Los Angeles was late to the high-stakes game of building high-rise luxury condominiums for the global elite even though real estate pros in New York City, Miami and Vancouver have been wheeling and dealing in this space for years.

“New development is in its early stages compared to New York or South Florida,” said Susan DeFranca, the CEO of new development marketing at Douglas Elliman. “But there is increasing interest in condominiums due to the convenience and lifestyle.”

Market watchers point to both a historic local preference for single-family homes and a particularly slow and painful recovery from the recession as reasons for L.A’s late entrance to the field.

“It really, really halted the progress that L.A. was making to become an international destination,” Sebastian Wolski, managing director for Nest Seekers’ Serhant Team Los Angeles, said of the Great Recession. “We’ve slowly been coming back, and that’s what you’re seeing today.”

Experts say that while L.A. plays catch-up, its condo market is a relative bargain compared with other global cities in North America.

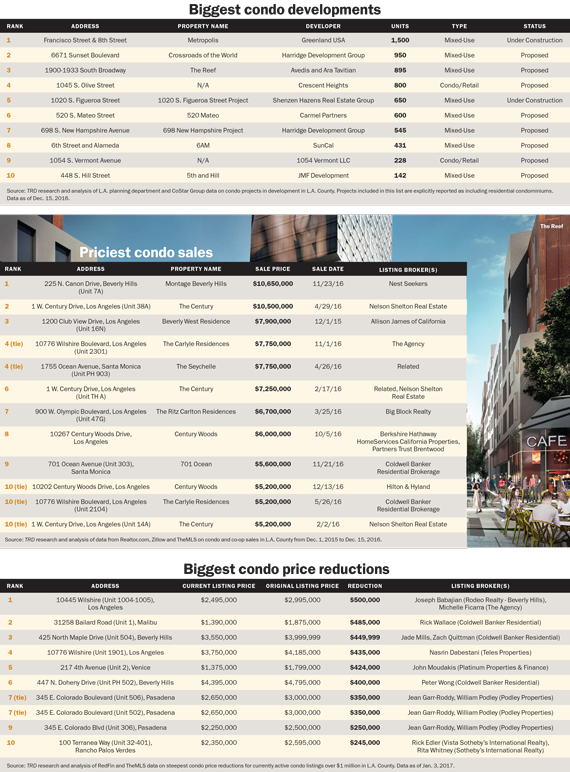

Asking prices for newly constructed condos typically range from $1,000 to $1,500 per square foot, according to Nestseekers. At Metropolis, the largest luxury condo project in the pipeline, asking prices go up to $1,900 per square foot. By comparison, New York buyers could pay $2,500 per square foot in a Brooklyn neighborhood like Greenpoint or in Manhattan’s East Village — hardly the most prestigious addresses for the global elite.

Despite the comparative bargains, for many Angelenos, new condo prices seem to be climbing faster than they can afford. In 2015, the average closing price for new condos in the city was up to around $600,000, according to Compass. The asking prices at many of the new luxury megaprojects in the pipeline will be more than twice that.

Pent-up demand in the years since the recession and the desire to lock in a low home mortgage rate are driving prices up, said Skylar Olsen, a senior economist at Zillow. She said that multiple bids weren’t uncommon in the L.A. residential market.

A rendering of an apartment at Metropolis

Who’s buying?

The Nest Seekers brokers said that buyers from New York were becoming increasingly common, and that they were bringing their lifestyle preferences with them. “They say things like ‘I really like having a super,’” Wolski said, emphasizing the importance these buyers place on having hotel-style services at their residences.

But it’s the new influx of international capital that is clearly helping fuel the sharp rise in local condo prices. Nestseekers’ Ryan Serhant estimated that from 20 to 30 percent of transactions for luxury L.A. condos are all cash — a hallmark of wealthy foreign buyers.

Foreign buyers in the market hail from China, Singapore, South Korea and the Middle East.

Hana Cha, managing director of new development for Compass in California, said that many wealthy Asian buyers “really do live like kings and queens.”

She said concierges and “smart home” technology (where you can manage many aspects of your home via an app on a phone or iPad) are increasingly important to capture the attention of these buyers.

The jury is still out on whether there will be enough demand for the thousands of gleaming new units slated to hit the L.A. market over the next few years, and Cha, for one, was concerned about what might happen if there wasn’t sufficient interest from Asian buyers.

She pointed out that Chinese buyers are increasingly restricted from taking capital offshore, and some of them may be worried about potentially hostile policies from the Trump administration.

Cha suggested that some Chinese investors may already be redirecting capital to Canada. “If China stops,” she said, “then who really is going to buy all of it?”