Machine Investment Group and Taconic Capital Advisors scored $90.4 million in Commercial Property Assessed Clean Energy financing for two Hyatt hotels in Hollywood, about a year after acquiring the properties through foreclosure.

The New York-based investors landed the C-PACE financing for the Thompson Hollywood hotel at 1541 Wilcox Avenue and the Tommie Hollywood hotel at 6516 Selma Avenue, the Commercial Observer reported.

Nuveen Green Capital, based in Connecticut, provided $49 million in C-PACE financing for the 190-room Thompson Hollywood and $41.4 million for the 212-room Tommie Hollywood.

Proceeds from the financing were used to refinance construction loans on both hotels and cover building improvements.

C-PACE allows building owners to borrow at low rates to make energy upgrades. Rising interest rates have heightened interest in the green financing program, which differs from other types of alternative financing, according to The Real Deal.

The financing provides money to a landlord for energy-efficiency improvements — from new windows to retrofits to gut renovations. C-PACE is not technically a loan, but a property tax assessment at a fixed rate and paid back over time.

The financing for both Hollywood hotels allowed Machine and Taconic to “dramatically” lower the cost of capital needed to tackle necessary upgrades over its 30-year term, according to Cory Jubran, senior director of originations at Nuveen Green, which specializes in C-PACE financing.

He said C-PACE debt allowed the firms more favorable terms than a traditional refinance given today’s higher cost of borrowing.

“C-PACE can be a solution to assets which are coming out of either a construction loan or looking for bridge to long-term financing,” Jubran told the Observer.

“They’re moving from a construction loan to a long-term loan,” he said, “and we were able to provide them with attractive economics, as well as long-term paper that allowed them to effectuate their business plan.”

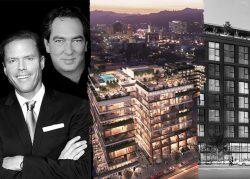

The Thompson Hollywood and Tommie Hollywood hotels were built by Los Angeles developer Grant King and his Relevant Group and opened in 2021, after lengthy construction delays and cost overruns.

But as his hotel empire teetered on collapse, he lost both hotels early last year to lenders Machine and Taconic through foreclosure. The two had provided a $72 million mezzanine loan on both properties.

— Dana Bartholomew

Read more