Tejon Ranch wants to more than double the size of its retail outlets and warehouses near the bottom of the Grapevine south of Bakersfield — paid for by a $61.6 million municipal bond.

The largest private landowner in the state is tapping the municipal bond market to expand its Tejon Ranch Commerce Center at 5205 South Wheeler Ridge Road, in Arvin, Bloomberg reported.

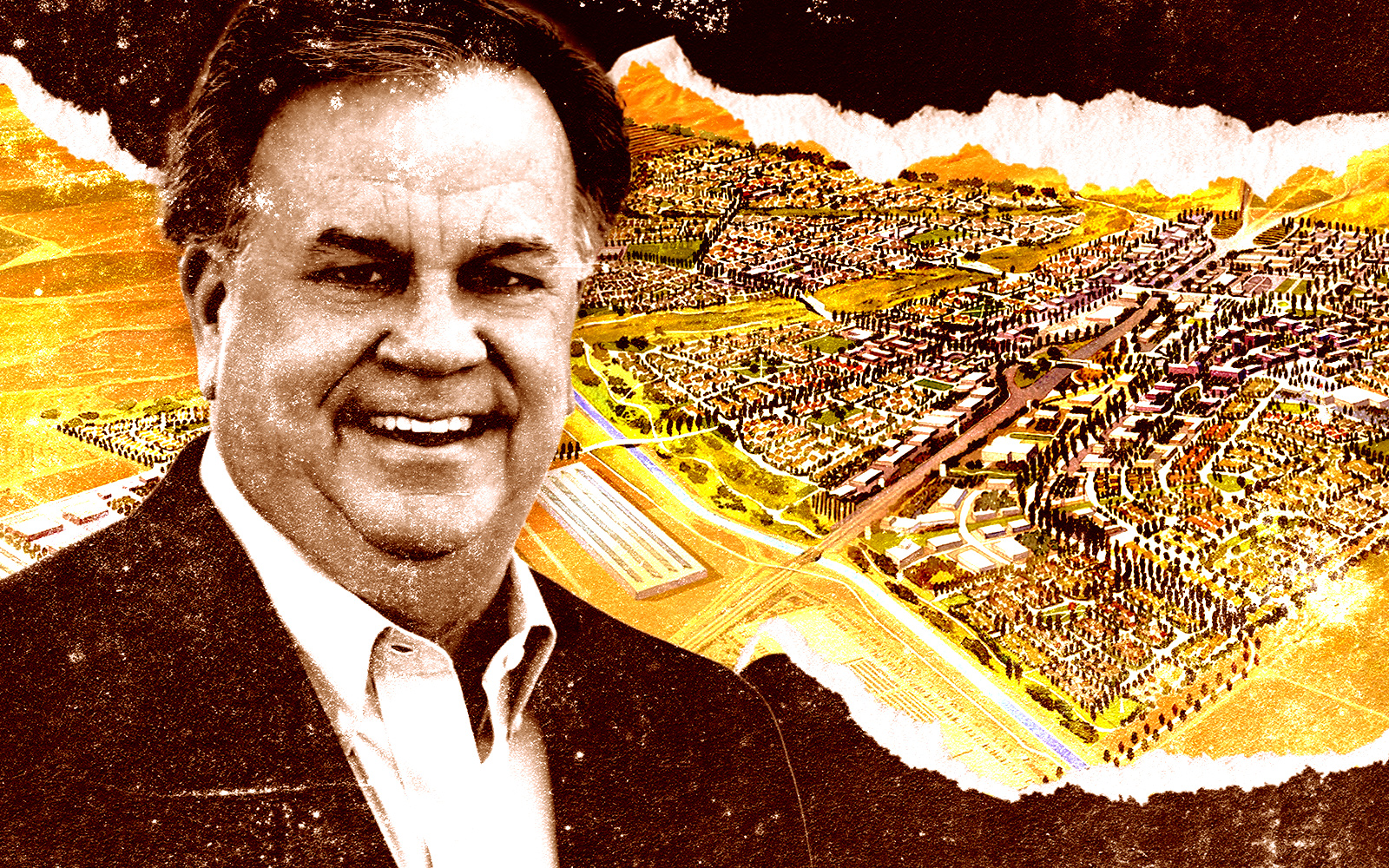

The owner of 270,000 acres in unincorporated Kern County has developed 7 million square feet of warehouses and outlet stores at its Commerce Center at the split of the 5 Freeway and Highway 99, according to its website. It’s the southernmost point of California’s central valley.

The latest financing would more than double the size of the center, now home to distribution facilities for Ikea, Caterpillar, L’Oreal and other retail giants. Plans for the site call for 20 million square feet after buildout. The center is part of a master plan to include 35,000 homes.

Tejon Ranch Public Facilities Financing Authority is expected to issue the bonds for the center this week. Proceeds will be used for the 20 million-square-foot development, according to bond documents. Stifel Financial is the sole underwriter on the deal.

On site, construction is underway on a 228-unit apartment complex expected to open by next year.

Hungry muni investors may be on the hunt for “rich yields,” according to Bloomberg. Terms of the bonds were not disclosed.

Given the lack of high-yield issuance bonds, “the things that do come will get a decent amount of attention,” David Mann, senior investment analyst at Manulife Asset Management, told Bloomberg “There should be some good demand for this.”

The commerce center is a part of a plan by publicly traded Tejon Ranch to develop real estate on its land. Plans include the Centennial project, a planned community of nearly 20,000 homes and more than 10 million square feet of commercial real estate in Los Angeles County.

But two decades after it was first proposed, a judge ruled that Tejon Ranch would have to revise its plans and complete an additional environmental impact analysis after a 2019 lawsuit challenged the project.

“It was conceived over 20 years ago, at a time that we didn’t really understand the environmental cost of building these areas, the wildfire risk and just the value of these grasslands and wildlife habitat,” J.P. Rose, a senior attorney with Center for Biological Diversity, the organization that filed the suit, told Bloomberg.

The property straddles Interstate 5, the busiest north-south route on the West Coast. Tejon Ranch was amassed through Mexican land grants in the 1800s and used for raising sheep and cattle. It still houses a working ranch, though farms and vineyards take up just 2 percent of its 270,000 acres, or 420 square miles.

“The investment is incredibly attractive,” David Spier, a portfolio manager at Nitor Capital Management, an equity investor in Tejon Ranch, told Bloomberg. “Everyday, hundreds of thousands of people have to go through it, commerce has to go through it.

“That gives Tejon the ability to take advantage of demand in the area.”

— Dana Bartholomew

Read more