, only six sales were recorded, according to Maize’s research.

She estimated that her revenue has declined 30 percent since May 2022 because she’s doing more business through leasing homes rather than sales. “The only thing stabilizing the industry is a shortage of supply,” Maize said of the L.A. market.

Read more