Los Angeles is used to rapid growth. But even by L.A. standards, the burgeoning demand for industrial real estate in the area and its adjacent counties is eye-popping.

This fact might not fit the stereotypical image of La La Land as the capital of media and entertainment, but the industrial and manufacturing base here is a major contributing factor to the region’s massive economy. If L.A. were a country, it would have the 17th largest economy on earth. If you include the areas south, down to Long Beach and on to Anaheim in Orange County, the Bureau of Economic Analysis measures the gross domestic product at $866 billion.

Riding the e-commerce wave, and benefiting from two of the largest and most active ports in the world — Los Angeles and Long Beach — manufacturing here is strong. In addition to Hollywood movies, all sorts of things are made in L.A. Apparel manufacturing accounts for roughly 60,000 jobs. The aerospace industry employs 65,000. Overall, Greater Los Angeles has more than 510,000 manufacturing jobs, making it the largest industrial base in the United States.

That manic level of production and trade requires millions of square feet of industrial space for manufacturing, warehousing, transportation and logistics.

Nearer the ports, businesses are focused on the import-export trade; farther inland, logistics for e-commerce companies support new industrial development. “The largest driver is the transformation of retail from brick and mortar to e-commerce,” said Steven Bellitti, a senior executive vice president at Colliers International.

Transwestern, a national real estate company based in Parsippany, New Jersey, reported that the amount of industrial space under construction in Greater Los Angeles had surged 39 percent in the second quarter from the previous quarter.

The base asking rates for industrial space ended the second quarter at 62 cents per square foot — up 3 percent from the previous quarter, and 9.3 percent year-over-year, according to Colliers. The overall vacancy rate is a thin 2.6 percent, and in some submarkets, such as Downtown L.A. and the South Bay, it dips below 1 percent.

Jeffrey Rinkov, CEO of commercial real estate company Lee & Associates, based in Orange, California, said the industrial market here is simply playing catch-up to the real estate revival that hit other parts of the market sooner.

“Industrial rental rates were somewhat flat or declining from 2008 to 2013,” Rinkov said.

But he said things began to turn in early 2015. “We have started to see rent growth, a strengthening of the tenant base and real downward pressure on vacancy rates.”

Naturally, the story differs somewhat across Greater L.A.’s various submarkets, but the themes of low vacancy and increasing rents remain consistent.

Central Los Angeles

There’s not much industrial space left in the core of Los Angeles, which is defined as the area between the 405 and the 710 freeways, and between the 134 and the 105.

The area has the region’s oldest industrial building stock — and an ultralow vacancy rate of 1.4 percent — but only 113,600 square feet of new industrial space is in development. Yet, with roughly 252 million square feet of industrial space, Rinkov said the market in this area is “seeing expansion of garment-related business, food processing and cold storage, and some smaller manufacturing and assembly operations.”

To complicate matters, much of the older industrial space is in the process of being converted to more profitable uses, including luxury condos, creative workspaces and high-end restaurants.

Such changes account for the fact that asking rental rates for industrial space are 30 percent higher in DTLA compared with similar space in the nearby Commerce and Vernon submarkets.

The city of Commerce, just south of East L.A., has a microscopic industrial vacancy rate of 0.8 percent, according to Colliers. The market conditions are a bit looser in Vernon, which is located across Interstate 10. The 5.2-square-mile unincorporated city has a residential population of — and this is no typo — 200. It has 90 million square feet of industrial space, with a vacancy rate of only 2 percent. Vernon’s manufacturing base is largely focused on apparel manufacturers, including Trinity Sports, Intimate Attitude, National Corset Supply House, Karen Kane and One Clothing.

A key advantage of manufacturing in Central Los Angeles is that it tightens up the retail supply chain substantially, allowing fashion companies to roll out new styles in as little as four weeks, according to the Colliers report, “as opposed to the months-long fashion cycle using traditional overseas supply chains.”

South Bay Port Area

The twin ports of Los Angeles and Long Beach together handle about 40 percent of all imports into the country, making Greater L.A. the nation’s largest port in terms of tonnage handled.

It also makes the South Bay a particularly significant industrial market — and one where there’s little available space on offer, putting pressure on rents. Asking rental rates, which bottomed out at 52 cents per square foot in 2011, have climbed to 70 cents. Vacancy rates ended the second quarter at 1.3 percent, holding steady with the previous quarter. And the nearer to the ports, the tighter the market conditions become. The vacancy in the Long Beach and Harbor Cities submarket has narrowed to 0.7 percent.

The situation is unlikely to improve anytime soon. There is only 1.6 million square feet of space under construction in a 212 million-square-foot market.

But South Bay is also one of the rare places with recent construction projects that measure 1 million square feet or more. The Brickyard project in Compton consists of two buildings scheduled to be completed this year — one at 525,400 square feet, the other at 481,600 square feet. The development is only 10 miles from the Long Beach and Los Angeles ports, and seven miles from LAX. Compton is also literally surrounded by freeways.

The Brickyard facility, backed by Clarion Partners, also makes a point of marketing itself for e-commerce, claiming on its website that it provides “a perfect supply chain and eCommerce solution.”

Inland Empire and beyond

The industrial building boom is largely occurring on vacant land in the Inland Empire, which stretches east to Riverside and San Bernardino. Historically, development in the L.A. basin has had a tendency to spread outward, run out of space, then spread outward some more.

In the second quarter of 2016, 15 million square feet of industrial space was sold or leased in the Inland Empire, Colliers reported. That marked the 27th consecutive quarter that the industrial space in this submarket posted positive absorption levels.

With a location about an hour and a half from the ports, logistics is the buzzword here. As Transwestern real estate measures it, this large and somewhat vaguely defined region has about 20 times more warehousing than manufacturing space.

Size is a factor. Although some industrial developments total more than 1 million square feet among multiple buildings, Colliers’ Bellitti said he couldn’t find industrial blocks of space that were at least 1 million square feet in the same building.

The Citrus Commerce Center in West Fontana, a large ongoing development, will have 1.9 million square feet of Class A warehousing spread among three buildings. Building 3 is expected to be completed in the first quarter of 2017. Leasing is being offered for 203,000 square feet, including 40 trailer stalls, 80 auto stalls and a clearance height of 36 feet.

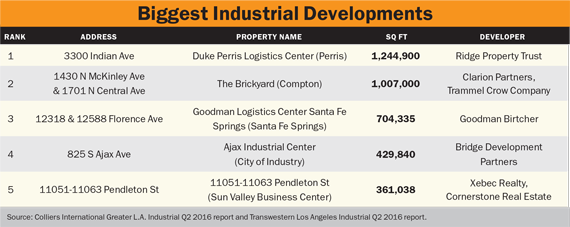

One of the few 1 million-square-foot structures in the pipeline is the upcoming building for the Duke Perris Logistics Center in Perris. One building in this industrial complex opened in 2015. It has 783,407 square feet of space, including 36-foot ceiling clearance and 118 dock doors. Another building is planned at 1.24 million square feet and is slated for completion in April 2017. Both buildings are fully leased, said Chris Burns, who is in charge of Duke’s Southern California business. He said many of the tenants are e-commerce companies.