When the city of West Hollywood granted the first licenses for cannabis consumption lounges in December, it wasn’t the first time the community had been a pioneer in the embrace of marijuana.

“The city has always been a progressive leader in the cannabis space,” John Leonard, the city’s community and legislative affairs manager, told Weedmaps in December. He cited how West Hollywood had advocated to make medical marijuana available to AIDS patients as far back as the late 1990s.

“Then, during the early stages of medical cannabis, a dispensary that wanted to open in West Hollywood couldn’t find anyone who would lease the space to them. The city purchased a building and leased them the space they needed,” Leonard added.

Related | High rollers in a budding business

Now the city hopes to bolster its successful nightlife scene with a new generation of cannabis retail offerings, which its proponents say will be unlike anything seen anywhere else in the country.

A handful of cities, including San Francisco, already allow onsite consumption of the controlled substance. West Hollywood’s concepts differ primarily in scale and luxury, catering largely to well-heeled clientele from nearby Beverly Hills or out-of-town tourists. Some of the businesses will include cannabis-infused foods and cultivation exhibits.

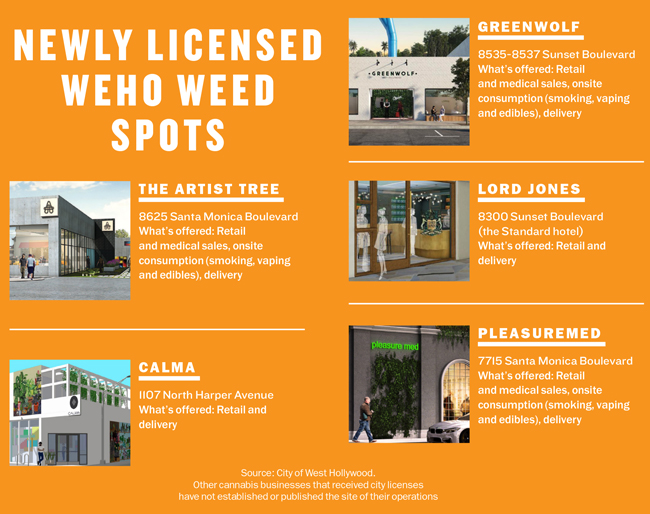

West Hollywood (WeHo) granted licenses in December to 20 out of 122 applicants for a variety of retail configurations. Fifteen of them will allow onsite smoking, vaping or consumption of edibles. The new tenants going into their WeHo spaces will be paying a premium for their occupancy — about double the going retail leasing rate for the area, according to several brokers.

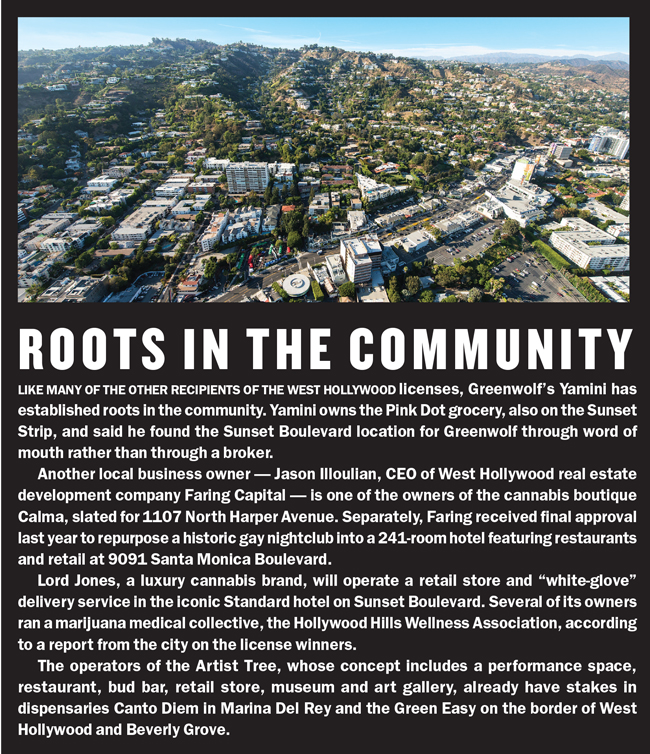

“The West Hollywood license was called the golden ticket,” said Sol Yamini, whose Greenwolf store will have a prime location on the Sunset Strip. The application for Greenwolf West Hollywood, which has a sister location in Glendale, describes it as “an all-inclusive mecca for cannabis, gourmet upscale dining and must-see social life.”

“These businesses are going to make a lot of money from this,” Yamini said. “It’s why they don’t mind paying the high rent.”

The golden ticket

Because of the West Hollywood-imposed cap on the number of retail cannabis businesses that can operate there and the area’s proximity to wealthy residents, the licenses were highly sought after. They cost between $10,000 to $15,000 in nonrefundable application fees, Yamini said.

A cannabis retailer’s high costs, of course, don’t end there. And landlords stand to make a lot of money from their enterprises. In addition to the premium charged to marijuana businesses due to the perceived risk of renting to a seller of a drug still illegal at the federal level, building owners may ask lounges for even more given the lack of precedent, said Clay Stevens, an associate at commercial real estate services company Lee & Associates.

“Any one of the West Hollywood consumption lounges is paying a very high price per foot,” Stevens said. “There’s still the stigma of onsite consumption. At least with dispensaries, you can look at other operators.”

A recent search of online commercial marketplace Loopnet for West Hollywood retail spaces for lease yielded results asking for between $27 to $170 per square foot annually for approximately 2,000 square feet.

The West Hollywood lounges were limited to the number of landlords willing to rent space to them. In addition to the fact that some landlords remain hesitant to lease to cannabis businesses — particularly if they have a loan from a federally regulated bank — local zoning, which restricts the proximity of cannabis to places like schools and churches, also narrows down the list of potential locations.

The West Hollywood lounges were limited to the number of landlords willing to rent space to them. In addition to the fact that some landlords remain hesitant to lease to cannabis businesses — particularly if they have a loan from a federally regulated bank — local zoning, which restricts the proximity of cannabis to places like schools and churches, also narrows down the list of potential locations.

“Oftentimes there are one or two, or two or three options, not the usual 15 to 18,” said Ryan Harding, an executive managing director at Newmark Knight Frank. “The landlords know that, too, which is why they’re price-gouging a little bit.”

While cannabis businesses can expect to pay as much as double what a traditional retailer might for space, Harding said that premium has decreased from the 250 to 300 percent that landlords charged before California legalized recreational use in 2016.

Choosing a location

Not all of the applicants have announced their locations, but many of the freshly licensed consumption lounges are on Santa Monica Boulevard and Sunset Boulevard due to the high foot and vehicle traffic on those streets.

The founders of the Artist Tree, for example, wanted to be near bars, nightclubs and hotels, said Lauren Fontein, an attorney and one of the owners of the business.

“West Hollywood has such a big nightlife scene, it’s a really good location to be close to all those bars,” said Fontein, noting that cannabis businesses cannot sell alcohol.

“West Hollywood has such a big nightlife scene, it’s a really good location to be close to all those bars,” said Fontein, noting that cannabis businesses cannot sell alcohol.

The Artist Tree wasn’t able to find a space large enough to contain everything they originally envisioned, so the business will split into a 5,000-square foot location at 8625 Santa Monica Boulevard with retail and an art gallery and then have another location a couple of blocks away housing the rest of the concept. The owners worked with Rohom Tabankia of RTK Property Group to find the location.

In the case of the Artist Tree and some of the other lounges, the proposed combination of selling both cannabis and noncannabis products, like food, violates California law, Fontein said. The owners, as well as the city of West Hollywood, are among those working with state lawmakers to draft an emergency bill that will address the issue. The soonest such legislation could be voted on is in July, meaning the Artist Tree’s secondary space won’t open until 2020, Fontein said.

Chris Malcolm is managing partner and CEO of 3C Companies, a comprehensive cannabis consulting firm that owns retail stores in Canoga Park and the Arts District in Downtown Los Angeles. Malcolm, whose company owns the buildings where it cultivates, manufactures and retails its product, said anywhere that has good population density and a decent amount of money is viable for retail.

“I like to be on a nice thoroughfare with at least two to three lanes of traffic and a thousand cars per day,” he said. “We’re in Canoga Park; it’s not the best area, but it’s dense and has lots of apartments.”

Retailers will likely seek out areas with younger residents, said Lee & Associates’ Stevens, whose clients include retail giant MedMen. He singled out Culver City, which has attracted major technology companies such as Amazon in recent years, and Venice, where he said MedMen is expanding its footprint, as prime future targets.

Many brokers expect operators to generally seek out high-income areas, too. The prices of products that have grown increasingly sophisticated as the industry matures necessitate being around wealthier patrons, Stevens said. He noted that MedMen, which has locations in half a dozen states, has 1,500 product variations.

“I think there’s been a big shift in the product design,” Stevens said. “Five years ago, it was just about getting an eighth of weed, and you went wherever was the cheapest.”

What’s ahead

Observers predict that if the new WeHo lounges are successful, other cities may follow suit by issuing similar licenses. At the moment, no other cities have announced plans to allow onsite consumption like West Hollywood. However, the city of Los Angeles is in the early stages of considering such a move, according to a few industry observers.

Los Angeles is also expected to begin accepting applications soon for 200 new retail licenses as part of the third phase of its rollout of cannabis regulations.

The general consensus among the real estate community is that the federal government will legalize marijuana by 2022, according to Newmark’s Harding.

Fontein, head of legal affairs at the Artist Tree as well as a co-owner, said she could see more consumption lounges springing up locally in the next two to five years.

“I think a lot of cities and the state are looking at West Hollywood to see how it pans out,” she said. “It’s almost an experiment in L.A., and WeHo is a pioneer.”