UPDATED, July 25, 2023, 5:04 p.m.: California will soon see consolidation in the banking industry, as Banc of California is reportedly in advanced talks to buy lender Pacific Western Bank.

The deal was announced on Tuesday, after both banks released second-quarter earnings results. The Wall Street Journal first reported the deal was in talks.

The new firm will be based in Los Angeles, with Banc of California CEO Jared Wolff retaining his role at the new merged company. The merged firm, to keep the Banc of California name, will have $36.1 billion in assets under management and $25.3 billion in loans and will continue real estate lending, the firms said.

With the deal, Banc of California will significantly boost its residential mortgage holdings, according to financial reports, and its commercial real estate loan book. The deal is expected to close in late 2023 or early next year, the firm said.

Banc of California had about $3 billion in loans tied to commercial real estate, multifamily and construction at the end of the first quarter, according to an April earnings release. It also held about $1.9 billion in single-family residential mortgages.

The firms also announced that Centerbridge Partners and Warburg Pincus have agreed to put $400 million in equity into the new bank.

Comparatively, PacWest had about $3.8 billion in commercial loans, $5.5 billion in multifamily loans and $15.4 billion in residential mortgages, according to an earnings report.

However, PacWest has since sold off $2.4 billion worth of its commercial loans to Canadian insurer Fairfax Financial and developer Kennedy Wilson. Fairfax agreed to pay $2 billion for 63 loans, and Kennedy Wilson will fund about $100 million of the deal. More than 70 percent of the loans are connected to multifamily or student housing developments, according to Fairfax, with the remaining going towards industrial, hotel and life science projects.

PacWest also sold more than $1.2 billion in construction loan commitments to Cain International.

Banc of California was the 135th largest bank in the country at the end of the first quarter, with about $10 billion in assets under management. PacWest was listed as the 49th largest, with about $44 billion.

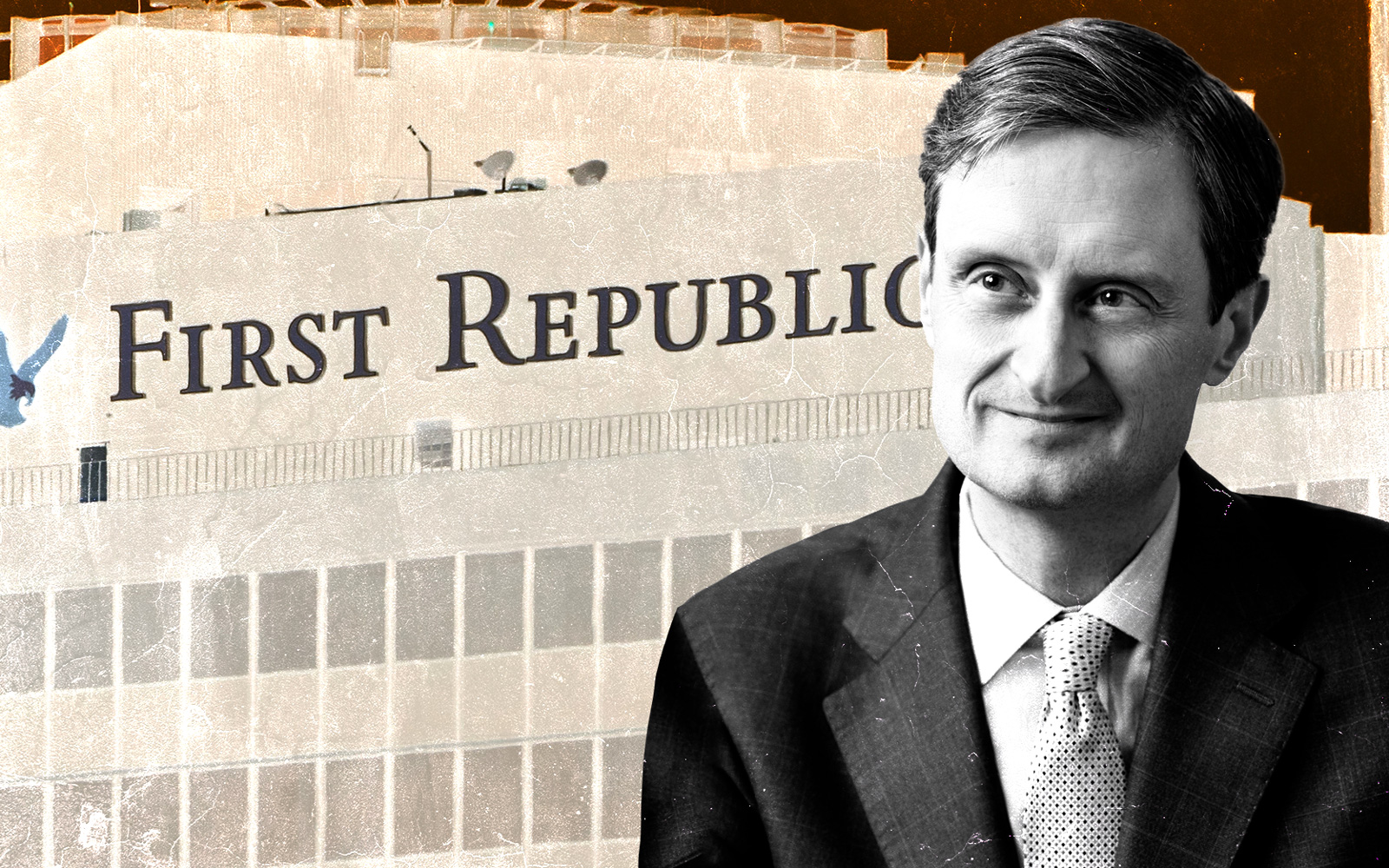

PacWest’s stock price has dropped 72 percent over the last year, including a drop of about 26 percent after the merger news broke on Tuesday. The lender fell victim to contagion fear in light of the collapse of both Silicon Valley Bank and First Republic Bank earlier this year.

In the first quarter, PacWest lost about 10 percent of its deposits — a metric that was better than originally expected, and substantially better than First Republic Bank, which lost nearly half of its deposits in the same period.

But similar to First Republic, PacWest struggled during the quarter with rising expenses which shrunk net interest income, calculated as income from interest on loans minus the interest the bank has to pay out on customer deposits and other liabilities.

Read more