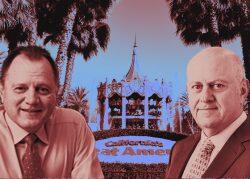

Herschend is taking its amusements to Southern California in a challenge to Six Flags’ roller coaster screams.

The Atlanta-based theme park firm bought Palace Entertainment’s U.S. properties from Madrid-based Parques Reunidos for an undisclosed price, tripling its size and gobbling up theme parks in San Dimas, Riverside, Palm Springs and Vista, the Orange County Register reported.

Herschend, parent company of Dollywood and Silver Dollar City, will pit its 21 theme and water parks against Six Flags’ 42 parks in a battle for regional amusement smiles.

The newly combined Herschend/Palace will have 20 million annual visitors compared to the Six Flags/Cedar Fair draw of 48.9 million, according to the Register.

The Herschend-Palace merger expands Herschend’s footprint for the first time into the Golden State and Southern California with Raging Waters Los Angeles in San Dimas, Castle Park in Riverside, and Boomers parks in Palm Springs and Vista.

The newly expanded Herschend introduces a “significantly ramped-up contender” to the Six Flags chain of regional amusement parks and the few remaining independent and family-owned parks in the United States, according to Dennis Speigel, CEO of International Theme Park Services.

“This merger may prompt other operators to reevaluate their strategies, potentially spurring liquidations and possible consolidations or partnerships within the industry,” Speigel wrote on the ITPS website.

Herschend will battle for fourth place in the U.S. theme park market with SeaWorld and Busch Gardens owner United Parks & Resorts, based in Florida, according to Theme Park Insider.

Disneyland (142 million annual visitors), Universal Studios Hollywood (60.8 million) and Six Flags (48.9 million) are far ahead of United (21.6 million) and Herschend (20 million) in annual attendance, according to a TEA/AECOM report.

Legoland California is part of the United Kingdom-based Merlin Entertainments Group that draws 62 million visitors per year.

Six Flags considered selling some smaller parks in a portfolio review after the merger of Six Flags and Cedar Fair in July, according to the Register. Following the industry’s latest merger, Herschend could emerge as the most likely buyer for some of rival Six Flags’ parks.

Read more