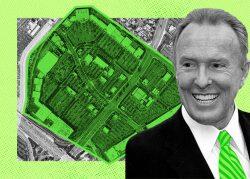

The Irvine Company will construct nearly 1,300 homes at the third largest outdoor shopping mall in Orange County, straddling Irvine and Tustin.

The Newport Beach-based developer won approval to build 1,261 apartments on the 79-acre Irvine side of The Market Place at 2961 El Camino Real, the Orange County Business Journal reported.

The outdoor shopping center has more than 120 stores, restaurants, cafes and theaters and is the third largest in the county, with nearly $663 million in taxable sales for the year ended June 30.

Initial plans had called for up to 1,400 apartments.

The new homes at the 35-year-old shopping center will replace 200,000 square feet of shops, including a former Hobby Lobby and a Barnes & Noble. A 24 Hour Fitness Center will be moved to a former Bed Bath & Beyond location.

The developer expects to break ground this summer. The Tustin portion wasn’t included in the housing plan.

The apartments will include 211 units, or 20 percent of the complex, set aside as affordable housing. Another 60 percent of the units will be geared toward local workers making between $50,000 and $110,000 a year.

Irvine Company officials say the housing will help boost shopping at nearby stores, generating $30 million a year in spending in and around The Market Place.

Rents for the new project were not disclosed.

The Irvine side of the project has landed notable tenants — including one of the first Amazon Fresh grocery stores in the nation. It also had high-profile closures, including the Bed Bath & Beyond.

The Market Place project joins mixed-use redevelopments of other malls across the county, including Brea Mall, MainPlace Mall, Westminster Mall and the former Laguna Hills Mall, among others.

The MainPlace Mall in Santa Ana was first to break ground on mixed-use apartments, with more than 300 units expected to be completed this year, with a second phase of more than 400 units to come later.

In March, Centennial Real Estate and USAA Real Estate’s $140.5 million loan on the 1.1-million-square-foot MainPlace Mall headed to special servicing for the second time in less than a year, The Real Deal reported, and faced “imminent maturity default.”

— Dana Bartholomew

Read more