Eight weeks free rent. Six months free parking. $2,500 off any three-bedroom with immediate move-in. These and similar deals are broadcast on apartment leasing websites and paid online ads sponsored by new properties throughout Downtown Los Angeles in what has become fierce competition for new tenants.

One leasing agent familiar with marketing tactics reports that in addition to tangible incentives like free rent or gift cards, agents are luring new tenants with promises that are difficult to assign a dollar value to, such as a sense of belonging tied only to living on the property or invitations to social events both on-property and off.

“Incentives such as one free month when signing for 12 months, free parking, and/or offering $500-plus American Express gift cards at signing are common practice while wooing would-be tenants to sign a lease,” said Kerry Marsico, a DTLA-based real estate agent with the Agency.

A bit further afield over in West Hollywood, The Apartment Residences at AKA (8500 West Sunset Boulevard) was even offering $1,000 with a signed lease within 72 hours of a first tour.

So how did we get here?

So how did we get here?

The construction boom that birthed a revitalization of DTLA has brought a glut of multifamily rental properties to market at once. In the third quarter of 2018 alone, there were five new apartment building openings in the area, including the debut of 888 at Grand Hope Park, Circa and the second residential tower of Metropolis.

These and other new buildings created one of the highest apartment unit totals seen in L.A. this century, according to CoStar data. In DTLA, more than 6,000 apartment units are currently under construction, and more than 2,000 units were delivered in each of the last three years. And the wave of new apartments isn’t expected to crest for at least a couple of years. The Downtown Center Business Improvement District (DCBID) reports another 26,400 apartments are proposed for the Downtown area.

Making the pitch

As the number of apartment rental options grows Downtown, property managers are becoming more and more aggressive about attracting and keeping renters.

While pet-friendly amenities aren’t new, at least one of the new DTLA buildings is finding more inventive ways to appeal to dog owners.

The Aliso, named for an ancient sycamore tree that once graced the vicinity, is a 472-unit luxury apartment complex situated near vintage shops and art galleries. The six-building property at 950 East 3rd Street has a green-screen room for residents to create videos and Insta-worthy social posts, as well as a recording studio. But one of its hottest selling points is a pet-friendly attitude referred to as “pup culture.”

There is a biscuit buffet and fresh water for pets in the apartment’s leasing office to show people how serious they are about being pet-friendly, said a company spokesperson.

The Aliso also has an exterior dog park with a watering station and an interior dedicated dog grooming area. A Pinterest board by Fairfield Residential, the Aliso Apartments’ management company, chronicles renters’ exploits with their pets, several of which are organized by the management company, from state park road trips to baking healthy dog treats to dog adoption tips.

Similarly, at the Sofia — a 606-unit complex at 1106 West 6th Street built by Vancouver-based Holland Partner Group — the amenities are heavily marketed and relied on to attract renters.

When Sofia leasing agent Josh Martinez takes potential tenants on tours of the building, one of his favorite aspects to highlight is its modern, spacious lounge. Visitors, he said, nod in approval at the luxurious common area. Then Martinez presents the icing on the cake: He pulls a book on a shelf, and the entire bookcase swings open to reveal a dimly lit bar that looks like a remnant of a 1920s speakeasy.

“It really has an awe factor,” said Martinez, one of several leasing agents at the property. “Our Speakeasy Bar is like a secret room and has a very warm feeling.”

Martinez has seen the competition for tenants increase in recent months — right along with the number of apartments available — and anything that gives an edge can make a difference, he said.

While he sees continued demand for apartments in DTLA, becoming fully leased has taken longer than expected.

“We’re getting close to fully leased,” he said. “Right now leased at 95.43 percent. We wanted to be leased closer to these numbers a couple of months ago, but we’re making steady progress.”

Like other DTLA leasing agents interviewed by TRD, Martinez relies on online advertising, revolving specials and location to draw potential tenants. “We get a lot of people who drive by and decide to come in for a tour,” he said.

Despite the number of apartment complexes coming online, agents familiar with the market claim they don’t expect a steep uptick in vacancy rates. They say that with increasingly sophisticated resident attractions, whether that means a complex hosts elaborate resident events or comes up with sparkling new amenities like karaoke rooms or private shoppers, renters will continue to be attracted to the area.

“With more competition, it’s going to make our product better,” Martinez said. “We’re going to want to reinvent, offer something new. As more apartment communities come in, they’ll offer new things to residents to make it worth their while to stay.”

Crica

In addition to amenities, views and a building’s aesthetics and design, tenant satisfaction is determined by location and management. Several of the newer apartment buildings in DTLA have already been resold, and thus are now under different management.

“Tenants are hyper-aware as the maintenance of a building wanes,” Marsico said. “When their repair needs aren’t tended to as quickly or the staff is thinned and performance is underwhelming, they notice immediately. A few buildings have suffered greatly due to a change in management.”

What’s in the pipeline?

Downtown L.A. has been leading new residential building in Los Angeles County, and while there is still a lot of activity, construction starts have slowed.

The building of only about 300 units began in the first half of 2018. Compare that to an estimated 3,000 apartment units that were recorded as new starts in Downtown in 2014 and 2015, more than 4,000 units in 2016 and about 1,000 units in 2017, according to CoStar.

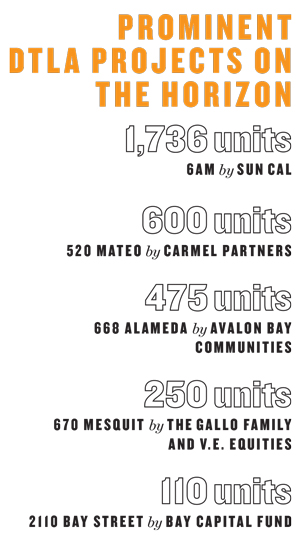

Although DTLA apartment starts have mellowed, plenty of projects are still underway. One of the most anticipated projects coming to the area is 520 Mateo, which is set to debut 600 residential units when developer Carmel Partners starts construction in 2020. At 1206 East 6th Street, Sun Cal is developing 6AM, a massive project with 1,736 residences, two hotels, offices, parks and more. And a partnership between the Gallo family and V.E. Equities is expected to begin construction this year at 670 Mesquit on 250 residential units, along with two boutique hotels, creative office and retail. AvalonBay Communities plans to turn a former cold storage building at 668 Alameda into 475 live-work apartments. And Bay Capital Fund is transforming a former parking lot at 2110 Bay Street into 110 live-work units.

Meanwhile, the apartment construction boom has overflowed into nearby neighborhoods, including Koreatown, Studio City/North Hollywood and Southeast Los Angeles, all of which now rank among the leaders for new construction.

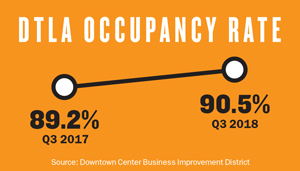

Occupancy is of course a key indicator of the multifamily market’s health, and the rate for DTLA apartments reached 90.5 percent in Q3 2018, up from 89.2 percent in Q3 2017, according to the DCBID.

Occupancy is of course a key indicator of the multifamily market’s health, and the rate for DTLA apartments reached 90.5 percent in Q3 2018, up from 89.2 percent in Q3 2017, according to the DCBID.

Between apartments, condos and affordable housing units, DTLA’s current inventory of 43,601 residential units is expected to grow to 51,260 by the end of 2020. By then, DTLA will have an estimated population of 87,655, according to data provided by the DCBID. The growth of DTLA’s population will keep pace with apartment demand, according to the organization.

L.A.’s multifamily market was one of the first commercial real estate sectors to rebound after the recession. Its momentum has remained strong, and this includes 2018, said Bill Cooper, an agent at Compass. He cautioned however, that all the multifamily properties coming onto the market could lead to “tenant pricing fatigue” in the future.

According to Yardi Matrix, which tracks apartment pricing, three-bedroom apartments experienced the greatest overall price increase, and are up 7 percent from last year to reach monthly rents of anywhere from $3,500 to $5,500.

“Everything that can be charged to a tenant is charged,” Cooper said, offering some examples: “A tenant can secure an 800-square-foot apartment with great amenities for $3,500 a month, but they discover they also are paying $150 a month for parking, $100 a month for all utilities and, if they have a pet, there is an additional charge,” he said.

Cooper anticipates that DTLA buildings may lose favor with tenants if that sort of pricing continues.

“These new projects are now charging for parking spaces, and all utilities including trash and sewer charges,” he said. “This type of ‘nickel-and-diming’ takes its toll at some point.”