LA Mayor Bass puts $150M from Measure ULA into proposed budget

LA Mayor Bass puts $150M from Measure ULA into proposed budget

Trending

LA mayor wants ULA money to cover back-rent payments

Tenants face Aug. 1 deadline to pay accumulated pandemic-era debt

Tenants rights groups have begged Los Angeles Mayor Karen Bass and the City Council to cancel millions of dollars in back rent before the payback deadline of Aug. 1.

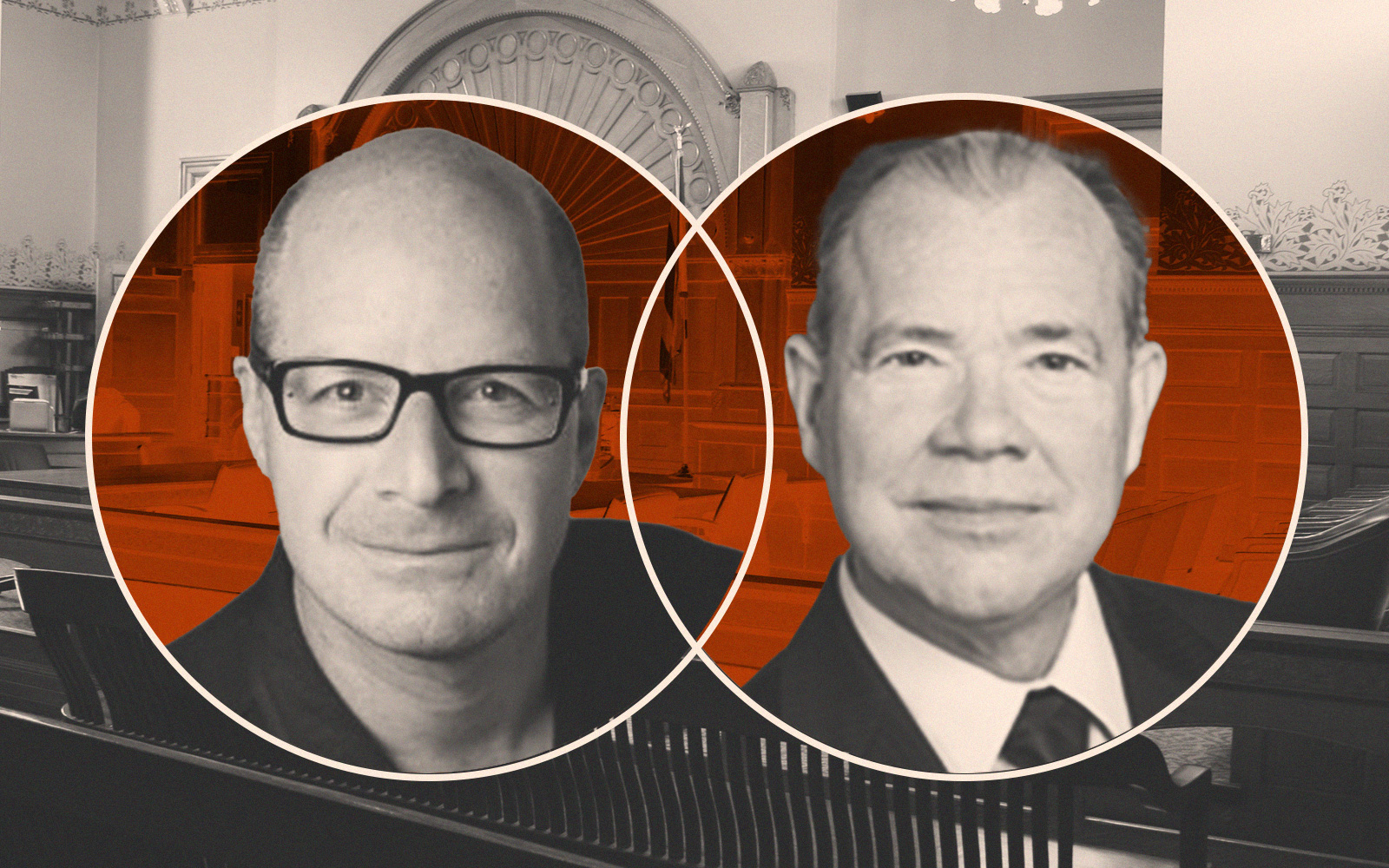

Bass and Councilmember Nithya Raman made a statement July 27 that help is on the way from the Measure ULA wealth transfer tax.

They noted that the council’s Housing and Homelessness Committee would consider at its Aug. 2 meeting an $18.4 million short-term emergency assistance program, funded by ULA tax dollars. It would allow eligible low-income tenants to apply for up to six months of owed back rent due to economic hardship. This program would later be considered by the full council.

Also up for discussion at the Aug. 2 committee meeting is a $23 million Eviction Defense Program which would offer legal support for tenants.

None of the funding ideas is particularly new. In an April state of the city speech, the mayor said the city budget earmarked about $20 million in short-term emergency funds from ULA money.

Unfortunately for the mayor and at-risk tenants, the ULA emergency program cannot be described as proverbial money in the bank.

In March, Matt Szabo, the city’s administrative officer, advised the elected officials not to spend ULA money before courts weigh in on lawsuits blocking the tax. “The collected taxes would need to be refunded regardless of the measure passing if the city loses in the pending litigation and Measure ULA is invalidated,” Szabo wrote in March comments reported in The Real Deal and other media outlets.

A court hearing is scheduled in September for two lawsuits seeking to invalidate Measure ULA.

ULA also is forecast to bring in much less money than initially forecast. The tax is projected to generate up to $672 million in revenues from July 1 of this year through June 30 of 2024, according to a March analysis from the City Administrative Office. It was initially forecast to pull in almost $1 billion in revenue.

The statement from Bass and Raman notes that state law prohibits eviction if a tenant provided a landlord with a declaration of COVID hardship from March 2020 to August 2020, or provided a declaration of COVID hardship and paid 25 percent of rent from Sept. 1, 2020 to Sept. 20, 2021.

The statement from Bass and Raman also talks up a new public information campaign to inform at-risk renters about city housing programs.

Read more

LA Mayor Bass puts $150M from Measure ULA into proposed budget

LA Mayor Bass puts $150M from Measure ULA into proposed budget

Judge combines two lawsuits challenging Measure ULA

Judge combines two lawsuits challenging Measure ULA

LA tenants have until Aug. 1 to pay 18 months of back rent

LA tenants have until Aug. 1 to pay 18 months of back rent