Jason Oppenheim has entered the Clear Cooperation Policy fray.

The president of West Hollywood boutique agency The Oppenheim Group delivered sharp criticism of how Compass CEO Robert Reffkin has pushed to eliminate the four-year-old rule, calling the latter’s campaign focused on seller choice “disingenuous.”

The National Association of Realtors’ Clear Cooperation rule requires that properties appear on the Multiple Listing Service within one business day of being publicly marketed. Eliminating the rule, supporters contend, gives clients a choice about where to list their properties. Those in favor of keeping Clear Cooperation argue the rule brings transparency to the marketplace and allows agents to cast the widest net to find buyers.

It has become a divisive topic, in many cases pitting large brokerages against their small- and medium-sized peers.

“[Reffkin] has every right to make that argument if he doesn’t want the Clear Cooperation Policy. He has every right to argue against it, but he should be making honest arguments about why he wants it removed,” Oppenheim told The Real Deal on Monday.

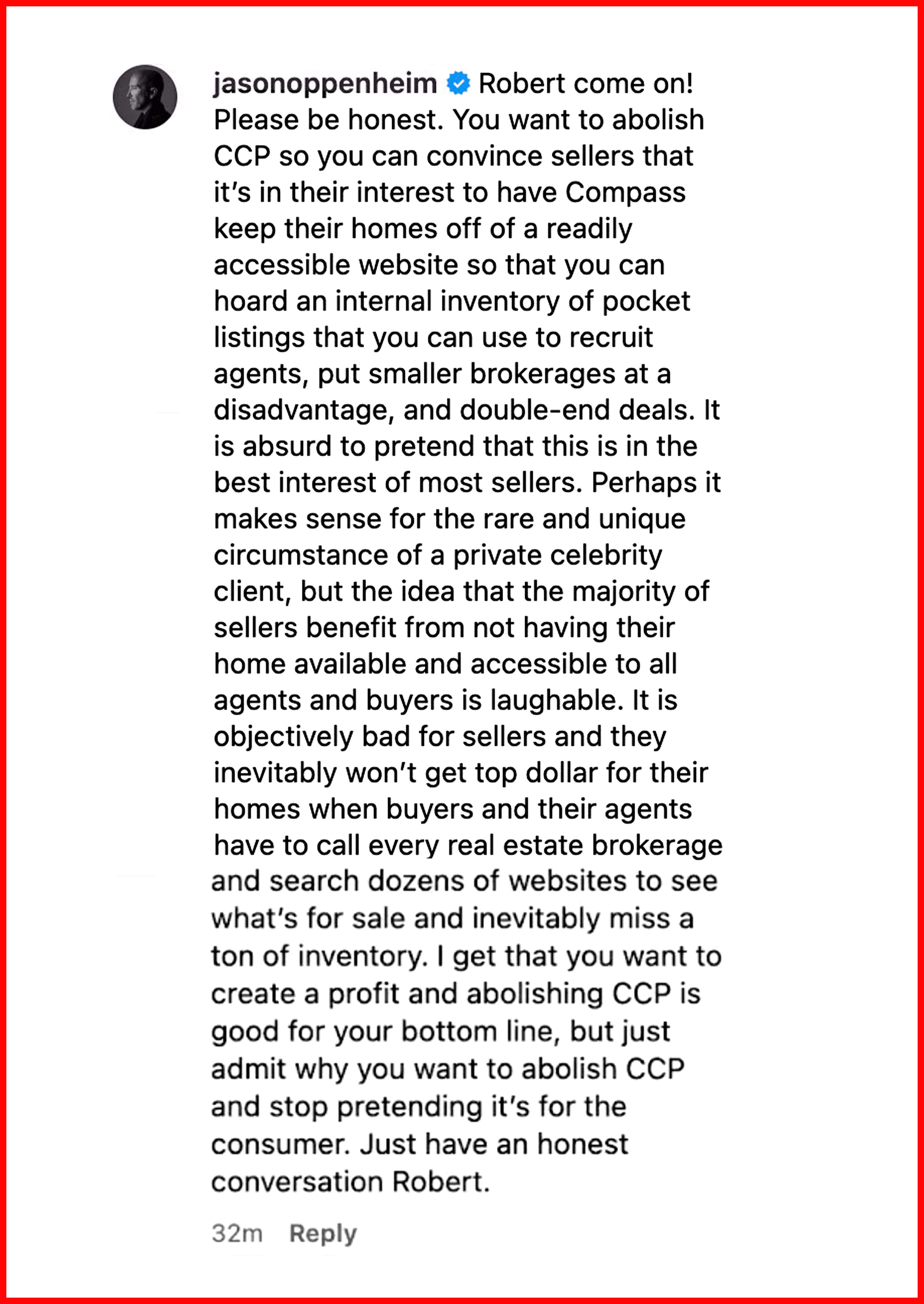

The broker, who stars on Netflix’s “Selling Sunset,” also laid out his points in a comment responding to a Compass Instagram post on the rule. The comment has since been deleted and Oppenheim said as of Tuesday he was blocked from Compass’ Instagram.

Reffkin has been on a tear lately to campaign for the policy’s removal.

“Clear Cooperation is forced cooperation,” Reffkin told Compass agents in an email obtained by TRD ahead of NAR’s Emerging Issues Advisory Board meeting.

The CEO and others contend the policy has prompted the need for sites such as Compass Private Exclusives, which does not publicize a property’s days on market or price reductions.

Compass Private Exclusives and similar platforms, Oppenheim argued, would make it easier for large brokerages to woo new agents and benefit from more double-ended deals. Oppenheim sees removal of the policy as creating less transparency and opening the doors to more seller lawsuits against agents for breach of fiduciary duty.

Compass, in a statement provided to TRD, did not specifically address Oppenheim’s issues with Reffkin’s messaging. Instead, the firm doubled down on its position.

“Many will state that removing Clear Cooperation will promote the proliferation of ‘pocket listings,’” a Compass spokesperson said. “The opposite is true. No rule in real estate history created more pocket listings than Clear Cooperation.”

Were the rule to be eliminated, Compass could return those “off-MLS” listings to Compass.com, the spokesperson said. Pocket listings refer to properties that are not on MLS, but marketed through other channels.

“[Reffkin] has a lot of reasons why he would like to be able to hoard information and create an internal list of properties because it will benefit his brokerage,” Oppenheim said. “That would be no different than if you were selling a piece of art and you went to Sotheby’s auction house and you said, ‘I want to sell my beautiful Warhol or Picasso,’ and the auctioneer says, ‘Hey, you know what? I think it’s better I call a few of my friends and I try to sell your Picasso.’”

Oppenheim acknowledged in cases involving a celebrity, for example, it could make sense not to have a property on the MLS for security reasons. However, he pointed to the exempted listings rule that gives sellers the option of not having their property in the MLS.

Read more

As the industry continues to hash out the pros and cons of Clear Cooperation, Oppenheim contends eliminating the policy holds significant industry implications.

“It would be the biggest change in real estate, probably bigger than what we’ve been dealt with the NAR settlement,” he told TRD.