UPDATED April 25, 10:45 A.M.: Multi-course dinners, brandy tastings and even the odd theme party are among the fêtes high-end brokers throw in the hopes of drawing the right clientele.

And while some ostentatious events were always part of the game, there’s an increasing urgency to the sales pitch these days. The top luxury brokers in Los Angeles said the market is moving to extremes, with even more overpriced luxury homes on the market than ever. High-end buyers are looking for value and want properties with more land and less house, while sellers are largely unrealistic in their pricing expectations, brokers said.

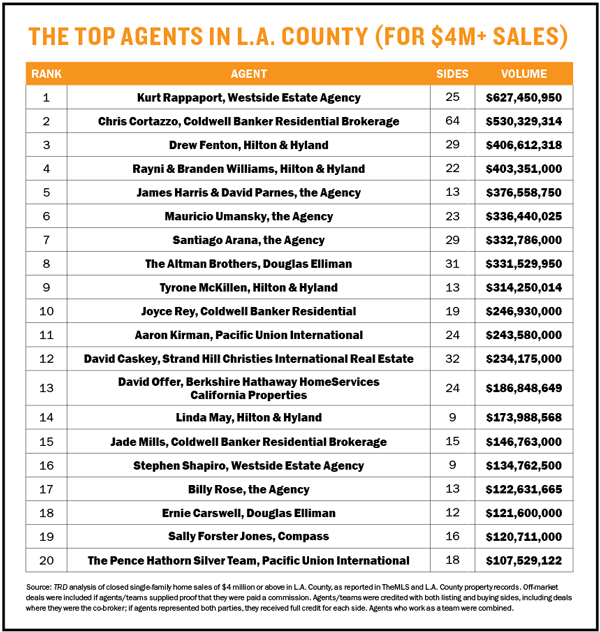

To get a better sense of what’s happening in the luxe market, TRD ranked the industry’s highest-performing luxury market players, analyzing single-family home sales of $4 million and higher to identify the 20 top-producing agents from March 1, 2017, through Feb. 28, 2018. Agents were credited with both listing and buying sides, including deals where they were the co-broker; an agent who represented both parties received full credit for each side.

Topping the ranking was Westside Estate Agency’s Kurt Rappaport, with over $627 million in sales. He was followed by Chris Cortazzo of Coldwell Banker Residential with $530 million in sales. Hilton & Hyland’s Drew Fenton placed third with almost $407 million in sales, and in fourth place, couple-slash-team Rayni and Branden Williams of Hilton & Hyland landed over $403 million in sales over the 12-month period.

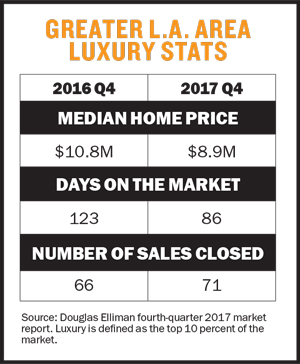

The brokers’ astronomical sales volumes and recent data reports suggest there are many deals to be done at the top of the market. In the fourth quarter of 2017, the number of closed luxury home sales was up 7.6 percent year over year. Those homes went fast, sitting on the market for an average of 83 days — 40 less than over the same period the year before.

But buyers are not ponying up as much as they used to, considering that the median luxury home sale price in Q4 of 2017, $8.9 million, was down 17.3 percent from the same time the year before.

Brokers say it’s been a persistent struggle to get luxury sellers to lower their pricing expectations.

“There’s a lot of good property, but there’s also a lot of bad property and a lot of overpriced property,” said Pacific Union International broker Aaron Kirman, who snatched the No. 11 spot in TRD’s analysis, bringing in nearly $243.6 million in sales.

“We’re seeing a disconnect between sellers who want to get the most from their house and buyers who want to get a value even at the upper level,” he said. “Agents used to price high to get media attention and get something sold, but I think that game is running cold.”

“We’re seeing a disconnect between sellers who want to get the most from their house and buyers who want to get a value even at the upper level,” he said. “Agents used to price high to get media attention and get something sold, but I think that game is running cold.”

Some homes may be listed for eye-popping numbers, but they eventually sell for much less, Kirman said, estimating that homes listed for $60 to $100 million sell for tens of millions less, with only a few exceptions.

But Coldwell Banker’s Jade Mills, who took the No. 15 spot in the ranking with nearly $147 million in sales, said some of her sellers are seeing interest in their properties even with sky-high asking prices.

“Because of the low inventory, we have a little more urgency than we did before,” Mills said. “People are willing to make an offer, even if they think something is a little overpriced.”

Sellers all over L.A. see what their neighbors are selling their homes for and expect to get more, she said. A home across the street may be completely remodeled, but someone with a house without updates will be convinced it should be priced similarly or for more. Sale prices are similar to last year, she said, but listing prices are higher. “It’s time to get them to become more realistic,” Mills added.

But there’s a large contingent of sellers who haven’t gotten there yet — and why should they, considering that some have been rewarded by their audacious pricing? Over the past six months, Hilton & Hyland’s Susan Smith has noticed an increase in the number of homes available for more than $40 million. Luxury listing prices have generally continued to inch upwards, she said.

“There’s definitely inventory,” Smith said of high-end abodes. “Most of the inventory is homes that were on the market before with other agents. Only 5 percent of it is new inventory.”

Ultra-targeted marketing

To move those ultra-luxurious homes, an ultra-specific marketing strategy is required, agents said. And that kind of targeting can take many forms.

If you are marketing a home as the ultimate bachelor pad, for example, you need to throw the ultimate party, said the Agency co-founder Mauricio Umansky (who came in sixth in our ranking with more than $336 million in sales). That’s something his agents regularly do.

Case in point: When “Million Dollar Listing Los Angeles” stars and Agency broker team James Harris and David Parnes were looking to sell 900 Stradella Road in Bel Air — previously owned by Michael Bay — they partnered with Dom Perignon and Hennessy for a brandy tasting and a seven-course meal for 30 potential buyers and brokers.

The property went into escrow one week after the party. The agent who represented the buyer was at the event, Harris said.

“It was a very high-end, upscale luxury dinner. We want to have the best people at the event,” Harris said.

Harris and Parnes, who placed fifth in the ranking, sold the home for $41 million.

Last year, for one house in Beverly Hills, Harris partnered with artist Retna to attract interest in the property. The listing showcased a new sculpture in the front driveway from the artist. Retna also painted a mural on the chimney worth $100,000, Harris said. Retna’s patrons came to see the property, as did clients of the Agency.

“Our events are so key in the business,” Harris said. “The real estate business is all about branding. It’s not just about throwing money at an event. It’s about looking at that house and deciding who to partner with.”

Last year, Parnes decided to get creative in selling a home near the Beverly Hills Hotel. It had been on the market with another broker for the previous eight months at a higher price and hadn’t sold. He hosted a party that “brought the Beverly Hills Hotel to the property.”

The party featured the hotel’s famous McCarthy Salads, had models wearing Beverly Hills Hotel uniforms and used its valet. More than 200 people attended. The property still hasn’t sold, but Parnes remains optimistic.

However, some brokers argue that lavish parties don’t move listings. “Parties are really to promote your own brand and make the seller happy, but they really do not sell a house,” said broker Josh Flagg of Rodeo Realty. Instead, Flagg invests in print and online ads.

Coldwell Banker’s Mills doesn’t find parties to be effective, either. “Unless it’s a destination property, we have not seen that really work,” she said.

Like Flagg, Kirman said he stays away from parties but does different forms of advertising. “Wealthy people like to read, and the best advertisement is telling the story of a house,” Kirman said. The broker said he spends $6,000 to $12,000 on one-page advertisements and also does plenty of PR.

Off-market listings

While off-market listings have long been prevalent in L.A., where celebrities and other well-known people are looking for privacy, some say they’re becoming even more popular as prices hit the stratosphere.

Another factor brokers say is driving the uptick in pocket listings is a new tool that gives them more exposure without the drawbacks of the MLS.

The Agency’s Umansky, along with Christopher Dyson, Harris and Parnes, launched the Pocket Listing Service (PLS), which allows brokers to privately share off-market home listings with each other. Agents must register with a valid license number. After creating a profile, they can upload details of their off-market listing and provide as much information as they like, from full details to simply an address.

The Agency’s Umansky, along with Christopher Dyson, Harris and Parnes, launched the Pocket Listing Service (PLS), which allows brokers to privately share off-market home listings with each other. Agents must register with a valid license number. After creating a profile, they can upload details of their off-market listing and provide as much information as they like, from full details to simply an address.

The PLS does not record pricing history of a house or how long it has been on the market since both can hurt the seller, Umansky said.

“On the PLS, you aren’t building that history and you can see the response before it’s on the MLS,” Parnes added.

Umansky estimated that there’s $3 billion worth of real estate on the PLS in around 600 active listings. The broker said roughly 5,000 agents have signed up for the service, which is currently free but will switch to a subscription model this year.

Kirman said that there are benefits to starting with an off-market listing, even if ultimately listing homes on the MLS remains the best way to maximize exposure. He will sometimes have an off-market listing for one or two months while getting the property ready. By the time he lists something on the MLS, he has already built interest and tested its price, he said.

Stephen Shapiro, chairman of the Westside Estate Agency, who clocked in at No. 16 with nearly $135 million in sales, currently holds the listing for the Grey Estate in Holmby Hills, priced at $77.5 million. He is no fan of off-market listings. “The goal is to find as many qualified people as possible, not as few,” he said.

In March, Shapiro had 20 “high-quality showings with people worth a billion dollars or more. If that was a pocket listing, we wouldn’t have had it.”

Others agree it’s better to rely on the MLS.

“You have many more people looking at the properties,” Mills said. “It brings in a bigger audience, and you have more chance of getting more money.”

The British are coming

While buyers from China have largely withdrawn from both L.A. residential and commercial investments in the last year, agents noticed a decided uptick in British buyers.

And that’s not just in L.A. In 2015, buyers from the United Kingdom purchased 8,315 U.S. properties for $3.8 billion, according to data from the National Association of Realtors. In 2017, they purchased 12,869 properties for $9.5 billion.

Most buyers from the U.K. are nonresident foreigners, but the share of resident foreigners buying increased in 2017, according to the NAR. Most U.K. buyers, however, purchased property for vacations in warm-weather states.

“International buyers have taken a huge interest in L.A.,” said Parnes, who noted that New York and Miami, by comparison, have an oversupply of high-rises, which is not necessarily what these buyers want. When people buy homes in L.A., “they are buying land. People realize the value in owning a piece of land rather than a piece of the sky,” Parnes said.

Parnes and Harris, who are both from the U.K., work together on the sales to their fellow Brits.

“Their interest level has risen considerably over the last few years,” Parnes said.

One reason for that, he explained, is that British buyers want to “put their money in the U.S. dollar.” There is a lot of uncertainty in Britain following the Brexit vote, making the U.S. a safer bet. You also get more bang for your buck in L.A. compared with London, he said.

Harris added that it’s not just an influx of European buyers making waves in L.A.

“The developers, too. Developers from Europe are seeing that Europe just isn’t doing so great and coming here,” he said. “They are buying the big, luxurious properties as teardowns or development properties.”

Looking forward

Kirman predicts that luxury prices are going to flatline this year.

With looming trade wars and the Dow falling 1,100 points twice in March, some would-be buyers may bail due to the uncertain future of the national economy.

“When stock markets start to fluctuate, that does show buyers are somewhat nervous, and that affects everything,” Kirman said. “That is a sign of some cracks in our system.”

Flagg said he anticipates fewer bidding wars. “That’s good, because at this pace, things are becoming unaffordable,” he said.

L.A., Kirman added, has a lot of inventory coming, but not a lot of land. “For a moment, everyone wanted architecture with views. Now I’m noticing a lot of buyers looking for acreage and privacy,” Kirman said. “We had a run for seven years. That’s the longest cycle in history. We’re due for a correction, but I don’t think it will be a bad correction; I think things are just going to chill out.”

Mills also underscored the idea that tastes are changing. “Land is more important than ever,” she said. “People are looking a little bit less at things that are two and three levels and more at things that might be one level and have land. Most people that call me are saying they are looking for land.”

Shapiro agreed that the buyer taste in local housing stock is changing.

“People are getting tired of those same white boxes with no land but great views,” he said. “That trend is wearing out. There are so many of those that are under construction. There will be a glut of those houses, and buyers will feel empowered when purchasing.”

Editor’s Note: The ranking has been updated to reflect that broker Sally Forster Jones moved from Pacific Union to Compass in February 2018.