The bromance between Jonathan Gray and Roy March is on full display in Los Angeles this year, as the CEOs have teamed up to sell a $2 billion-plus treasure trove of office towers. But the bond between Gray and March has a history. It was set in stone more than a decade ago, with a haircut.

It was 2006, and March, the CEO of Eastdil, told Gray, the CEO of Blackstone Group, that he was scared to cut his hair. If March trimmed his “unbelievable golden mane,” as Gray called it, the companies might lose their mojo in the seemingly Sisyphean feat they were trying to accomplish: to acquire Equity Office Properties (EOP) in what would be the biggest leveraged buyout in history, then quickly flip most of its assets in a series of smaller portfolio trades.

“It was a reference to the Samsonesque [notion] that I would lose my strength by cutting my hair,” March said in a June interview with The Real Deal. He agreed, he said, to let Gray cut it himself if they won the deal.

On February 9, 2007, the $37 billion transaction closed, and Gray’s wife, Mindy, arrived at Blackstone’s office in New York with an oversized bottle of Veuve Clicquot. Right after the glasses clinked, Gray trimmed March’s hair on the office floor as both of their teams cheered.

“That was the moment our firms became incredibly close,” Gray said.

The bond between Eastdil Secured and Blackstone may be sacred, but it’s not monogamous. Eastdil has relationships with most, if not all, major institutional owners, including the local buyer of many of Blackstone’s recent dispositions in L.A., the Santa Monica REIT Douglas Emmett Inc. (DEI).

While other shops have beefed up their capital markets operations — Newmark Knight Frank, in particular, bumped up its market share when it poached Kevin Shannon and his fast-growing team from CBRE in December 2015 — no brokerage has come close to Eastdil when it comes to cornering the priciest end of the office market.

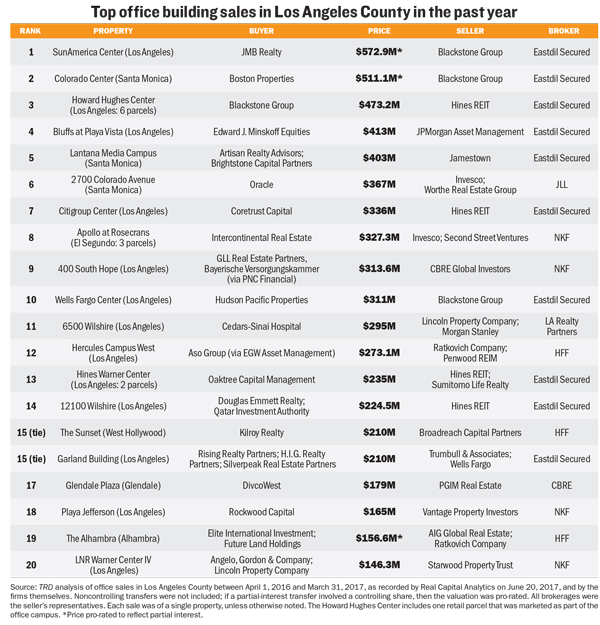

Out of the 20 most expensive trophy tower sales in TRD’s ranking, which covers offices sold in L.A. County between April 1, 2016, and March 31, 2017, Eastdil was the listing broker on 10. Newmark listed four. Holliday Fenoglio Fowler (HFF) brokered three. CBRE, JLL and L.A. Realty Partners each brokered one — while other major players, from Cushman & Wakefield to Madison Partners, did not make the cut.

“Eastdil is [my team’s] biggest competitor and has been for past 20 years,” Shannon told TRD.“The last of the Equity Office Properties deals will be sold this year, and that has obviously been very helpful [to Eastdil’s market share]. They are very good, so we are just going to continue the fight. I enjoy competing with them.”

The endgame

Eastdil’s market share in L.A. County has steadily grown over the years. In 2010, it brokered 31 percent of investment deals in all product types over $50 million, according to Real Capital Analytics data. By 2015, it had crossed the meridian to 56 percent. Last year, that share fell to 51 percent, but it still achieved four times the volume of its nearest competitor, HFF. And Eastdil’s share is up again, as the company is at 55 percent so far in 2017.

By comparison, the RCA data reveals that rival CBRE’s market share has been declining. The company had 18.5 percent of investment deals in all product types over $50 million in 2015, but its share dropped to 13 percent in 2016, and year to date in 2017, the company has about 12 percent.

With Blackstone liquidating the last remaining properties in the EOP portfolio by year’s end, there is reason to believe Eastdil will take an even bigger piece of the pie in 2017. It had already clocked in $3.6 billion as of July 3, according to RCA.

Eastdil negotiated each of the top five priciest deals in TRD’s ranking, many of which already show the rewards Gray and March have reaped from the tail end of their EOP bet. In the No. 1 slot, JMB Realty bought back Blackstone’s two-thirds stake in SunAmerica Center in March for a hefty $572.9 million, according to TRD’s analysis of RCA data. The deal gave the Chicago-based investor full control of the Century City office tower it developed nearly three decades ago at 1999 Avenue of the Stars. JMB had sold the stake to EOP for a mere $72.4 million in 1999. It was acquired by Blackstone eight years later as part of the buyout.

As more East Coast investors flock to L.A.’s Westside — with New York developer Steve Witkoff building a hotel and, rumor has it, a luxe residential complex — Eastdil has the connections to reel them in. Boston Properties, for example, made its grand entrance into L.A. last year, buying a stake in Santa Monica’s Colorado Center, another EOP property, from Blackstone for just over $511 million (No. 2 in the ranking). And New York’s Minskoff Equities bought the creative office campus of the Bluffs at Playa Vista from J.P. Morgan last summer for roughly $413 million (No. 4), shocking the market with its nearly $826 per-square-foot price tag.

But it’s not just outsiders who are making deals with Eastdil and Blackstone. Jordan Kaplan, the CEO of DEI, had offered to pay an attractive 4 percent capitalization rate on the Westside EOP assets in 2006, a suggestion that kick-started Blackstone’s quest to acquire the company and is now culminating in these major deals. DEI, true to its top-dollar promise of yesteryear, bought a trophy waterfront office tower at 1299 Ocean Avenue that was part of the EOP portfolio from Blackstone in April, one of about $550 million in properties that it bought from the firm with its partner, Qatar Investment Authority, this year. The joint venture paid $1,385 per square foot for the building, breaking the roughly $1,165 per-square-foot record in Santa Monica formerly held by Oracle’s purchase of 2700 Colorado in November 2016 (No. 6, brokered by JLL). DEI also clocked in at No. 14 in TRD’s ranking with its acquisition of 12100 Wilshire from Hines for $224.5 million.

“Brokerages fundamentally changed after the last recession,” said Chris Rising, president of the Downtown development firm Rising Realty Partners, whose $210 million acquisition of the Garland Center with H.I.G. Realty Partners and Silverpeak RE Partners, brokered by Eastdil, made the ranking of priciest office sales at No. 15. “Before that, someone like John Cushman [III] could dominate because it was all about a large tenant … and the leasing men and women” who could lure a prospective buyer with the stature of the tenants they’d sign. “After 2000, we really started to see specialized investment sales teams with a global network. That started with Eastdil,” Rising said.

Stacking up

Eastdil is a bit of an odd bird as a brokerage. A subsidiary of Wells Fargo, it operates much like an investment firm, with 325 employees across 13 offices worldwide. Its brokers take home a salary and bonuses, not commission, and they rarely leave the company. With the exception of New York brokers Doug Harmon and Adam Spies, who departed last year for Cushman & Wakefield, there are few poaching stories of note — on either end. Its managers act more like advisers in high-end deals, working closely with financing specialists who can tap into global resources, according to sources.

“The dominance of Eastdil today is almost completely due to the idea that real estate is local but capital is global,” said one real estate adviser.

The brokerage merged with the L.A.-based Secured Capital Corp. in 2006. It was a move that bulked up its team of debt specialists and brought on Michael Van Konynenburg as president and power players Jay Borzi and Stephen Silk as managers, thereby eliminating some of its competition. Both firms were more data-focused than your average brokerage and doubled down on that approach when they combined their databases.

“We believe we are more of an information franchise, as opposed to the more covetous commission cultures,” March told TRD. “We don’t spend a lot of time thinking about the competition.”

Commercial real estate investors interviewed by TRD put it more bluntly.

“The other brokerages, CBRE, etc., are these little fiefdoms across the country, fighting over commissions,” said one landlord. “Eastdil is the only one with a team approach, where 10 senior people know what is going on in any given deal. When they merged with Secured, it created this mega-powerful organization — a brokerage on steroids.”

Some insiders said that power can force the hands of investors who worry that if they don’t list their properties with Eastdil, they will be blacklisted when they are bidding on an Eastdil listing.

“It’s the Eastdil strong-arm,” one broker said. “ ‘ You better list your property with us, and you better sell it with us, too.’ ”

Van Konynenburg denied any jockeying.

“Most often, if we are selling the transaction, because of the deep knowledge we have and because we are the most active, we end up selling it the next time,” he said. “But obviously that is not a condition.”

Newmark rising

Shannon and 14 members of his team shocked the industry when they left CBRE for Newmark days before the start of 2016. The team, which covers the entire West Coast, then went on a poaching spree. It hired industrial specialist Bret Hardy from Colliers; Brad Feld and Steven Salas from Madison Partners; and Will Adams and Norman Lee from CBRE within a year.

By the end of 2016, Newmark’s office sales volume in the L.A. area had risen fivefold over the previous year, according to Real Estate Alert.

Shannon’s team was the only other brokerage besides JLL to sit with Eastdil in the top 10 in TRD’s deals ranking. The team’s former home at CBRE, which insiders say is still on its way to rebuilding after their exit, entered the ranking at No. 17, with DivcoWest’s $179 million acquisition of Glendale Plaza.

Shannon’s recent blockbuster deals have included the three-parcel Apollo at Rosecrans campus in El Segundo, which Intercontinental Real Estate bought for $327.3 million from Invesco and Second Street Ventures (No. 8). It also brokered Brookfield Office Properties’ $440 million stake in the California Market Center in June, after the March 31, 2017 cutoff for TRD‘s top deals ranking.

But only one of the Shannon team’s sales in the ranking occurred in L.A.’s beau ideal of an office market, Silicon Beach, where Eastdil holds a pretty tight grip. The team sold Playa Jefferson campus in Playa Vista for $165 million to Rockwood Capital (No. 18). Oracle’s JLL-brokered purchase and the HFF-brokered deal for Google’s Spruce Goose hangar (No. 12) were the only others in the top 20 to break into the area.

Eastdil’s near-domination of Class A trophy office disposition assignments on the Westside inevitably causes other investment brokers to chase lower-profile listings or trophy assignments in secondary markets where Eastdil doesn’t have a presence, several sources said.

Newmark did well this year poking around the San Fernando Valley, which is not known to be Eastdil territory. It clocked in with No. 20 in our ranking, brokering Angelo, Gordon & Co. and Lincoln Property Company’s $146.3 million acquisition of two buildings in the LNR Warner Center from Starwood Property Trust.

“Some will say going where Eastdil doesn’t is a strategy that pays off, if not in trophy sales then in overall sales volume,” one broker said.

But if big dogs like Shannon roll to secondary markets, where do the little dogs go? That’s a question that could soon become pertinent, with deal volume down this year and most of the deals that are closing coming in at the higher end of the spectrum.

In the second quarter, over $2 billion in office buildings traded hands in Los Angeles, up 33 percent from the $1.5 billion in sales volume reported in the first quarter, according to preliminary second-quarter data from Transwestern. However, that figure was down 14 percent from $2.3 billion during the same period in 2016, the data showed. Year-to-date sales volume of $3.5 billion is also down 27 percent from the $4.8 billion reported in the first six months of 2016.

Some assets that seemed to be trophies have sat on the market only to be quietly removed, sources said.

“Well-located trophy assets are selling for high pricing and low cap rates while everything else sits on the market because of the disconnect in pricing between buyers and sellers,” one source explained.

Luckily for Eastdil, it deals in trophies.

“Our median transaction nationally tends to be $100 million,” Van Konynenburg said. “We tend to be focused on transactions that are bigger in scale.”

—Harunobu Coryne provided research for this article