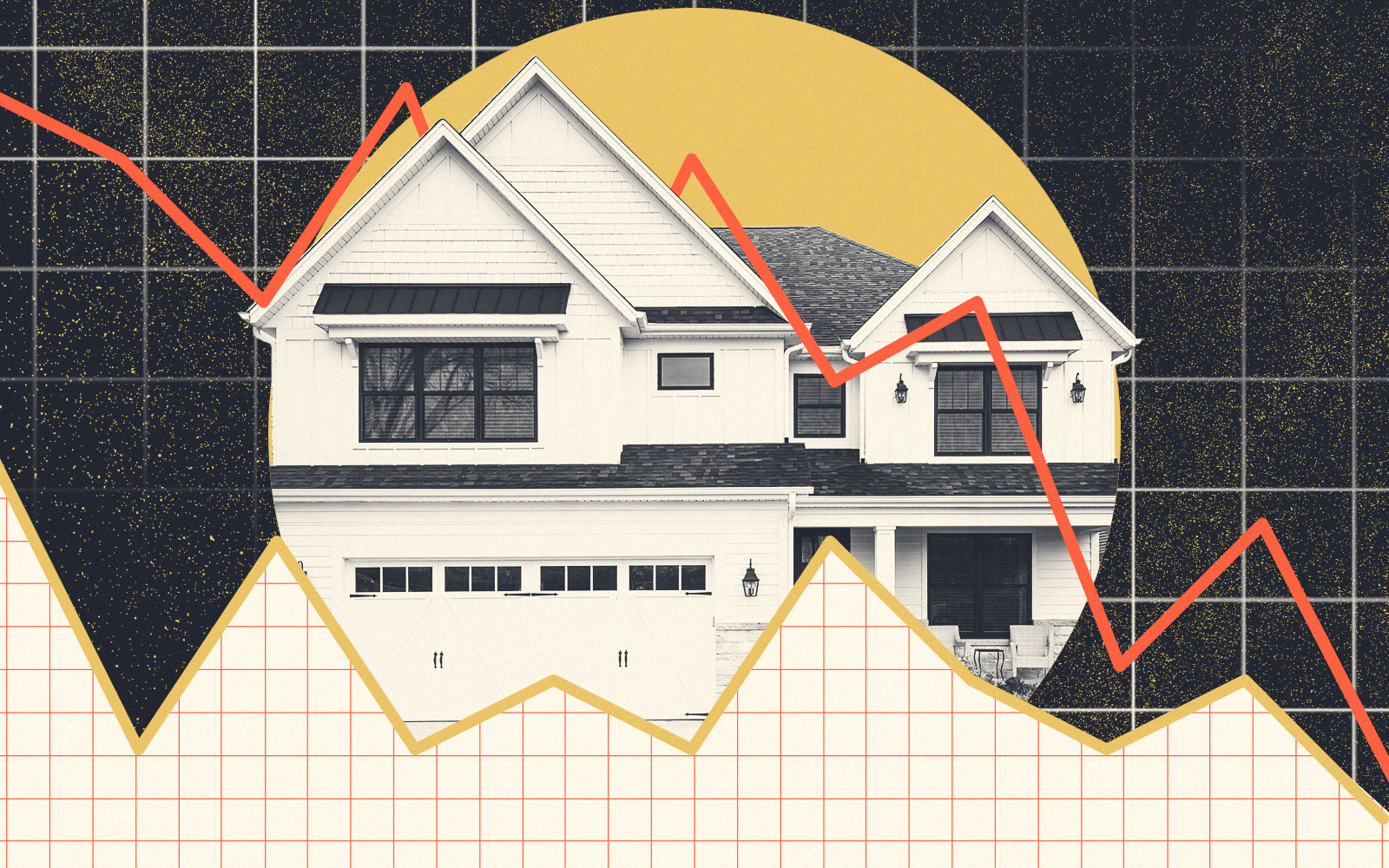

Home buyers across the Golden State now face record mortgage payments.

To purchase a typical home, a buyer must come up with a record-high $4,359 a month, the Orange County Register reported, citing the California Association of Realtors.

The median selling price for a home in California in July was $832,340. At the same time, mortgage rates soared to an average 6.84 percent for 30-year loans.

With a 20 percent down payment, or $166,000, a home buyer last month faced a $4,359 monthly mortgage payment -– 17 percent more than the same time last year.

The payment is more than twice as high, or 110 percent, than what a typical home buyer paid in February 2020, just before the pandemic.

The state’s record payment stood at $3,040 a month from June 2007, near the peak of the Great Recession, until March last year.

Since then, new mortgage payment records have been set seven times in 17 months, with the current payment 43 percent higher than the 2007 high.

Just 16 percent of California households qualified to buy a median-priced single-family home in the second quarter, according to a Realtor affordability index.

With fewer people able to afford a home, statewide sales fell 9 percent from a year ago and 34 percent below the 34-year average, according to the Register. In Los Angeles County, July sales declined 16.2 percent compared to the previous year.

California listings are down 27 percent in a year and 68 percent below the 34-year average.

A typical listing is on the market 16 days, the 32nd lowest level over the past 34 years. Time on the market is down 11 percent in a year and down 62 percent compared to the 42-day average since 1990.

— Dana Bartholomew

Read more