Developers have big Hollywood dreams, and their target audience is millennials. Several multifamily projects are slated to hit the Hollywood market over the next few years as young creative professionals clamor for apartments in the thriving new media hub.

The neighborhood hit 96.2 percent of its residential capacity at the beginning of December, according to Rainmaker Insights, the research partner of apartment search engine Rent Jungle. That’s somewhat tighter than the 95 percent the firm recorded for the City of Los Angeles as a whole.

With very few vacancy signs in Hollywood, rents are climbing — a fact that hasn’t escaped the notice of developers.

The average Hollywood apartment asking rent rose nearly 14 percent to $2,947 in November 2016, up from $2,595 a year earlier, according to Rainmaker Insights data scientist Michael Mele. By contrast, the firm clocked in the Los Angeles countywide rent increases at around 1 percent.

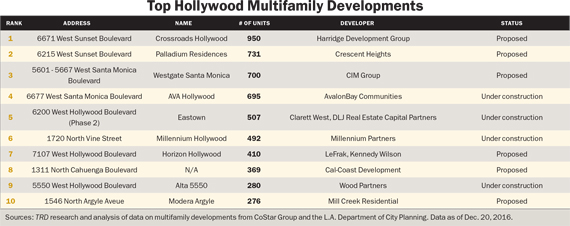

The 10 largest multifamily projects that are either proposed or in construction would add 5,410 residences to the Hollywood market.

“There is a need for more density and to bring the cost of housing down,” said Eric Sussman, a managing partner at Sequoia Real Estate Partners, a Westwood real estate investment company.

Projects in the pipeline

A handful of the units that have been added to the residential market are creative live/work space, a type of housing typically associated more with New York than with new Hollywood. Phase one of Eastown, completed in 2014, has 517 apartments and 18 live/work spaces, as well as 74,000 square feet of ground-floor retail.

Phase two of the development, which is rising along the Hollywood Walk of Fame, will replace a parking lot at the 6200 West Hollywood Boulevard parcel.

Developers DLJ Real Estate Capital Partners and the Clarett West call Eastown a “neighborhood defining” project. Phase two promises to add 507 apartments and about 62,000 square feet of retail.

The passage of Measure JJJ requires that all new developments requiring zoning changes include a percentage of affordable units, and Eastown will comply with these rules. However, Frank Stephan, a Clarett West senior managing director, told The Real Deal that affordable housing was always a part of the plan, and not a forced concession. There are also over 1,300

below-ground parking spots for residents and patrons of the Pantages Theatre, located on the opposite corner.

The largest multifamily project already under construction, AVA Hollywood, is slated to add nearly 700 units to the market. Located at 6677 West Santa Monica Boulevard, it will include 20,000 square feet of retail and three roof decks with views of the Hollywood Hills for residents. Developer AvalonBay plans to begin renting apartments around 2018.

Mark Janda, a senior vice president at the developer, said they are looking for a food hall concept attractive to renters, such as a celebrity chef or a high-end coffeehouse.

Although there are thousands of new units planned for Hollywood, Janda said he isn’t concerned about the potential for oversupply. “No one has a perfect crystal ball,” he said. “The bottom line is, housing has been so underproduced in Los Angeles that there is a lot of pent-up demand.”

Eastown

AvalonBay Chairman and CEO Timothy Naughton said during an October earnings conference call that apartments are in high demand across the nation, and that Southern California is one of the top markets on which their executives are focusing their attention.

Some of the new apartments are in large, mixed-use buildings, which are still a relatively new concept in Hollywood, said Stacy Gottula, director of the Luxury Estates Division of The Agency. “If you look at Downtown, mixed-use space has been a trend and is working really well.”

Growing pains

Market watchers say the trend toward denser housing developments in the area began in nearby West Hollywood, which is an incorporated city, then edged toward Hollywood.

“West Hollywood has been moving east, and the area has been getting nicer and nicer,” said Jason Oppenheim, founder and president of The Oppenheim Group, a real estate brokerage. “People’s property values have been increasing.”

Not everyone is elated by the trend. Although millennials may relish the notion of living in upscale apartments in an urban setting, some of old Hollywood is saying, “Not so fast.”

In early 2015, for example, the Los Angeles City Council temporarily blocked the Millennium Hollywood, a big mixed-use project that will add 492 residential units totaling about 700,000 square feet, up to 200 luxury hotel rooms and upscale restaurants and retail stores to the neighborhood. There was a lot of neighborhood pushback against the plan, and the opponents of the large-scale project gained real traction when they said that a corner of the site, which is

located at 1720 North Vine Street, was on top of an earthquake fault. However, city planners found no active fault and signed off on the project in July 2015. It is now under construction.

Meanwhile, one of the biggest Hollywood projects proposed has been slapped with a not-in-my-backyard lawsuit. Palladium Tower, a 731-unit mixed-use complex that would include the historic Palladium Theater, was scheduled to begin construction in 2017. Then the AIDS Healthcare Foundation sued. If the project were built, it would block the panoramic views from the organization’s international headquarters on the 21st floor of the Sunset Media Center.

“Because we’re in litigation, we’re taking a deep breath and waiting to see how it all comes out,” said Steven Afriat, a consultant who is advising Miami developer Crescent Heights. AHF did not return TDR’s requests for comment. The future of the project remains an open question while the lawsuit proceeds through the courts.