Ben Ashkenazy, who has struggled to keep up with loan payments for a strip mall in Beverly Grove, may get help from Bloomingdale’s.

His New York-based Ashkenazy Acquisition has leased a 20,000-square-foot storefront to Bloomingdale’s Outlet at the Beverly Connection mall at 100 North La Cienega Boulevard, Commercial Observer reported.

Terms of the deal were not disclosed.

The ground-level store is expected to open this year. Ashkenazy and Bloomingdale’s represented themselves in the deal.

The strip mall, across the street from the Beverly Center mall, contains other discount retailers such as Saks Off Fifth, Nordstrom Rack, T.J. Maxx and Ross Dress for Less.

Ashkenazy bought the two-story, 340,000-square-foot mall in 2014 for $260 million, or $765 per square foot. He financed it with three commercial mortgage-backed securities loans from Citigroup totaling $210 million, according to CO.

Alongside the senior loans, the investor added $35 million in unsecuritized subordinate debt secured by the property, according to Morningstar.

Then the pandemic struck five years ago, and brought a plunge in foot traffic. Ashkenazy began skipping loan payments.

Since 2020, its three CMBS loans have been managed under a special servicer, according to CO. Three years later, Ashkenazy struck a reinstatement agreement, but the debt stayed with the special servicer.

The value of the strip mall just fell 10 percent. This month, the property was appraised at $193 million, down from its previous appraised value of $214 million, according to Morningstar.

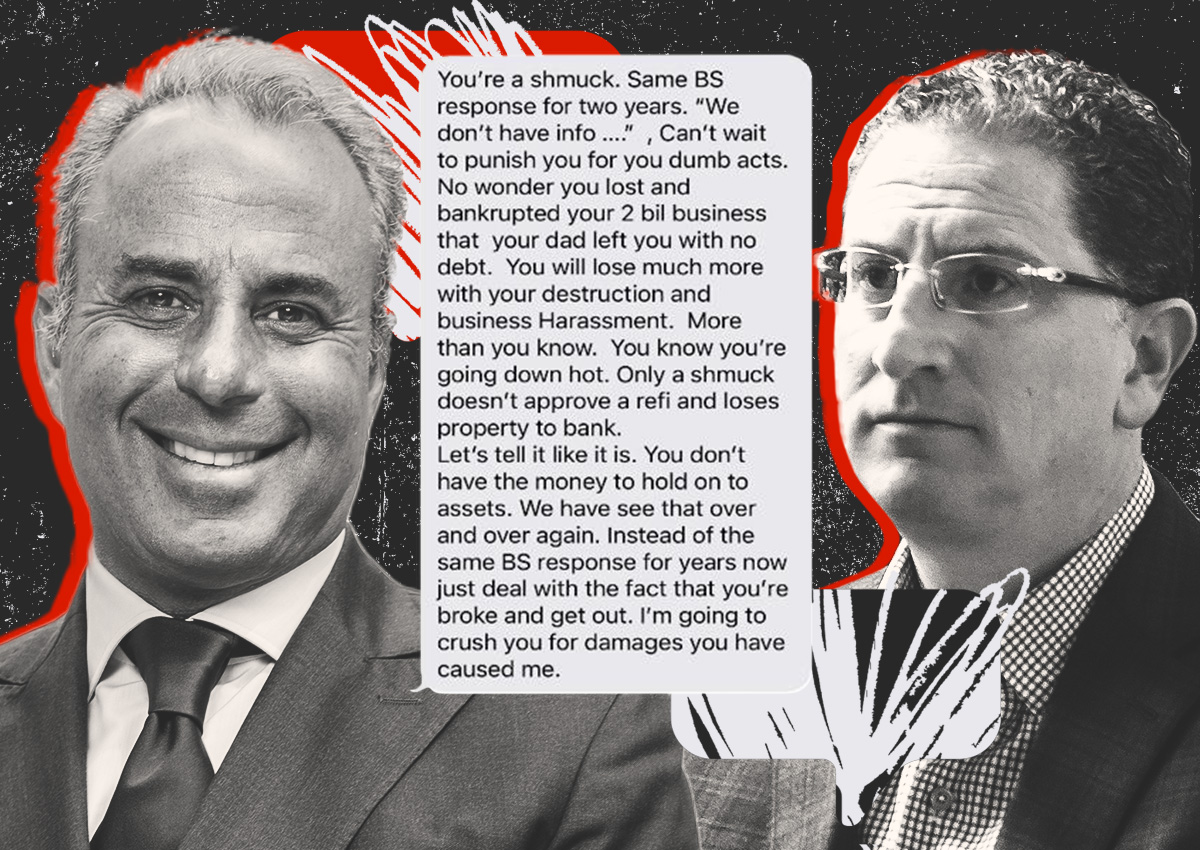

Ashkenazy, meanwhile, has been fighting uphill on its own turf.

This month, a New York judge issued a scathing decision against the investor in a Union Station legal case, saying he “had sufficient resources to repay the loan but chose not to.”

Read more