Flocks of construction cranes are roosting in many Los Angeles neighborhoods. This late in the cycle, experts say, developers are rushing to complete new retail, residential and hotel projects — especially in Downtown L.A. But even tony neighborhoods such as Beverly Hills and West Hollywood aren’t immune to huge new developments that will dramatically increase density.

The strain is beginning to show. Retail projects have gone up so quickly that store space is sitting vacant in shiny new shopping centers. Large condo projects, such as the 2-million-square-foot Metropolis, are being built in a city where luxury residential properties have long been defined as roomy single-family homes on the west side of the city. And nearly 11,000 new hotel rooms are in the pipeline for Los Angeles County, according to an analysis by The Real Deal.

Market pros have started doing some soul-searching, asking themselves whether there will be enough demand to meet the new supply due in 2017 and 2018. And there are signs that financiers are among the skeptics, as banks begin pulling back capital.

“Financing is the canary in the coal mine. It’s the first sign that a segment of the market doesn’t have confidence in the longer-term view,” said Ryan Iwasaka, an attorney who chairs the Real Estate Group for Los Angeles-based law firm Greenberg Glusker. He said construction lenders were becoming more cautious and that was prompting some developers to rush to complete projects because “if you miss the market, you’re a goner.”

Cue the foreign investors. Many large investors from Asia and Europe hold a different view of gateway cities like Los Angeles. Iwasaka said the “overpayment factor” of foreign capital is having a ripple effect in L.A.’s real estate market, and “making it difficult for local guys to participate.”

Foreign capital, particularly from China, is seeking refuge in L.A. real estate, almost as if it were a massive piggy bank. “The business model for foreign investors is based on capital preservation, because U.S. real estate is seen as a safe haven,” said Andrew Kirsh, founding partner of Sklar Kirsh in L.A., and a commercial real estate transaction attorney who chairs the firm’s real estate practice.

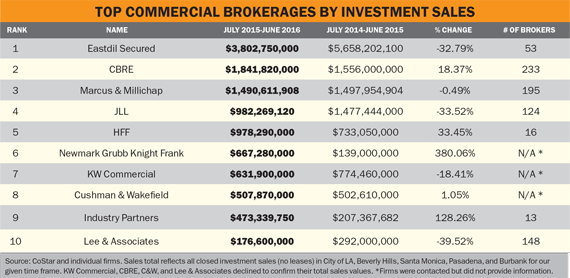

Market pros expect the trend to only increase after the British vote in favor of exiting the European Union. “Because of Brexit, L.A. is going to benefit from many foreign buyers taking London off their shopping list for the time being,” said Kevin Shannon, president of West Coast Capital Markets at Newmark Grubb Knight Frank [TRDataCustom].

Meanwhile, local critics of the building boom say that it is not creating the type of development L.A. really needs — particularly, affordable housing.

“It’s a very segmented housing phenomenon,” said Jonathan Miller, president and CEO of Miller Samuel Real Estate Appraisers, a New York real estate firm that keeps tabs on the L.A. market. “Currently there’s more supply at the top.”

Looming ballot initiatives could soon shake things up. Backers of the Neighborhood Integrity Initiative, which is heading for the March 2017 ballot, hope to slow high-density development by mandating a two-year pause on projects that require zoning amendments, or, in other words, most development projects.

“It would destroy development,” Kirsh said of the initiative, while clarifying that he thinks development “has to be done in a responsible way, near mass transit, and done to help make a dent in this lack of affordable housing for L.A.’s workforce.”

Backers of a rival initiative, Build Better L.A., hope to counter with a November ballot initiative to include affordable housing when large projects require changes to zoning.

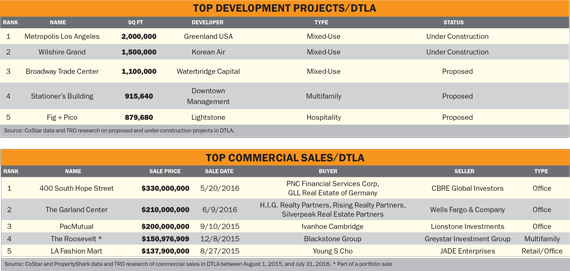

Despite looming challenges, new projects are being completed, and megadeals for investment properties are being inked, including the $152 million that Chanel paid for its Rodeo Drive store and the $330 million recently paid for the DTLA office building at 400 South Hope Street.

Here’s a bird’s-eye view of some of the most significant projects bucking the headwinds — and forging ahead — in three of L.A.’s hottest neighborhoods: DTLA, Beverly Hills and West Hollywood.

DTLA

Metropolis, a horizon-altering megaproject, is being built by Greenland USA, a branch of China-based real estate developer Greenland Holding Group. Although a relatively new player in Southern California, it is not so to the U.S. real estate market. Greenland USA spent $5 billion for a majority stake of Pacific Park Brooklyn, a 20-acre mixed-use property in New York, before turning its attention to L.A. Its parent company, founded in 1992, is owned by the Chinese government and is 311 on the Fortune 500 global enterprise list.

“As one of the largest real estate companies in China, it was only natural that Greenland Group look internationally, and particularly to the U.S., for growth,” said Gang Hu, CEO of Greenland USA. “We’ve found two terrific projects, Metropolis in Los Angeles and Pacific Park in Brooklyn, that speak to our expertise in developing large-scale, mixed-use projects. And we look forward to continued growth across the nation.”

Greenland USA’s project in L.A. tops the The Real Deal’s list of the largest developments in the works for Los Angeles County.

Metropolis is a $1 billion undertaking that measures 2 million square feet across four buildings of residential, retail and hotel space. The project will anchor the western edge of DTLA. The 6.3-acre site sits adjacent to the financial district to the northeast, while the Sports and Entertainment District lies to the southwest. Metropolis is expected to connect the financial and entertainment districts by adding a missing piece to the

pedestrian corridor along Francisco Street between Eighth and Ninth streets.

The project is being built on one of the neighborhood’s last substantial parcels of underdeveloped land, space that had previously been languishing in failed-project purgatory. In the late 1980s, City Centre Development planned to build a Mediterranean-style office, hotel and retail complex designed by New York-based architect Michael Graves, but the project was scrapped when the economy slowed. In 2005, the IDS Real Estate Group, a Los Angeles-based commercial real estate firm, purchased the parcel and received city approval for a residential and hotel project that ultimately withered during another real estate downturn. In 2014, Greenland USA scooped up the property for $150 million from IDS.

The project is being built on one of the neighborhood’s last substantial parcels of underdeveloped land, space that had previously been languishing in failed-project purgatory. In the late 1980s, City Centre Development planned to build a Mediterranean-style office, hotel and retail complex designed by New York-based architect Michael Graves, but the project was scrapped when the economy slowed. In 2005, the IDS Real Estate Group, a Los Angeles-based commercial real estate firm, purchased the parcel and received city approval for a residential and hotel project that ultimately withered during another real estate downturn. In 2014, Greenland USA scooped up the property for $150 million from IDS.

The site’s master plan was designed by Gensler. The first phase includes Hotel Indigo, an 18-story, 350-room hotel positioned to compete with W Hotels, as well as Tower I, a 38-story, 1,500-unit residential building. Both towers are scheduled for completion in December 2016. Tower I includes studios and one- and two-bedroom units, and will be home to Met Six, a clubhouse located on the sixth floor with a swimming pool, cabanas and a dog park. Other high-end amenities include a movie theater, fitness center, yoga studio, meditation garden and steam rooms.

Tower II and Tower III, which already have broken ground, are slated for 2018. Tower II, a 40-story building with 525 units ranging from studios to one- and two-bedroom condos, will include Met Nine, a 1.5-acre rooftop park and pool adjacent to a lounge, screening room, yoga studio, meditation garden and other perks. When complete, Tower III will be one of the tallest residential structures in California. The 58-story building will rise to 647 feet and include 725 residential units.

At the base of Tower II and Tower III will be 70,000 square feet of retail space lining Francisco Street between Eighth and Ninth streets. Residents will access the shopping center via a private elevator.

Luxury properties like Metropolis, which are driven by foreign investment, are raising costs in DTLA — not only for land parcels for new development but also for existing commercial assets. “International buyers need to make deals so they don’t lose capital,” Kirsh said. “Even if they take a hit in value, they know that in the long term the value will be back.”

Even so, there are lingering doubts about whether many Angelenos will choose to occupy DTLA luxury digs. Chinese buyers have so far purchased many of the units in Metropolis, and while that segment is attractive in part because 70 percent of Chinese homebuyers typically make all-cash deals, according to a 2015 survey by the National Association of Realtors, those buyers aren’t expected to live in the neighborhood full-time. This could mean they’ll spend much of their cash elsewhere, which won’t benefit locals.

Two blocks northwest of Metropolis, the Wilshire Grand is rising from the remains of the short and stocky circa 1952 Wilshire Grand Hotel. It is expected to open in early 2017. Topped by a 100-foot spire, the 1,100-foot-tall building will wrest the title of “tallest building west of the Mississippi” from another DTLA office building, the U.S. Bank Tower, which measures 1,018 feet.

The $1.2 billion tower will include the 900-room InterContinental Los Angeles Downtown Hotel, office and retail space. The 1.7-million-square-foot, 73-story hotel designed by AC Martin and developed by Korean Air will feature a rooftop pool and a lobby on the 70th floor.

As these properties rise, others are changing hands. PNC Financial Services Corporation of Pittsburgh, Pennsylvania, and GLL Real Estate of Germany bet on a Class A jewel-shaped office building at 400 South Hope Street built in 1982 and renovated in 2010. They paid $330 million in a deal that closed in May 2016.

The 26-story structure spans an entire 1.85-acre city block and has an 862-space parking garage and admirable access to the 110 and 5 freeways. Newmark Grubb’s Shannon worked on the deal while he was still with CBRE, which was the seller in this transaction. CBRE Global Investors had purchased the property for $238 million in July 2012 and leased the top two floors to its parent company for its global headquarters. CBRE will continue to occupy space.

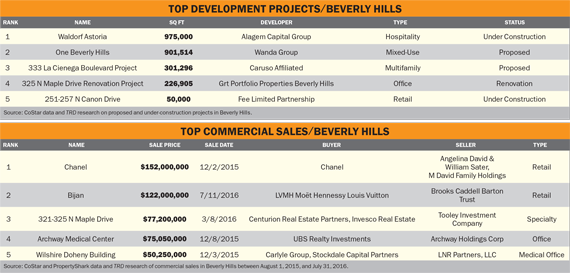

Beverly Hills

Two luxury hotel projects are planned right next to each other: the first Waldorf Astoria on the West Coast — a 170-key, 12-story, $200 million project designed by Gensler — is currently rising in the heart of the fashionable enclave. A rival $1.2 billion, mixed-use project called One Beverly Hills — with a 134-key boutique hotel and 193 luxury condominium apartments — is planned next door on Wilshire Boulevard.

Yet while all eyes are focused on the rival hotels, a quiet transition is occurring in the Beverly Hills office market. “There’s been a slow exodus of businesses and companies, whether moving closer to the beach or to Century City,” Iwasaka said. In some cases, he said, departing office tenants are finding “fancier office buildings, with all the bells and whistles, for essentially the same rental rate.”

Some of the past year’s biggest commercial real estate stories in the famed 90210 zip code were in the retail sector. “There are only a few streets in the world that rival Rodeo Drive, and they’re in London, New York, Hong Kong, Tokyo,” Kirsh said. “Rodeo Drive can command an incredible price tag.”

How high of a price tag? Try $152 million. That’s what the fashion-and-fragrance powerhouse Chanel paid to buy the store it had been leasing at 400 North Rodeo Drive, which works out to $13,217 a square foot — at the time, a retail record for California. The retailer plans to expand the 11,500-square-foot space by integrating it with a property it already owned next door.

The second-priciest deal was also on Rodeo Drive. LVMH Moët Hennessy Louis Vuitton paid $122 million for the Bijan store located at 420 North Rodeo Drive — a stratospheric $19,405 a square foot, setting a new record.

Deals like this are seen as marketing plays by luxury retailers, Kirsh said, adding that the record-setting prices are justified because “you can’t build anything on Rodeo Drive. The supply is the supply.”

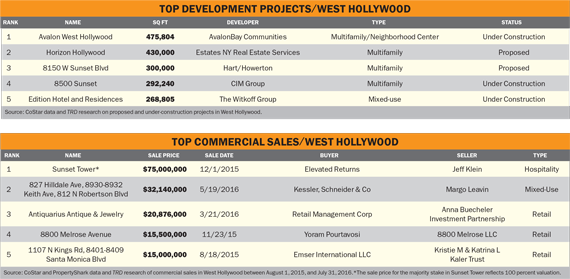

West Hollywood

Avalon CEO Timothy Naughton

A huge wave of new office and residential product will be hitting West Hollywood soon, but Kirsh says that many investors aren’t concerned about a market glut. “West Hollywood won’t suffer the absorption problems that downtown will. Everyone seemingly wants to be there,” Kirsh said. “I think pricing will certainly increase. It’s a strong market.”

After purchasing the defunct Movietown Plaza shopping center at 7300-7328 Santa Monica Boulevard, in 2012, Virginia-based real estate investment trust AvalonBay Communities razed the structure and waited 18 months to break ground.

The delay was primarily caused by a substantial redesign to the plan for the 2.9-acre parcel known as Avalon West Hollywood. The REIT, which owns hundreds of apartment communities in 12 states, partnered with West Hollywood Community Housing to add 77 affordable housing units. Avalon West representatives declined to comment on the decision to add affordable housing, but analysts believe rebates or incentives likely played a role.

Another 200 apartments will take the top four floors of a series of five-story buildings in a 475,804-square-foot complex, all centered around an outdoor courtyard and pool. The ground floor along Santa Monica Boulevard is planned for retail space, where Trader Joe’s is expected to be a key tenant. The project is slated for completion by the end of 2016.

“West Hollywood has the type of demographic that can support a higher-end product, whether hotel, residential multi-family or condos, at a larger scale than downtown LA,” Kirsh said.

The year’s biggest sale in WeHo was on the famed Sunset Boulevard. Jeff Klein, the hotelier who exclusively owned Sunset Tower Hotel, located at 8358 West Sunset Boulevard, sold a majority stake. The recapitalization gave it a full valuation of $75 million. The buyer, Elevated Returns, also owns the St. Regis Resort in Aspen, Colorado, and now holds 80 percent of the 81-room Art Deco-style Sunset Tower.

The hotel opened on Sunset Strip in 1931 and was placed on the National Register of Historic Places in 1980. Klein worked with New York real estate investor Peter Krulewitch of Kingston Investors to purchase the building in 2004 for $18.5 million, and then spent $15 million restoring it.

The sale is occurring at an interesting time for the L.A. hospitality industry, with nearly 100 hotels planned and a total of 11,120 keys in the pipeline for the county, according to a TRD analysis.

Jan Freitag, of Tennessee-based Lodging Insights, which tracks and analyzes hotel markets, said WeHo’s hotel occupancy rates were robust, with an annual rise of 3 percent for existing rooms. “That’s a very healthy

performance,” Freitag said.