UPDATED June 3, 12:50 p.m.: There’s been a lot of chatter about housing prices nearing the edge of a cliff, a bubble about to burst, an impending market crash. But — perhaps unsurprisingly — that’s not how the luxury brokers in Los Angeles see it.

Yes, the market is leveling a bit. Sure, the fourth quarter of 2018 slowed to a crawl. No, sellers can’t automatically receive the astronomical asking prices of a few years ago. But brokers said that’s more a reflection of prices stabilizing and buyers demanding value than it is of an overall market decline.

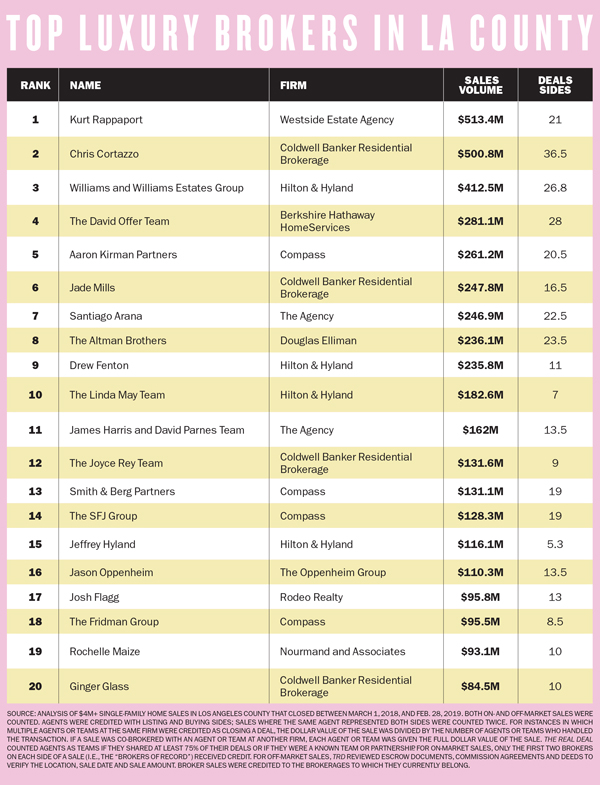

To get a look at the residential playing field in Los Angeles County, The Real Deal ranked the highest-performing luxury brokers between March 1, 2018, and Feb. 28, 2019. TRD analyzed single-family home sales of $4 million and higher to identify the 20 top-producing agents. Agents were credited with both listing and buying sides, including deals for which they were the co-broker. An agent who represented both parties received full credit for each side. Off-market sales were included when brokers provided evidence of a commission received for the transaction.

Westside Estate Agency’s Kurt Rappaport tops our list with $513.4 million in sales. Coldwell Banker’s Chris Cortazzo clocked in second with $500.8 million in sales. The Williams and Williams team at Hilton & Hyland clocked in at third place with $412.5 million. David Offer’s team at Berkshire Hathaway ranked fourth with $281.1 million. Aaron Kirman Partners, which became part of Compass last year, came in fifth with $261.2 million. And Coldwell Banker’s Jade Mills ranked sixth with $248 million.

There were some monster deals that closed last year. Hard Rock Cafe co-founder Peter Morton’s Malibu home sold for a record $110 million (Rayni and Branden Williams were the seller’s agents). The Holmby Hills estate of a former movie executive sold for $69 million (the listing was shared by Linda May of Hilton & Hyland, No. 10 on our list, and Stephen Shapiro of the Westside Estate Agency). Le Belvedere, a property once owned by developer Mohamed Hadid, sold for $56 million (the Agency’s Stacy Gottula and Coldwell Banker’s Joyce Rey, whose team is No. 12 on our list, both represented the seller). Rappaport and Branden and Rayni Williams closed Beverly Hills’ 826 Greenway Drive for $27.6 million in December.

“The high-end areas of L.A. haven’t suffered a big adjustment,” said the Agency’s Santiago Arana, No. 6 on our list. “On a deal-by-deal, property-by-property basis, [the decline] hasn’t been dramatic.”

Brokers said the buyers are still there, but they’re just being more cautious and waiting for prices to go down. It’s a different picture from that of the last few years, when prices were skyrocketing and everyone was scrambling to get in.

“Before, it was sellers setting prices and breaking records,” said David Parnes, who, with James Harris, was No. 10 on TRD’s ranking. “Now they can’t set outrageous prices and expect the buyers to meet them.”

Much of this was due to a lack of clarity about where the market was going. The stock market saw incredible volatility throughout the year, and the Dow Jones Industrial Average finished 2018 down 5.6 percent — the worst performance in a decade. Worries over monetary policy, U.S. politics and the global economy also contributed to a general sense of uncertainty.

On top of that, November’s Woolsey Fire hit Malibu hard, destroying about 400 single-family homes in the area. Arana said he lost about $50 million that was in escrow when buyers pulled out of the deals as a result of the fires.

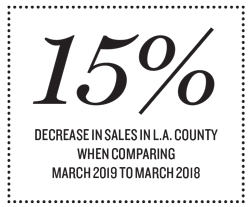

All of those factors contributed to a slowdown in the luxury market, particularly in the fourth quarter of the year. Between March 2018 and March 2019, inventory in Los Angeles County increased by 5 percent, while properties sold decreased by 15 percent, according to a market report from Douglas Elliman. The trend was more pronounced in luxury pockets like Bel Air-Holmby Hills, where inventory increased by 13 percent and properties sold decreased by 33.3 percent.

The competitive edge

Being upfront about the realities of the market is one of the main things that helped Arana hit $247 million in sales volume last year, he said.

“As agents, our job is to communicate,” Arana said. “If we’re proactive with doing that, we’ll be selling those properties. If you do nothing, you might lose the listing to someone who has the ability to explain [where the market’s at] and get it sold.”

Coldwell Banker’s Rey attributed part of her success last year to the premium she put on her buyers. She saw buyers’ attitudes start to shift because of the uncertainty in the marketplace and said she told her entire team to focus more on buyers’ needs, as opposed to focusing quite so much on acquiring new listings.

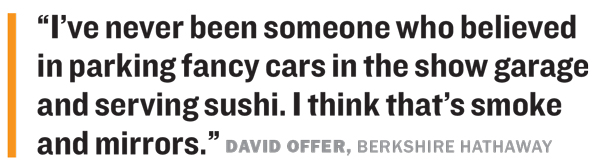

Offer at Berkshire Hathaway said that after 28 years in real estate, he gets most of his client base from referrals.

“I’ve never been someone who believed in parking fancy cars in the show garage and serving sushi. I think that’s smoke and mirrors,” he said.

Parnes and Harris, on the other hand, have made a name for themselves with over-the-top parties that showcase their homes. They’ve hosted everything from a Burning Man-themed party in Hollywood to a Havana Nights party on the Sunset Strip to a “Great Gatsby”-themed party in Bel Air, many of which were featured on Bravo’s “Million Dollar Listing Los Angeles,” on which they both star.

“At the end of the day we want to get as many good people into a house as possible,” Parnes said. “We’ve got a great contact list of clients and top agents and have sold a phenomenal amount of real estate to buyers or friends of buyers who’ve come to events.”

Kirman of Compass, meanwhile, said his team is focused on constantly innovating in order to stay on top.

“Agents don’t have clients anymore. I don’t have clients,” he said. “As many as I have, a client is going to go with whoever they think is going to get highest dollar in the shortest amount of time in the most ethical way.”

Kirman said building a big team with a lot of hyper-specific focus areas has helped him stay ahead of the curve. He currently has more than 65 people on his team who handle everything from administrative support to creative strategy. Kirman said they spend “hundreds of thousands of dollars” experimenting with new strategies to tell their story and acquire new clients.

The team can end up losing thousands of dollars on a bet that doesn’t pay off, but when they do, Kirman said it’s a game changer. One of the strategies that’s been successful for them is using targeted digital ads through Google’s AdWords and AdSense, which allows them to show individualized properties to potential buyers.

“Based on intelligence we have through our website, we can curate who’s looking at any price point in our area and send them any piece of inventory in their area,” Kirman said.

From there, his team does extensive follow-ups, which could involve everything from sending specialized books to flying potential clients out to Los Angeles.

Kirman said a targeted campaign helped them connect with a Russian billionaire who was looking to spend between $50 million and $80 million. That unidentified individual is now coming to Los Angeles to look at properties.

“Bottom line, this is a changing market and we refuse to be status quo,” Kirman said. “We want to be the market leader, and we know it’s changing so quickly that if you’re not changing with it, you’ll be left behind.”

The poaching problem

Kirman’s team is entirely self-contained, even though it’s now part of Compass, which bought Pacific Union International in August. That was just one of Compass’ many acquisitions as it continues to lead the real estate industry’s rapid push to consolidate. Even so, brokers not affiliated with Compass don’t appear overly concerned with its buying spree.

“Our model is completely different,” said Arana, one of several managing partners at the Agency. “Are they poaching our agents? They are. And some are leaving, but at the same time, we’re going after other agents who have gone [to Compass] and that’s not what they want.”

He said the Agency prioritizes quality over quantity and looks for agents who have years of experience, are well-connected and can hit the ground running. In his view, Compass’ “only goal is to gain market share… We’re not targeting the same people and not targeting the same things.”

Offer, similarly, didn’t put much stock in all of the buzz about industry changes.

“Most of my clients don’t even know where I work,” Offer said. “They don’t care. They’re listing with David Offer, not Berkshire Hathaway. I can’t imagine [the consolidation is] having a negative impact other than people losing phone numbers because [the numbers are] changing so often.”

Pricing, pricing, pricing

It’s become difficult to advise buyers and sellers on pricing because there have been “fewer data points,” according to Offer.

“In a market where the direction is very clear and prices are appreciating and there are lots of transactions, it’s relatively easy to provide a narrow range of value for the property,” Offer said. “When things are choppy and fewer transactions are happening, it can be more challenging to pinpoint the value.”

High-end buyers are increasingly looking for a property that has something special — and don’t mind paying if they find it, added Kirman, citing a 4,500-square-foot condo in Santa Monica that sold for $12 million and Ricky Schroder’s ranch in Topanga, which sold for $9.3 million. Both went for relatively high prices, considering what they were at face value.

“We’re seeing the unique and the interesting are selling, the out-of-the-box are selling, while some of the run-of-the-mill stuff is really sitting, including the view properties because they’re all similar and some aren’t as defined as they should be,” Kirman said.

Arana added that he sets realistic expectations upfront. That means leveling with sellers that they might not get the asking prices of a few years ago, but also making sure buyers know that a lowball offer might mean they lose the house because “some things aren’t going to take a hit.”

And while a lot of the ultra-high-end luxury homes have seen price reductions over the last year, brokers said that doesn’t necessarily mean the market is falling, but perhaps that the homes were overpriced to begin with. Arana cited Bruce Makowsky’s so-called “Billionaire” spec home, which was originally priced at $250 million but is currently on the market at $150 million.

“It’s created the sense in the consumer that the market is crashing,” said Arana, adding that he thought the Bel Air home was worth something closer to $85 million.

Off-market’s waning appeal

In the last few years, pocket listings have proliferated for these ultra-high-end listings. Offer said he’s had sellers who are increasingly open to such a route, especially in a more “rational market,” where bidding wars are less likely and clients want the discretion that often comes with an off-market listing.

“At the same time, sometimes in order to have success you need more exposure than the pocket listing can provide,” Offer said. “Pocket is sometimes out of sight, out of mind.”

Hilton & Hyland’s Branden and Rayni Williams and Westside Estate Agency’s Kurt Rappaport sold 826 Greenway Drive in Beverly Hills for $27.6 million.

Jade Mills of Coldwell Banker said that as inventory has increased over the last year, she’s seen pocket listings go down.

“I think sellers want to jump in with both feet and be seen,” said Mills, who’s one of the listing agents for the $245 million Chartwell Estate in Bel Air, the most expensive property currently on the market.

Rey said her office did an analysis of sales in the first quarter of 2019 and found that pocket listings had decreased. She, too, believes that in this market sellers want and need the exposure that comes with the MLS.

“The minute you list with our company, we have a service that automatically translates it into 40 languages and sends it to 80 countries,” said Rey, referring to ListHub, which Coldwell Banker uses. “Off-market, you don’t have that benefit.”

Kirman is also focused on his global reach. He got back from a trip to Asia in March and said that as China’s growth is slowing, he’s starting to target wealth managers in Indonesia and Vietnam. Not only does this expand the potential client base, it gets outside of the Los Angeles real estate bubble.

“I was in Hong Kong with a buyer who was ready to spend $100 million on a 4,000-square-foot property. I couldn’t believe my eyes!” Kirman said. “I wanted to tell him, ‘You need to buy in L.A. — I could sell you a kingdom!’”

Editor’s note: This ranking has been corrected to show that Coldwell Banker’s Chris Cortazzo had the second-largest sales volume in this ranking and that Ginger Class, also of Coldwell Banker, ranked 20th. The revision also shows that Rochelle Maize of Nourmand & Associates placed 19th. The article has been amended to show that both Branden and Rayni Williams co-brokered the sale of 827 Greenway Drive with Kurt Rappaport.