UPDATED JAN. 6 at 9:00 a.m.:

From dwindling mall occupancy at Santa Monica Place to downsizing office tenants on Silicon Beach, commercial borrowers found themselves in hot water as their loans came due in 2024.

Landlords in Los Angeles and Orange counties started the year with a bleak outlook: Some $21 billion worth of commercial mortgage-backed security loans and collateralized loan obligations tied to properties in the two counties came due in 2024. And more than half of those loans were already on a special servicing watchlist at the start of the year.

More than one in 10 CMBS loans tied to office properties across the country was delinquent by the end of 2024, according to a report by Trepp. Southern California did not buck the trend.

And owners burdened with other commercial mortgage debt also ran into trouble, such as Edward J. Minskoff Equities, which sold its 500,000-square-foot Playa Vista office complex known as The Bluffs last fall for a fraction of its 2016 value.

But the office market wasn’t the only sector to see supersized loan defaults over the past 12 months. The year’s top defaults in Los Angeles County include retail and multifamily properties, compiled below using Morningstar Data and The Real Deal’s previous reporting. All deals on the list reach a debt threshold of at least $200 million.

Santa Monica Place | Macerich | $300 million

Mall owner Macerich relinquished its 527,000-square foot outdoor shopping center, Santa Monica Place, in April after defaulting on a $300 million loan set to mature before the end of the year.

Occupancy at the shopping center, located at 395 Santa Monica Place across from the Santa Monica Pier, fell from 95 percent before the COVID-19 pandemic to 81 percent in 2022, according to Morningstar data.

The debt first hit turbulent waters that year, when it was sent to special servicing, but Macerich won an extension and maneuvered its way out of immanent default, as TRD previously reported.

But the 60-year-old real estate investment trust, which is also headquartered in Santa Monica, wasn’t so lucky the second time around. The loan hit special servicing again in April, and Macerich defaulted the following day. Occupancy has continued to decline, reaching 69 percent this year, and the company decided to walk away from its flagship property last spring.

“Ultimately, trying to figure out the end game was just too obscure,” Scott Kingsmore, Macerich’s chief financial officer, told Women’s Wear Daily.

The Bluffs | Edward J. Minskoff Equities | $271 million

Edward J. Minskoff Equities was hit with a default notice from its lender, Morgan Stanley, in May after its $250 million loan tied to 12121 and 12181 Bluff Creek Drive in Silicon Beach’s Playa Vista neighborhood came due with an unpaid balance of $271 million.

A resolution came in October, when Lincoln Property and Strategic Value Partners bought the office complex, known as The Bluffs, for $187.5 million, Commercial Observer first reported.

That’s considerably less than the $413 million Minskoff’s firm paid when it acquired the property in 2016.

Problems mounted after Fox Interactive Media, which had occupied almost the entire complex, came to the end of its lease in 2021. More than half the space in the buildings became available, and Minskoff struggled to fill it up. Tech giants like Google, Snap and X that had previously anchored the Silicon Beach office hub downsized after the pandemic.

Ovation Hollywood | Hollywood | $211 million

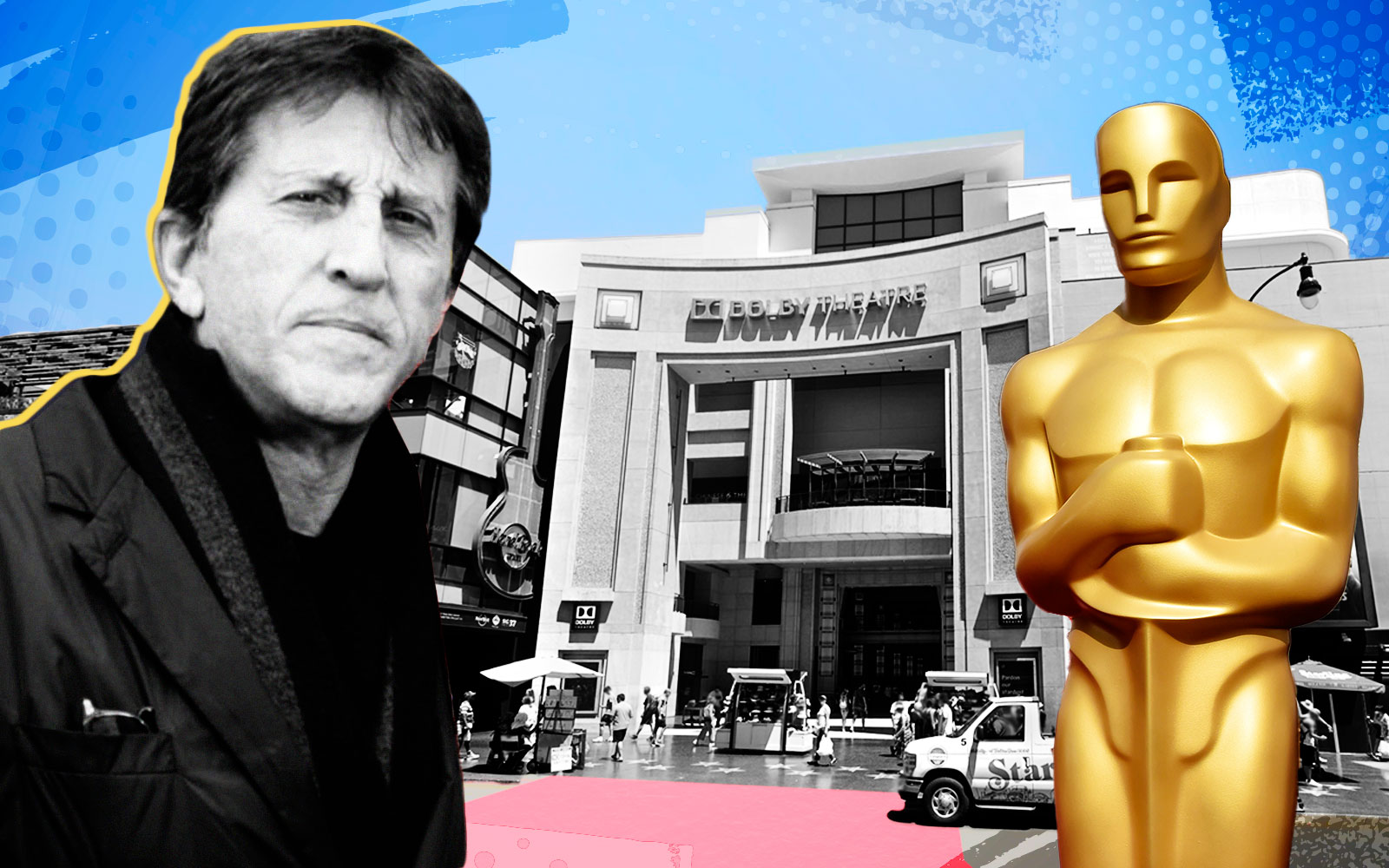

In a troubling sign for Hollywood’s North Highland entertainment hub, a $211.3 million loan tied to the 462,827-square-foot Ovation Hollywood shopping center, previously known as Hollywood & Highland, defaulted in August.

Gaw Capital took out the massive loan in 2019, Morningstar data shows. It contains two notes secured by Ovation Hollywood which matured Aug. 5 last year. It was placed on a special servicing watchlist in May before transferring to special servicing the following month due to “immanent maturity default,” which occurred in August.

The property, located at 6801 Hollywood Boulevard, was built in 2001 and is 75 percent occupied, according to Morningstar data. It’s home to the historic 3,400-seat Dolby Theater, where the Academy Awards take place.

The venue traded hands in September, as TRD reported. Hollywood producer Elie Samaha’s JEBS Hollywood Entertainment bought the Dolby Theater for $50 million in a discounted deal brokered by Avison Young’s Christopher Bonbright, with JLL’s Will Poulsen and Peter Hajimihalis representing the seller, CalPERS, along with Muhlstein CRE’s Carl Muhlstein.

Mandarin Oriental Residences | Shvo & Deutsche Finance | $200 million

Michael Shvo sold 10 luxury condominiums at the newly developed Mandarin Oriental Residences Beverly Hills for an average of $3,200 per foot before the project was hit with a default notice in September.

The owners of the 54-unit complex at 9200 Wilshire Boulevard, which include Shvo and partners Deutsche Finance and a German pension fund group, failed to pay back a $200 million loan tied to the property, according to Acore Capital’s notice.

The owners hired Newmark’s Adam Spies to oversee the sale of the remaining units and about 6,000 square feet of retail space on the ground floor. They went up for bulk sale Sept. 4.

“The decision allows the partnership to re-allocate investment resources to purchase new income producing assets, in anticipation of a lower interest rate environment,” reads a statement from September. “The project was just completed in May of this year and has already sold 10 units at an average of more than $3,200 [per square foot].”

CORRECTION: Previous story incorrectly identified the party that hired Newmark to bulk sell units at Mandarin Oriental Residences Beverly Hills.