The Santa Ana winds are shifting in the Los Angeles luxury condo market, and so are buyers’ priorities and preferences.

The original go-to location in L.A. for a high-end condo experience had long been Millionaire Mile, a gilded stretch of the Wilshire Corridor abutted by the “golden triangle” of Beverly Hills, Bel Air and Holmby Hills. But it looks like many of those who can pay top dollar are now putting down luxury roots in nearby Century City instead.

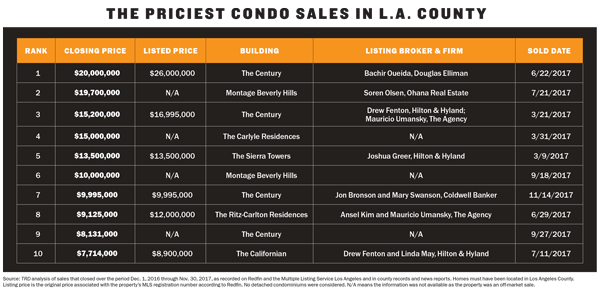

Nearly half of this year’s 10 priciest condo sales in L.A. County had addresses in the Westside’s hottest up-and-coming neighborhood, according to The Real Deal’s analysis of closed sales recorded from Dec. 1, 2016 to Nov. 31, 2017, on Redfin and the Multiple Listing Service Los Angeles and in county records and news reports.

What was once just the Fox Studios backlot is now not only the gateway to Beverly Hills but also a high-end shopping and dining destination itself. The Westfield Century City mall recently underwent a $1 billion renovation meant to entice shoppers with Mario Batali’s Eataly, an Amazon bookstore and even a cryotherapy clinic. And the neighborhood’s overall increased walkability — along with its hotly anticipated access to mass transit — makes it the most-desired destination in town, brokers said.

“All eyes are on Century City now,” said Jon Bronson, who with fellow Coldwell Banker agent Mary Swanson sold a $9.9 million townhouse in the Century — the seventh-priciest deal in TRD’s ranking.

Susan Smith, an agent with Hilton & Hyland who has sold several units in the exclusive Enclave at Century Woods development, has seen an increase in demand for pedestrian accessibility even from her highest-profile clients.

“Hey, Jane Fonda drives a Prius,” Smith said, not ruling out that the actress and new Enclave resident might also take the Metro. The Century City/Constellation Purple Line station begins construction this year and will connect Century City to Downtown L.A. upon its completion.

In just the last two years, Smith has seen a big transition in the area. Clients who once reflexively looked to the Wilshire Corridor for prime condo properties are shunning the neighborhood due to its lack of transit accessibility and street-level engagement.

“There’s nowhere to walk,” Smith said. “I’m seeing it across the board. Even people from Beverly Park are looking for this ease of access.”

David Kramer, an agent with Hilton & Hyland who handled the sale of a $6.7 million condo in the Century in 2017, further confirmed that “L.A. is now in transition,” with luxury condo buyers moving away from the Wilshire Corridor and over to Century City. He’s also noticed more interest from out-of-town buyers who come to L.A. often for business or pleasure. They may pop in and out but don’t have an intimate understanding of the city, which makes a pedestrian-friendly neighborhood particularly appealing, he said.

“If you don’t know the area well, Century City is very easy to navigate,” Bronson added.

And there seems to be one place in particular the most high-flying buyers turn to for a Century City condo. Four of the priciest sales in the area were for units in the Century, developed by Related Group.

Nestled close to the new Waldorf Astoria Beverly Hills and the Peninsula Hotel, the 42-floor tower designed by Robert A.M. Stern Architects houses 140 units on 4 acres. The amenities — including a screening theater, private Equinox fitness center, private wine storage and comprehensive security — are drawing interest from all over the map.

Bachir Oueida of Douglas Elliman handled the priciest condo sale of the year: a $20 million penthouse in the Century, which sold in June. Months later, he handled the sale of a whole-floor condo unit with 360-degree views for $6.15 million. He has had a total of 39 closings in the Century since it opened in 2010, he said.

“People are downsizing from megamansions. They’re coming from Bel Air, Beverly Hills, the Bird Streets, coming from $15 or $16 million properties. They want low-maintenance, vertical-estate living,” said Oueida.

He sees interested buyers coming from the East and West coasts, in addition to international buyers looking for a no-fuss pied-à-terre. Oueida added that he has buyers renting out Century City condos for $20,000 per month.

The Montage Beverly Hills had two of the priciest condo sales of the year.

The pace of dealmaking in the area has noticeably picked up as of late, Kramer noted. He listed the $6.7 million Century unit, which had been fully gutted and given a facelift, and fielded several calls in short order. The buyer came in with an all-cash offer with no contingencies and moved in within a week. That’s just how hot things are in L.A., he said.

That supports the trends noted in Douglas Elliman’s Greater Los Angeles luxury condo market report for the third quarter of 2017. Median prices largely inched upward, while marketing time was short and discounts remained nominal. In the Century City and Westwood areas, which are grouped together in the report, the median sale price was up 13.6 percent from the year-earlier quarter, to $883,000. The average number of days on the market was down to 53 days, from 59 days in Q3 2016.

Signs point to escalating demand for the neighborhood. There were 130 luxury condo sales closed in the area in the third quarter of 2017 — an increase of 24 percent from the previous year, according to the Elliman report.

Despite the promising pace, insiders are wary of making predictions about how long the boom will last. Though they’ve been watching and waiting for the bubble to burst, Kramer said that the figures indicate that’s not happening yet. “You’d be crazy to try to predict now where we are in the seven-year cycle. We just had a very strong November and December,” he said.

While he is cautiously optimistic, Kramer is wary of a number of uncontrollable factors that could impact the market both negatively and positively. He pointed to questions of safety around the world that could affect whether international clients choose to relocate.

But on the flip side, there’s also been an influx of new industries into L.A. that could bring a whole new demographic of clients into the market, he noted, pointing to the recent tech boom that has minted a whole new class of wealth seeking the kind of ultraluxury experience these high-end condos offer.

“I saw the 2006 bubble coming a mile away, but now it’s so much harder to predict,” the broker said.

Still, there are some tea leaves to read.

“The only thing I can say: There’s not a huge uptick in inventory in certain neighborhoods,” said Hilton & Hyland’s Smith.

She pointed to Beverly Hills as one example. “I can’t see a huge correction there. A lot of people are moving around from the same area. But there’s such a restriction on inventory that I’m getting several offers on things that are well-priced,” Smith said.

The median condo price in Beverly Hills was $1,272,500 in the third quarter, an increase of 7.4 percent from the year-earlier quarter, Elliman reported.

While unique homes at the very top of the market are commanding sky-high sums, the price growth isn’t happening at the same rate it once was, Smith said. “The numbers aren’t going up like they were. But they are up 40 percent from 2007 in Beverly Hills, Bel Air and Malibu,” Smith said.

Oueida anticipates more interest in the area on the horizon, a good thing given the amount of new ultraluxury product slated to come online nearby.

Century Plaza has two 46-story condo towers slated to open this year atop the Fairmont Century Plaza Hotel. Developer Beny Alagem is planning two 12-story condo towers atop the Waldorf Astoria Beverly Hills, at the corner of Wilshire and Santa Monica boulevards. (This after voters rejected a ballot initiative to alter the proposal to one 26-story condo tower on the property in 2016.)

More buyers are realizing that they can get many of the features of a single-family home in a luxury condo, brokers said.

Coldwell’s Bronson, for example, chalked up his near-$10 million condo sale specifically to the quality of the product he was selling, which was one of only two townhome units on the Century’s ground floor. Being on the first floor gives residents the feel of estate living with all the advantages of condo life, he said.

Bronson sold the unit for his client, owner Marc Schorr, former COO of the Wynn Resorts in Las Vegas. The broker said he knew he’d be able to close the deal at asking price because of the work put into the unit. Schorr had engaged the same designer responsible for the suites at the Wynn in Las Vegas to redo the entire townhouse with the same luxurious finishes.

Bronson closed the deal just under eight weeks after the listing date. “We knew that if we priced it correctly, it would sell. My client didn’t want to price it above market,” Bronson said. It only took a small number of showings before it was clear that they had a deal, he added.

Stunning views are another important factor in selling high-rise condos to buyers used to L.A.’s single-family luxury homes. Elliman broker Oueida’s sale of a 9,700-square-foot unit occupying the entire 26th floor with a 360-degree view is a case-in-point.

“If you’re living in the hills or the Bird Streets, you want views. Those houses generally have a 180-degree view with a hillside behind it,” he said. “This offers a jetliner view.”