Measure ULA proponents may have justification for the nickname “mansion tax.”

Single-family residential transactions account for the largest bucket of money generated so far by the property transfer tax.

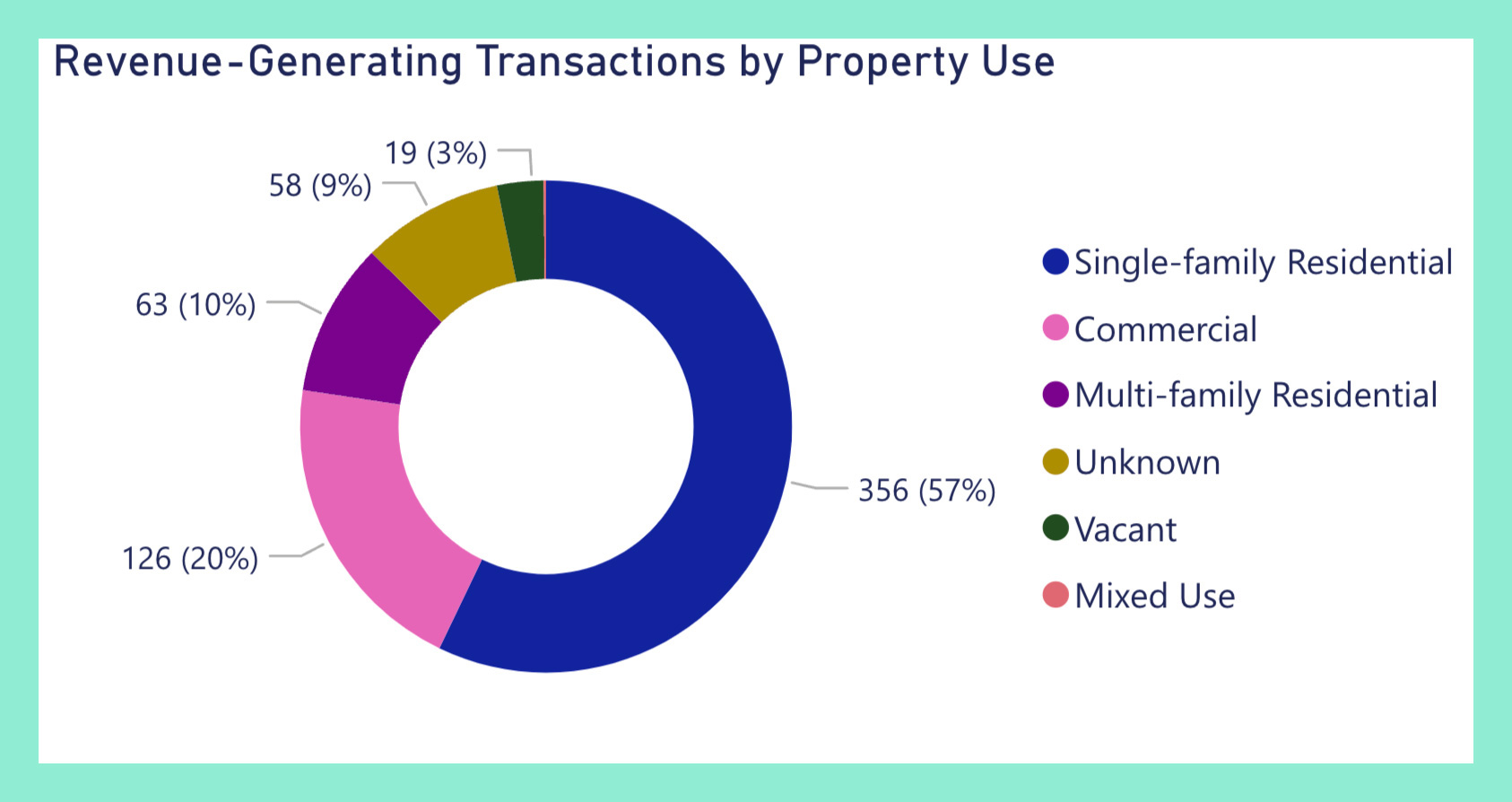

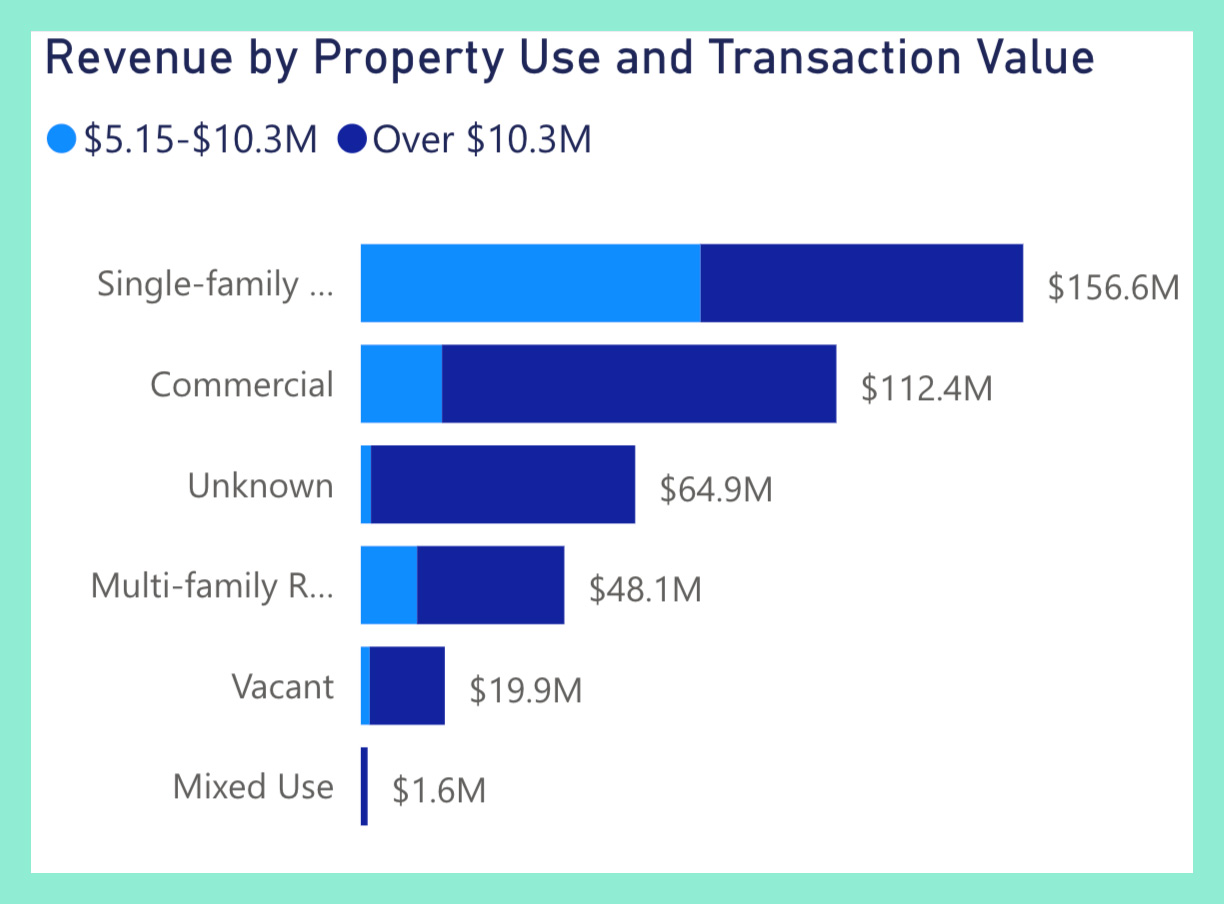

Revenue from the residential category totaled $11.6 million, or 59 percent of the total, in September, according to the most recent data available from the Los Angeles Housing Department. Residential’s lead is a trend that has held since Measure ULA went into effect last April, with the segment accounting for nearly 39 percent, or $156.6 million, of total funds raised to date.

Currently, ULA imposes a 4 percent tax within the city of Los Angeles on properties sold for $5.15 million or more. For deals of $10.3 million or more, a 5.5 percent tax goes into effect. Each year those thresholds are updated in line with the Consumer Price Index.

Commercial in September was the laggard of the property types in terms of revenue generation, bringing in $4.5 million across four deals. Since the start of ULA, commercial deals generated $112.4 million from 126 transactions.

Revenue from multifamily is reported separate from commercial, with one transaction last month that brought in $4.7 million. Multifamily deals have totaled 63 transactions since Measure ULA’s start, equating to $48.1 million in revenue.

The ZIP codes with the highest number of transactions since implementation are 90272, which is Pacific Palisades, and 90049, which includes neighborhoods such as Bel-Air and Brentwood.

Voters approved Measure ULA in November 2022, with the ballot initiative originally projected to bring in $600 million to $1.1 billion annually to fund affordable housing, homeless prevention and tenant assistance programs. Media and proponents labeled it a “mansion tax.” The ballot initiative also created a Citizens Oversight Committee, which held its October meeting this week, to function as a watchdog.

The program has missed on its initial revenue estimates with $296.7 million collected in the 2024 fiscal year ended in June.

Still, a report released in April and co-authored by individuals from Occidental College, UCLA and USC largely applauded ULA as “effective in improving housing conditions” in the city. The report, called “Measuring LA’s Mansion Tax,” cited $54.7 million in development projects being funded by ULA and another $24 million in rental assistance as some examples of that efficacy.

For real estate, agents have reported a cooling of sales activity because of the tax, or in the case of residential, deals shifting to cities other than Los Angeles, such as Malibu or Beverly Hills, to avoid the issue. Brokers say some sellers have largely accepted that the tax is not going away any time soon.

Nourmand & Associates President Michael Nourmand described to The Real Deal two different client perspectives in relation to Measure ULA. One client told Nourmand he will no longer buy property within the city. Another is happy because they have no plans to sell and, therefore, don’t have to think about paying the tax.

“For a lot of people, it has postponed things,” Nourmand said.

Studies on the tax’s business implications beyond real estate are also missing from the conversation, Nourmand pointed out. That includes the impact of deal contraction on title and escrow companies, inspectors, contractors, cleaning crews and other industries.

Christie’s International Real Estate Southern California CEO Aaron Kirman said about as much during TRD’s LA Real Estate Forum last month.

“I think the city eventually is going to realize they’re losing billions of dollars to make a couple hundred million,” Kirman said.

Read more