Up until a year or two ago, Los Angeles’ development pipeline was filled with glass towers and sprawling multi-use projects. There were ambitious plans for glossy luxury condos, retail and hotels at gargantuan Downtown projects like Oceanwide Plaza and 6AM — both of which have since been stymied by financing problems and other issues.

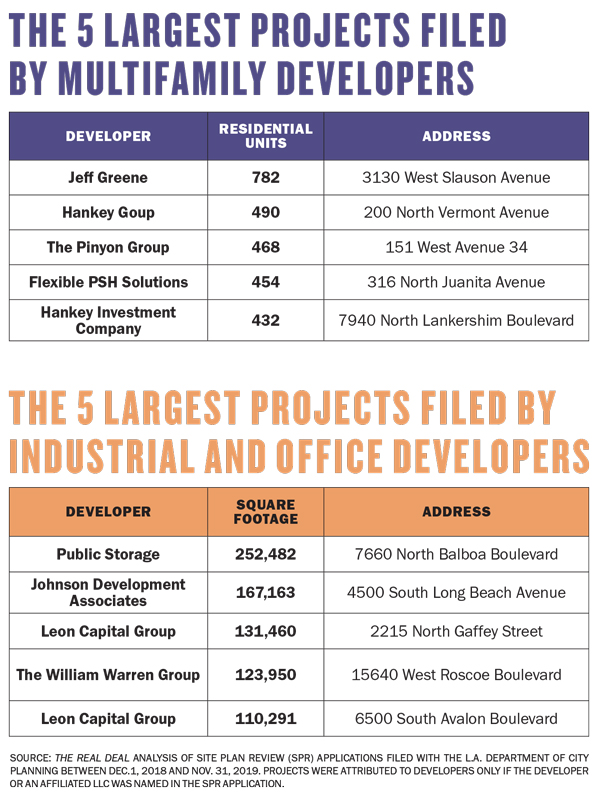

But today’s landscape looks markedly different. Plans for multifamily residences near transit stations and self-storage facilities in lower-income areas dominate the list of the largest proposed developments in the city of L.A., according to a TRD analysis of permits filed between Dec. 1, 2018, and Nov. 31, 2019.

Why the shift away from office space, hotels and condos? Construction cost increases combined with an oversupply of high-rise apartments are to blame, said CBRE’S Laurie Lustig-Bower.

“There were a lot of high-rises in Downtown L.A. and a lot opened at once, causing all the buildings’ rents to go flat,” said Lustig-Bower. “It changed the underwriting for projects going forward.”

Now developers are turning to projects that allow them to take advantage of the city’s Transit Oriented Communities Incentive Program (TOC), as well as storage facilities, which investors view as a high-demand product that’s recession-resistant.

The top builder for commercial property types including retail, office and industrial space was Public Storage, which filed to build 252,482 square feet.

And in multifamily, Hankey Group took the top spot, filing for a total of 922 rental units over the aforementioned period. Multifamily builders and their projects were ranked separately from other commercial entities, since the information required on multifamily permits differs from that of the other commercial types.

Flexible PSH Solutions’ Enlightenment Plaza

Multifamily and storage properties have a bit of a symbiotic relationship, as people tend to use storage while between homes and apartment dwellers tend to stay for less time in an apartment than in a house, said Greg Wells of Cushman & Wakefield’s Self Storage Advisory Group .

“If apartments in mixed-use [projects] have been really hot, self-storage would typically be a couple of years behind,” said Wells.

The demand for storage space seems bottomless. Despite the fact that the amount of storage built in the U.S. more than tripled from 2015 to 2018, vacancy rates generally remained around 9 to 10 percent, according to Statista.

But L.A. in particular has room to grow. On average, major metropolitan areas in the U.S. have close to 7 square feet of storage per person, whereas the Greater L.A. area has less than 5 square feet per person, according to Wells.

And the demand for more housing means the multifamily market across L.A. is strong right now, Lustig-Bower said, pointing to a vacancy rate of 3 to 3.5 percent.

“We’re really seeing a surge of developers going into areas that maybe they wouldn’t have gone five years before,” she said, pointing to the success of Downtown’s Arts District. “It seems to be evolving naturally and organically.”

Apartment building boom

The seeds that were sown with the creation of the TOC program in 2017 are now starting to sprout, as clusters of proposed multifamily residences have popped up near the city’s Metro stops. TOC benefits such as density increases or parking reductions apply to projects within a half-mile radius of a rail station or the intersection of two or more bus routes. The first project to receive such incentives, a 62-unit building at 88th and Vermont in South L.A., opened in January.

In the past year, billionaire developer Jeff Greene proposed perhaps the largest project to make use of the TOC incentives. His filings for a 782-unit project at 3100 West Slauson Avenue in Park Mesa Heights puts him in second place among the top multifamily developers. The site is about a block away from the future Hyde Park station on the Crenshaw/LAX Metro line, making it eligible for the biggest incentives under the city program, including an 80 percent density bonus and a height increase of 33 feet. The seven-story building, which would include 141 affordable units, would be less than 4 miles from SoFi Stadium, also slated to open in 2020.

Greene, a West Palm Beach resident who has built most of his projects in South Florida, said he bought the L.A. property 20 or 25 years ago with the intention of eventually demolishing the existing building.

“Then they decided to put a train stop on the corner in response to the goals of the city to reduce traffic and reliance on cars,” said Greene. “We decided to take advantage of it and build more density.”

Greene, whose 118-unit luxury building at Highland and Franklin Avenues in Hollywood is expected to be finished in the next couple of months, estimated that it would cost around $300 million to develop the Slauson Avenue project. He didn’t yet know how much the company would charge for the market-rate units. One-bedroom apartments in the area rent for between $1,300 and $2,000 per month on RadPad.

“Hopefully, with the density bonus, it will pencil out,” he said. “Whether it works by the time it gets approved, we’ll see.”

Over on the Vermont/Sunset line to the north, two large projects are clustered around the Vermont/Beverly Metro stop in Rampart Village. The No. 4 developer in TRD’s multifamily ranking, nonprofit affordable housing builder Flexible PSH Solutions has a project at 316 North Juanita Avenue, and top developer Hankey Group’s 490-unit project is going up at 200 North Vermont.

Although Hankey applied for a 70 percent density bonus under the TOC, it had already planned on developing the site in partnership with Koreatown-based developer Jamison Properties before the city released its guidelines, according to W. Scott Dobbins, Hankey Group’s president. The 2.8-acre site, which is now vacant, was the first property that Hankey’s chair, Don Hankey, ever invested in when he bought a stake in Midway Ford in 1958.

Hankey Group’s Lankershim project

Despite its proximity to the Vermont/Beverly Metro stop, Flexible PSH Solutions didn’t apply for any incentives under the TOC. That’s because it received other government funding under Proposition HHH due to its plan to build a facility that houses the homeless, Chief Executive John Molloy said. Voters approved the $1.2 billion bond in 2016 to build 10,000 units of supportive housing in the city over 10 years.

The fact that the site is isolated from other residential housing made it a particularly good location for his project, Molloy said, given that residents are not always welcoming of facilities for the homeless moving in nearby. Enlightenment Plaza, as the project is called, will have support services onsite, offering residents help with employment and physical and mental health.

Although Flexible PSH applied to build 454 units, it only has enough funding to build 330 units, at 500 square feet each, as of now, Molloy said. The company might build the balance in an adjacent structure in the future if it secures funding, he added.

The squeeze

While there’s huge demand for multifamily housing, rising construction costs are forcing developers to pass the cost onto the customer, said Jack Nourafshan, chief executive of Reliable Properties, a Mid-Wilshire based real estate development company that ranked fifth on TRD’s multifamily developer list. The firm is shrinking units by 10 to 20 percent in its proposed 412-unit mixed-use project in order to maximize profitability.

“People need to step up [in paying rent] or accept a smaller space like in Europe or other major metropolitan areas,” said Nourafshan.

The project, at 5525 West Sunset Boulevard in Hollywood, is one of the only developments on the list that’s located in a higher-income area. Units will range in size from 600 to 800 square feet. Reliable also applied for a 70 percent density increase, with a quarter of the units designated for affordable housing.

The project, at 5525 West Sunset Boulevard in Hollywood, is one of the only developments on the list that’s located in a higher-income area. Units will range in size from 600 to 800 square feet. Reliable also applied for a 70 percent density increase, with a quarter of the units designated for affordable housing.

The company is planning on offering updated amenities such as warming areas for food delivery, garden plots for residents to grow their own food and programming to promote socializing among residents, Nourafshan said.

Everybody’s got the same idea

Given the amount of storage space that’s come online in the past six years, Timothy Hobin, executive vice president of real estate at William Warren Group, which develops and manages projects nationally under the StorQuest Self Storage trade name, wasn’t surprised that the top commercial projects were almost all self-storage.

“Self-storage has outperformed other real estate asset classes in downturns,” said Hobin, whose Santa Monica-based firm proposed an almost 124,000-square-foot facility in the Lake Balboa area.

He pointed to the success of specialized real estate investment trusts such as Glendale-based Public Storage, which has a market capitalization of around $38 billion and which also proposed a facility in Lake Balboa — the largest non-multifamily commercial project filed over the period analyzed by TRD.

Hobin isn’t worried about the competition, which includes a third developer, San Diego-based All Right Storage, building a facility in the Valley neighborhood near Van Nuys. The three projects will offer a combined total of 476,000 square feet. The grouping was a coincidence, several experts said.

Because cities aren’t always friendly to low-employment projects like storage facilities and due to the time it takes to get a project approved, L.A. has a higher barrier to entry than some other places in the country, experts said. The restricted supply means that developers can charge higher rents, according to Hobin, who believes that’s why out-of-state companies like Leon Capital Group and Johnson Development Associates have been drawn to L.A. The companies placed second and third, respectively, in the ranking of non-multifamily developers. They did not return emails or calls for comment.

Because cities aren’t always friendly to low-employment projects like storage facilities and due to the time it takes to get a project approved, L.A. has a higher barrier to entry than some other places in the country, experts said. The restricted supply means that developers can charge higher rents, according to Hobin, who believes that’s why out-of-state companies like Leon Capital Group and Johnson Development Associates have been drawn to L.A. The companies placed second and third, respectively, in the ranking of non-multifamily developers. They did not return emails or calls for comment.

“I do know the Leon guys have been aggressive,” said Hobin. “They’ve bought up properties without entitlements [and] taken the risk in order to quickly build a pipeline.”

Neither company specializes solely in self-storage, and Johnson Development’s proposed project at 4500 South Long Beach Avenue in Vernon appears to be the company’s first in L.A., based on its website.

Leon Capital Group already has a few self-storage locations in the L.A. and Orange County areas, according to its website. The firm submitted plans last year to build two more — one in San Pedro and the other in South L.A.

Cushman’s Wells expects Greater L.A.’s average monthly storage space rent of $1.80 to $2 per square foot to grow 3 to 4 percent annually in the near future. He also echoed the idea that the area’s relatively low supply of storage is drawing outsiders like Leon and Johnson to L.A.

“It’s one of the few places left in the country that’s still very undersupplied and has a lot of room for more development,” he said.