UPDATED, June 22, 2023, 10:20 a.m.: After defaulting on $1.1 billion worth of debt tied to three office buildings in Downtown Los Angeles, Brookfield now faces the risk of defaulting on another $400 million in loans tied to a separate office tower in the city’s central business district.

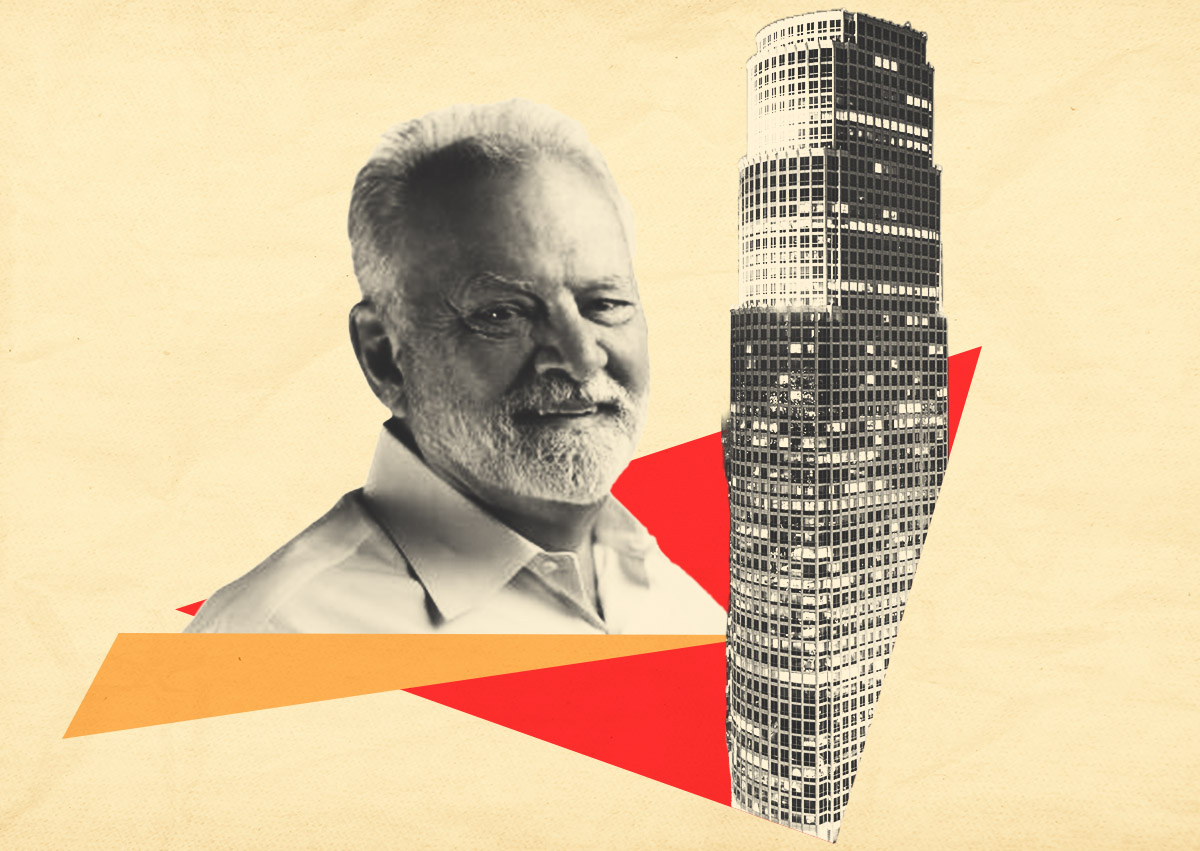

Brookfield has a “heightened maturity default risk” on the commercial mortgage-backed securities debt connected to its 1.4 million-square-foot Bank of America tower at 333 South Hope Street, according to a Fitch Ratings report.

The originators of the loans on Bank of America Plaza — Wells Fargo, Goldman Sachs, Morgan Stanley and Citigroup — are already reporting a loss on debt, Fitch Ratings said.

“Bank of America Plaza is currently more than 90 percent leased and performing well,” a Brookfield spokesperson said in an emailed statement, adding the firm has identified potential tenants to replace “expected vacancies” by the first quarter of next year.

The building is the latest Brookfield-owned office domino to wobble, as rising interest rates have caused alternative investment firm’s debt payments to soar while office occupancy has lagged in light of remote work.

Since February, Brookfield has lost two Los Angeles towers — the Gas Company Tower and EY Plaza — to a court-appointed receiver and has been in technical default on 777 Tower, though it’s still paying the debt service on the latter.

But Brookfield’s troubles at Bank of America Plaza are more tied to vacating tenants and dropping income, rather than rising rates. The CMBS debt on the building has a fixed interest rate of 4.05 percent, according to filings with the U.S. Securities & Exchange Commission, meaning it’s immune for now from the effect of rising interest rates.

The CMBS debt on the building won’t mature until September 2024, leaving Brookfield with more than a year to sort through any financial issues, SEC filings show.

Brookfield, which did not respond to a request for comment, has said the defaults on 777 Tower and the Gas Company Tower represent a “very small percentage” of the firm’s portfolio.

On the other side of the country, Brookfield is facing distress on about $1 billion worth of shopping malls, located in a swath from New Jersey to Virginia.

This story has been updated to include a comment from a Brookfield spokesperson.

Read more