It was an announcement that would make fellow retail developers shudder: After five years and tens of millions of dollars, Wayne Ratkovich’s development firm would withdraw from the Bloc renovation project in early April.

National Real Estate Advisors bought out Ratkovich Company to become the Bloc’s majority owner (they had been partners on the project since 2013, along with Blue Vista Capital). Terms of the deal were not disclosed.

There had been clues that a major change was pending, said retail professionals. Months earlier, Ratkovich Company admitted to being more than a year behind schedule and nearly $70 million over budget on the project. “[Ratkovich] was extremely underwater,” said a source, speaking on the condition of anonymity.

When the Bloc’s renovation began in 2013, transforming the bulky behemoth into an airy shopping center seemed like a winning proposition. Industry insiders said that while Ratkovich initially succeeded by removing the dated atrium and opening entryways off of Hope and Flower streets, other necessary course corrections for the shopping center never happened.

“They were in denial and resistant to the reality of what shoppers wanted in the Financial District, which is not a hipster area, so to speak,” said Brigham Yen, a Realtor with Miren.co who closely monitors the Los Angeles retail markets. “The stores they went after didn’t really jive with some of the legacy tenants like Jewelry Pavilion. It’s good to have a tenant mix, but you have to do it with an identity and long-term goal in mind.”

“They were in denial and resistant to the reality of what shoppers wanted in the Financial District, which is not a hipster area, so to speak,” said Brigham Yen, a Realtor with Miren.co who closely monitors the Los Angeles retail markets. “The stores they went after didn’t really jive with some of the legacy tenants like Jewelry Pavilion. It’s good to have a tenant mix, but you have to do it with an identity and long-term goal in mind.”

The managements of L.A.’s major retail centers have been all too aware of the need to develop such an identity. “It’s not enough to merely provide space any longer,” said Farid Yaghoubtil, an attorney whose L.A. practice handles retail real estate negotiations. “Tenants are demanding more from shopping centers.”

Those that have evolved successfully — by signing on attractive tenants and offering elaborate event programs, among other things — are benefiting from rising asking rents.

Across Los Angeles, those rates climbed nearly 10 percent from the year before, with West L.A. and Mid-Wilshire posting particularly strong numbers, according to the latest quarterly report from CBRE, for the fourth quarter of 2017. In the Greater L.A. market, the average asking rate increased to $2.71 per square foot a month, equivalent to a 9 percent rise from 2016 to 2017.

However, industry insiders caution that the momentum carrying rate increases will slow in 2019 and beyond, as retail vacancies rise throughout L.A. and in shopping malls specifically.

Which retail centers will survive in this “Hunger Games”-like battle for survival? The Real Deal checked in on five major shopping centers to find out what’s working and what isn’t.

The Bloc

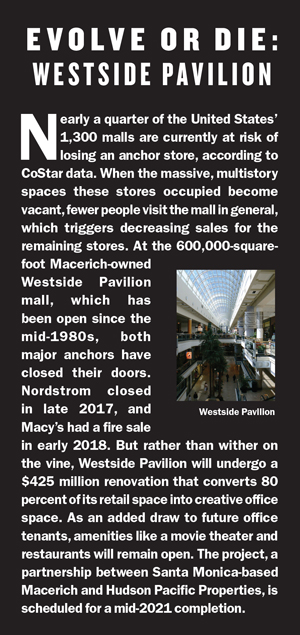

The partners who bought out ratkovich at The 1.1 million-square-foot, mixed-use redevelopment are now seeking a new management firm.

Sources told The Real Deal that development firm Lincoln Property Company and the asset management arms of commercial brokerages JLL and CBRE are pursuing the project.

By bringing a new partner into the mix, the move “could expedite leasing activity and get some great retail tenants into the center,” said Yen.

Westfield Century City

Westfield Century City

What originally began as an $800 million redevelopment at 10250 Santa Monica Boulevard in 2016 has blossomed into a fully renovated 1.2 million-square-foot shopping center with 70 additional shops, along with 8 acres of new outdoor public space and additional parking.

Westfield’s revamped Century City shopping center is benefiting from the November opening of new tenant Eataly, the food emporium founded by celebrity chef Mario Batali, though he has stepped back from the brand amid sexual harassment allegations. Its multistory 50,000-square-foot space, which includes cafes, restaurants and a cooking school, is similar to the Eataly setups in Boston, New York and Chicago.

“Westfield is strategically approaching the food and wellness space with unique and thoughtful offerings at Century City,” said Christina Mendez, a spokesperson for Westfield. “This focus begins with actively seeking out new retailers, restaurants, gyms, fitness studios and entertainment offerings that possess the vision and willingness to revolutionize what it means to visit their location.”

Westfield Century City’s curated mix of tenants soon will include cryotherapy clinic Next Health and the Saint Marc Pub-Cafe, Bakery & Cheese Affinage, Mendez said. Westfield also hired Los Angeles International Airport security firm Gavin de Becker & Associates to operate the shopping center’s luxury VIP lounges, where celebrities can receive private fittings and gourmet food on demand.

Westfield Century City

Oceanwide Plaza

Oceanwide Plaza

In 2016, construction began on Oceanwide

Plaza, a mixed-use complex situated on a 4.6-acre site at 1101 South Flower Street in DTLA, across from Staples Center and L.A. Live.

The 1.5 million-square-foot project is bound by 11th, 12th, Figueroa and Flower streets and is expected to be complete in early 2019. It’s the first project in the United States for Oceanwide Holdings of Beijing, a conglomerate that has plans for building megaprojects in San Francisco, the Sonoma Valley, New York City and Hawaii.

Oceanwide Plaza includes 164 Park Hyatt-branded condos, a 183-key Park Hyatt Hotel and twin 40-story buildings that have an additional 340 condo units.

With most of the area’s foot traffic coming from those heading to events at the Staples Center and L.A. Live, Louis Vuitton and Coach may not be the right fit.

It’s a reality that hasn’t gone unnoticed by Thomas Feng, chief executive of Oceanwide Plaza. “We analyzed the current neighborhood rental value, and it’s really high. The purchase power is not low, so we’re trying to match the purchase behavior [of potential shoppers],” Feng told The Real Deal. “We can’t say it will be very high-end stores, but it’s not going to be low-end.” He said retailers interested in downtown spaces are still circling.

Oceanwide Plaza

Beverly Center

The 886,000-square-foot Beverly Center is situated between Beverly Hills and West Hollywood at 8500 Beverly Boulevard. The shopping center’s owner, Taubman Centers, a Michigan-based global retail real estate company, opened the mall in 1982.

In 2016, the company embarked on a massive remodeling plan that began chipping away at the shopping center’s blocky exterior, known locally as “the beige blob.” The plan also included interior renovations to install a series of skylights in addition to adding an upper-level food hall with sweeping views of Downtown L.A. It’s slated for an end-of-year completion.

Nearly $500 million and two years later, the exterior features a perforated steel façade and an updated streetscape with drought-resistant greenery. Inside, a center courtyard with a 20-by-35-foot LED screen serves as an informal gathering place, and there is a greater degree of natural light thanks to those skylights. Anchor tenants Bloomingdale’s and Macy’s opted early on to remain at Beverly Center during construction, as did other existing tenants.

Beverly Center