At a time when the Los Angeles market is seeing such landmark acquisitions as the Compass takeover of Pacific Union and Douglas Elliman’s purchase of Teles Properties, which brokerage an agent wants to call home — and for how long — seems even more uncertain than usual.

The industry’s high turnover rates are increasingly affecting the way L.A.’s top residential brokerages operate and how financially successful they are, as firms put more and more resources toward recruiting and retaining top-tier talent.

At Hilton & Hyland, for example, the better an agent performs, the higher the payout on commission splits. While new agents once expected a 60-40 split between agent and brokerage, the split can now go as high as 80-20, favoring the agent, with high performers getting as much as 85 percent on a transaction, said an agent at the firm who spoke on condition of anonymity. Industry insiders say that now the split may go as high as 90 percent, and more brokerages are offering additional perks such as paying for the expenses of marketing a property.

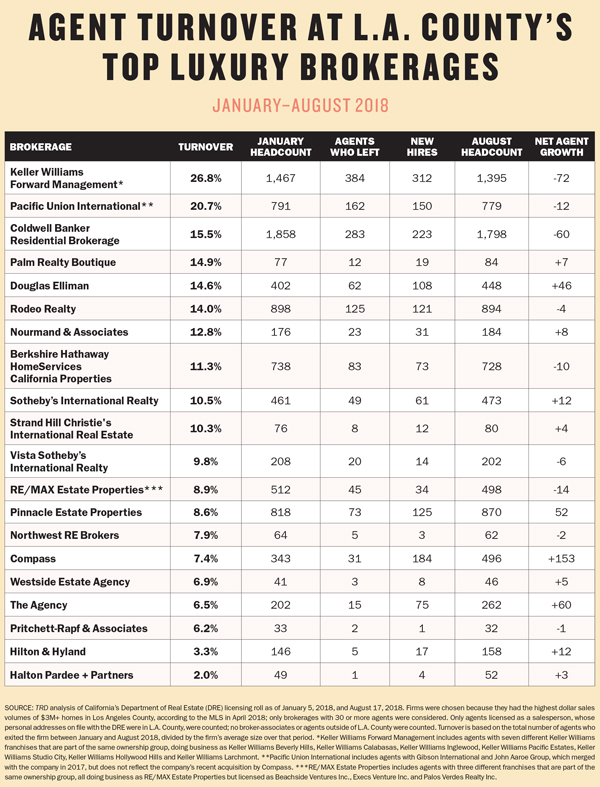

For a closer look at agent turnover, which describes the number of agents who join and leave a brokerage over a set period of time, The Real Deal dove into data from the California Department of Real Estate to analyze changes in headcount from January to August 2018. The department’s public data covers agents with a salesperson license, thus brokers and broker associates— who make up only about 10 percent of the resi brokerage workforce — are not accounted for here. In keeping with the standard formula for calculating the rate of turnover at a firm, TRD took the total number of agents who exited a brokerage between January and August 2018 and divided that by the firm’s average size over that period. For the purposes of this analysis, TRD looked at the 20 brokerages in L.A. County with the highest dollar volume of sales in the $3 million and up range.

For a closer look at agent turnover, which describes the number of agents who join and leave a brokerage over a set period of time, The Real Deal dove into data from the California Department of Real Estate to analyze changes in headcount from January to August 2018. The department’s public data covers agents with a salesperson license, thus brokers and broker associates— who make up only about 10 percent of the resi brokerage workforce — are not accounted for here. In keeping with the standard formula for calculating the rate of turnover at a firm, TRD took the total number of agents who exited a brokerage between January and August 2018 and divided that by the firm’s average size over that period. For the purposes of this analysis, TRD looked at the 20 brokerages in L.A. County with the highest dollar volume of sales in the $3 million and up range.

As expected, turnover rates varied dramatically among L.A.’s residential brokerages. Keller Williams franchises owned by Forward Management had the dubious honor of having the highest turnover, at nearly 27 percent. The seven-office brokerage lost 384 agents and gained 312 over the eight-month period from January through August.

“Even with our top-quality training, the industry, by nature, has high attrition rates. National Association of Realtors statistics show that as many as 87 percent of realtors leave the business within their first five years,” said Paul Morris, CEO of Forward Management.

There are indications, though, that there is more going on these days than standard industry churn: Several agents interviewed byTRD revealed that they are concerned that the traditional brokerage model is outdated.

Working for a firm that takes up to 40 percent of an agent’s commission and emphasizes an office with desks and assistants may not be as attractive as it once was, agents said. With everything — listings, market reports, pipeline data, customer information, contracts and more — online or in the cloud, the focus is starting to shift to agents with mobile offices, and they are advocating for higher splits.

Major acquisitions

Over the past year, Pacific Union International merged with three of L.A. County’s top brokerages — John Aaroe Group, Partners Trust and Gibson — and experienced a turnover of almost 21 percent from January to August, when its sale to Compass was announced. The company lost 162 agents over that period, and it gained 150 new agents. “With bold moves and disruption comes changes, and turnover is often a part of that,” said Nick Segal, president of Pacific Union International, Southern California.

By contrast, during the January to August time period, which predates the PacU acquisition, Compass had a mere 7 percent turnover, losing 34 agents but gaining 184.

Often billed as part tech startup and part real estate company, Compass initially intended to be a major disrupter in the real estate market by doing away with the commissioned agent business model and paying salaries instead. However, when those salaries translated into incomes that were lower than the average take-home pay that commission-based agents earned, Compass reverted to a more standard compensation structure — while dangling the carrot of advanced technology. Among the tech tools for agents are a Pinterest-like app for organizing home listings and a dashboard with copious amounts of neighborhood data.

Pacific Union president Patrick Barber previously indicated toTRD that technology was a major driver in the company’s decision to accept a buyout in late August, citing concerns that they could not compete with the technology Compass has in place.

Tech matters

Technology is a driver for eXp Realty, too. It was the fastest growing brokerage in the county during the January to August time frame, although it did not make the cut for TRD’s top 20 list. At eXp, agent headcount increased by 164 percent in the first eight months of this year, with 125 agents joining the roster for a total of 201.

The firm is a virtual, cloud-based brokerage that offers such perks as lead generation tools and revenue sharing to its agents. As active agents bring others onboard, they receive a percentage of the new agent’s revenue.

The firm is a virtual, cloud-based brokerage that offers such perks as lead generation tools and revenue sharing to its agents. As active agents bring others onboard, they receive a percentage of the new agent’s revenue.

The activities agents typically experience in a regular office instead take place in eXp World, a virtual landscape. The set-up is reminiscent of the world-building game The Sims, and is one in which every agent has an avatar, plus access to the support he or she would otherwise receive at a traditional real estate office.

This virtual world has agent training and education, as well as back office, technical, transaction and operations support and opportunities to interact with other agents online.

After 12 successful years at a Keller Williams brokerage, Mark Zawaideh left for eXp. “I felt like I was given all of the tools, technology and systems to succeed at a higher level,” he said. “Not only did I love the entire cloud-based agent-owned brokerage model, but the revenue sharing plan was real.”

According to Zawaideh, agents share a piece of the revenue made by agents they sponsor. For example, when an agent Zawaideh sponsors sells a home, eXp pays 3.5 percent of that commission, up to $2,800 per year.

When to retain, and when to cut bait

Even the best tech disrupters require a human touch, and that’s where the challenge really gets real. It’s relatively easy to attract people to become agents. Retaining them is another matter.

The National Association of Realtors reports that nearly 90 percent of all new agents quit the business after five years. Yet each year, more freshly minted agents take on the challenge. Turnover is a constant.

Some of the agent loss occurs when boutique firms are acquired by large companies, sending agents fleeing for smaller firms. “It has fueled our growth because agents that signed up to work at boutiques are not happy about working at a large company, so they are switching firms,” said Michael Nourmand of Nourmand & Associates.

But in other cases, high turnover is at least partially the result of some house-cleaning.

Coldwell Banker Residential Brokerage, which has 38 offices in L.A. County, had a 15.5 percent agent churn from January to August, with 283 agents leaving and 223 agents coming on board, arriving at a headcount of 1,798 by August.

“We were unloading non-producers,” Debra Moseley, manager of Coldwell Banker Hallmark Realty, said of her office’s efforts. “And that includes us letting people go that aren’t showing up and that aren’t proving they’re serious about staying.”

That scenario is a pretty common one at L.A. County brokerages, according to industry insiders who confirm that losing agents to inertia is a frequent occurrence.

“Only about 10 percent of new agents realize what they need to do to find their way, and those are the people who end up thriving,” Moseley said. “The rest either leave on their own or are asked to leave.”